Q1 2021 Digital Health (Healthcare IT) Funding and M&A Report

$299.00 – $549.00

Venture Capital Funding

in Digital Health Sector

Reaches $7.2 Billion in Q1 2021

Click here to download the Executive Summary.

The report covers both consumer-centric and patient-centric technologies and sub-technologies, including: Social Health, Mobile Health (mHealth), Telehealth, Personal Health, Rating & Shopping, Health Information Management, Revenue Cycle Management, Service Providers and Security.

Click to see the complete list of technologies covered in this report.

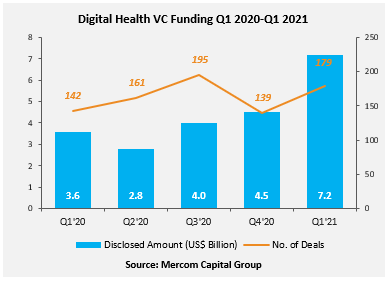

Global venture capital (VC) funding, including private equity and corporate VC into Digital Health companies in Q1 2021, came to a record $7.2 billion in 179 deals, up 60% compared to $4.5 billion in 139 deals in Q4 2020. VC funding in Q1 2021 increased 100% compared to the same quarter of last year when $3.6 billion was raised in 142 deals.

This was the single largest funding quarter to date for Digital Health since 2010.

“Q1 2021 was the largest funding quarter ever for Digital Health. Almost half of all funding raised in 2020 was matched within just the first quarter of 2021 and Q1 VC funding was more than venture funding raised in any one year between 2010 and 2017. Telehealth was the biggest beneficiary with a 100% increase in funding quarter-over-quarter. Increased M&A activity was another positive takeaway from the quarter. While it certainly looks like Digital Health is positioned for a record-breaking year, the next two quarters will tell whether the COVID-19 fueled funding surge is peaking or has peaked,” said Raj Prabhu, CEO of Mercom Capital Group.

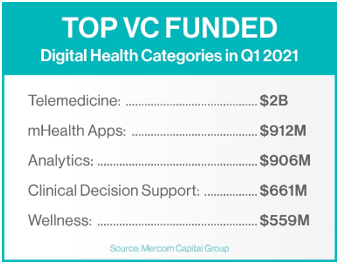

The top-funded categories in Q1 2021 were: telemedicine with $2 billion, followed by mHealth apps with $912 million, analytics with $906 million, clinical decision support with $661 million, and wellness with $559 million.

A total of 547 investors participated in funding deals in Q1 2021 compared to 433 investors in Q1 2020.

Eleven Digital Health products received FDA approvals in Q1 2021.

In Q1 2021, there were 63 M&A transactions involving Digital Health companies compared to 52 M&A transactions in Q4 2020. In a YoY comparison, there were 41 M&A transactions in Q1 2020.

The top disclosed M&A transactions included: Optum acquired Change Healthcare for $13 billion, Boston Scientific acquired Preventice Solutions for $925 million, Philips acquired Capsule Technologies for $635 million, Appriss Health acquired PatientPing for $500 million, and Accolade acquired Innovation Specialists (dba 2nd.MD) for $460 million.

The Q1 2021 Digital Health (Healthcare IT) Funding and M&A Report also contains year-over-year (YoY) and quarter-over-quarter (QoQ) information on market activity displayed in easy-to-digest charts, graphs and tables, as well as data-driven analysis covering:

- Venture capital (VC) funding deals, including top investors, QoQ trends, and charts and graphs broken down by technology and stage;

- Practice-focused technology and subgroups;

- Consumer-focused technology and subgroups;

- VC funding by country and U.S. state;

- VC funding trends in early stage deals (below $2 million) and trends in deals over $2 million;

- Debt and public market financing deals;

- Mergers and acquisitions (M&A), including QoQ trends, a breakdown of charts and graphs by technology and geography;

- New Healthcare IT funds

This report also contains comprehensive lists of all announced Q1 2021:

- VC deals with investors and transaction details;

- Debt and public market financing deals and investors;

- M&A transactions and acquirers.

This report is 106 pages in length, contains 60 charts, graphs and tables, and covers 849 investors and companies.