Sienna Bidco, wholly owned by funds advised by KKR, has agreed to acquire UK-based Smart Metering Systems (SMS), a smart energy infrastructure and services provider, in a deal that values the company at £1.3 billion (~$1.63 billion).

The deal will see KKR take SMS private and delist it from the London Stock Exchange, where it has been trading since 2011. KKR will pay £0.955 (~$1.21) per share in cash, a 40.4% premium to SMS’s closing price on Wednesday.

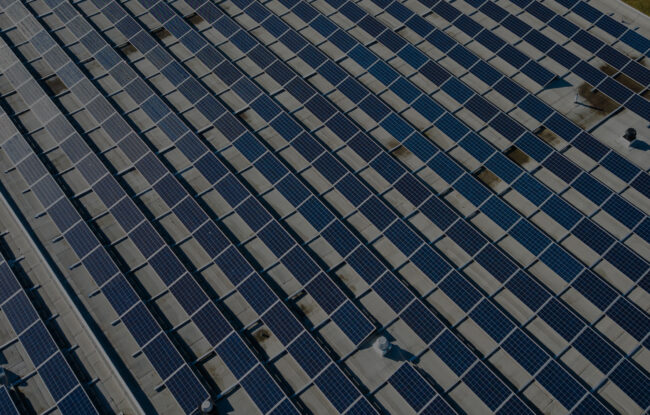

SMS provides a fully integrated offering as an end-to-end installer, owner, and operator of smart energy assets, including smart meters, grid-scale battery storage systems, electric vehicle chargers, and other behind-the-meter assets such as solar, storage, and heat pumps.

According to SMS, the deal would allow it to pursue its growth ambitions and capitalize on the large and attractive pipeline of opportunities in the UK’s energy sector.

Commenting on the Acquisition, Tara Davies, Partner and Co-Head of European Infrastructure at KKR, said: “SMS has a strong asset base and a clear strategy across different business lines, which are critical enablers of the UK’s Net Zero goals, and we share the team’s vision of putting SMS at the heart of the UK’s energy transition. Achieving this growth opportunity requires significant capital of scale, flexibility, and certainty, which is best facilitated in the private markets. KKR is a major investor in UK infrastructure and behind the energy transition, and we will bring our expertise and operational resources to bear in supporting SMS to invest at the level required and successfully scale its business over the long term.”

KKR will fund the deal largely through its KKR Global Infrastructure Investors IV fund, a $17 billion fund focusing on critical infrastructure investments with low volatility and strong downside protection.

SMS’s board of directors has unanimously recommended the deal. The deal is subject to shareholder approval and is expected to close soon.

According to Mercom’s recently released 9M And Q3 2023 Funding and M&A Report for Storage & Smart Grid, in 9M 2023, there were eight Smart Grid M&A transactions compared to 18 in 9M 2022.

Last Month, OVO Energy, an independent energy supplier that provides gas and electricity services to residential and business customers, announced the acquisition of the UK Public Electric Vehicle (EV) Charging Aggregator Startup Bonnet.