Elucid, a precision medicine software platform for cardiovascular disease, raised $8 million in Series A financing.

The funding round was led by MedTex Ventures and Global Health Impact Fund. New and existing investors Checkmate Capital, IAG Capital, BlueStone Venture Partners, University of Michigan – Wolverine Venture Fund, Willamette Valley Capital, and Angel Physicians Fund also participated in the round.

“We are excited to be part of Elucid’s mission to transform the diagnosis of cardiovascular disease, especially as they begin to realize the significant commercial potential of this platform technology,” said Ashok Gowda, partner at MedTex Ventures.

This latest round of financing will enable us to continue advancing our unique technology for non-invasive estimation of cardiovascular event risk, myocardial ischemia, and therapeutic response, said Blake Richards, CEO of Elucid.

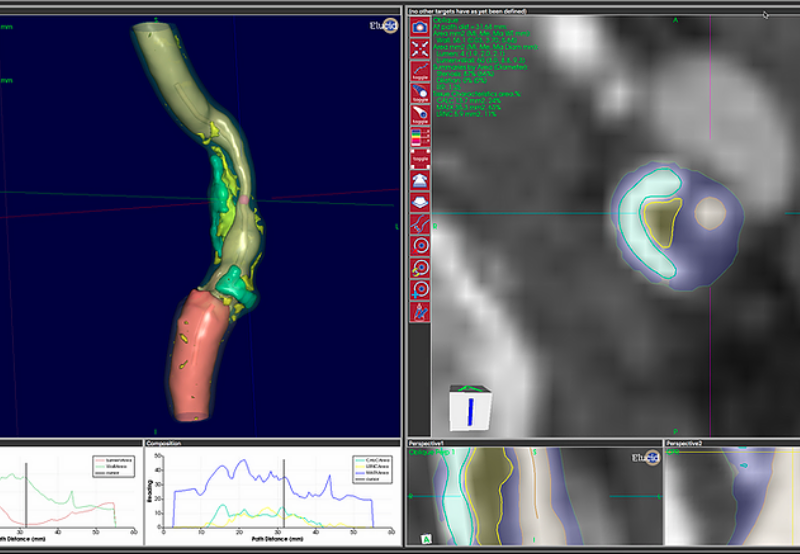

According to Elucid, its precision medicine platform uses interpretable and validated AI to provide physicians with a means to optimize treatment decisions for patients with known or suspected cardiovascular disease. The platform also provides physicians advanced clinical insights, critical information designed to enable precision medicine, the company said.

“Our team continues to develop our portfolio of products based on the power of our ideas. This latest round of funding enables us to deliver key aspects of our vision,” said Elucid Founder, President, and CTO Andrew Buckler.

Andrew Buckler added: “Understanding the nature of the vascular disease and taking on some of the challenges which have previously held the field back allow Elucid to reduce stressful procedures for patients while simultaneously improving the diagnostic power available to the clinicians seeking to improve outcomes.”

Clinical Decision Support software companies raised $661 million in 15 venture capital (VC) funding rounds in Q1 2021, compared to $505 million in 12 funding rounds in Q4 2020, a 31% increase in quarter-over-quarter funding activity, according to the latest Mercom Digital Health Funding and M&A Report. Strive Health, a kidney care decision-making platform, secured a $140 million Series B round of funding led by CapitalG, Alphabet’s independent growth fund. Strive Health has raised $223.5 million to date.