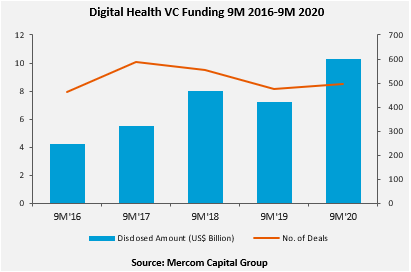

Global VC funding for Digital Health companies in the first nine months of 2020 broke all previous 9M funding records, bringing in $10.3 billion. Funding activity was up by 43% during 9M 2020 compared to $7.2 billion raised in 9M 2019.

Digital Health companies raised $4 billion in VC funding in 195 deals during Q3 2020 compared to $2.8 billion in 161 deals in Q2 2020, also a 43% increase quarter-over-quarter (QoQ). Year-over-year (YoY), VC funding was up by 100% compared to $2 billion in 155 deals in Q3 2019.

To learn more about the report and download a free executive summary, visit:

https://mercomcapital.com/product/9m-and-q3-2020-digital-health-healthcare-it-funding-and-ma-report

Almost half of the funding went into only 20 Digital Health companies during Q3 2020.

“Digital health and especially telehealth, has taken off amid COVID-19 and VC funding has already surpassed funding raised in any full year to date. There were five IPOs in digital health, which is unprecedented and we also had one of the biggest M&A deals in digital health history in the third quarter,” said Raj Prabhu, CEO of Mercom Capital Group.

Digital Health consumer-centric companies raised over $2.7 billion, accounting for 67% of the sector’s total ($4 billion) in VC investments during Q3 2020. Practice-focused companies accounted for 33%, with $1.3 billion in funding.

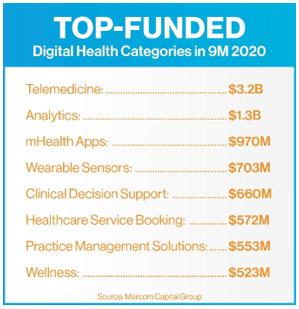

The top-funded categories in 9M 2020 were: Telemedicine with $3.2 billion, followed by Data Analytics with $1.3 billion, mHealth Apps with $970 million, Wearable Sensors with $703 million, Clinical Decision Support with $660 million, Healthcare Service Booking with $572 million, Practice Management Solutions with $553 million, and Wellness with $523 million.

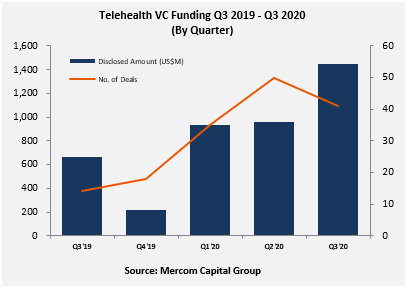

Telehealth companies received a record $1.4 billion in 41 deals in Q3 2020 compared to $962 million raised in 50 deals in Q2 2020, a 50% increase QoQ. Funding increased 118% YoY in Q3 2020 compared to $653 million in 14 deals in Q3 2019.

“Investors do not want to be left out and do not seem worried about investing at the peak of the market with sky-high valuations. This level of activity may not be sustainable as we come out of the pandemic. We are already beginning to see a slowdown in telehealth visits and the markets will need to self-correct in the not too distant future,” added Prabhu.

Other top categories that received funding in Q3 2020 included: Data Analytics with $424 million, Wearable Sensors with $382 million, Practice Management Solutions with $320 million, Healthcare Service Booking with $246 million, and Wellness with $239 million.

Early round venture capital funding (Seed, Series A) came to $1.2 billion. Most of the early round VC funding in 9M 2020 went to Telemedicine, mHealth Apps, Data Analytics, Wellness, and Clinical Decision Support companies.

A total of 601 investors participated in funding deals in Q3 2020, compared to 488 investors in Q2 2020.

General Catalyst, Initialized Capital, Oak HC/FT, Techstars Ventures, and YCombinator led Digital Health financing activity during Q3 2020, with each investing in four rounds.

A record 1,522 investors participated in 9M 2020 compared to 1,171 investors in 9M 2019.

The Top VC deals in 9M 2020 included: $285 million raised by ClassPass, $250 million raised by Alto Pharmacy, $200 million raised by Ro (formerly Roman), $194 million raised by Amwell (formerly American Well), $175 million raised by Grand Rounds, $155 million raised by KRY, and $150 million raised by Concerto HealthAI.

Twenty-one different countries recorded Digital Health VC funding deals in Q3 2020. Companies in the United States recorded the highest number of VC funding deals with 129.

FDA/CE approvals doubled YoY with twenty-six Digital Health products receiving (FDA/CE) approvals in Q3 2020.

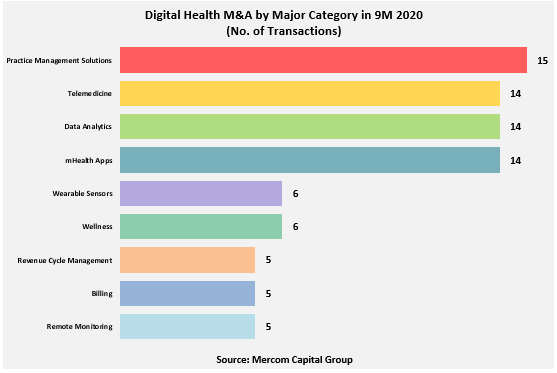

In 9M 2020, a total of 132 Digital Health M&A transactions were announced compared to 125 in 9M 2019. In Q3 2020, there were 49 M&A transactions compared to 34 in Q3 2019.

Practice Management Solution companies were involved in the most M&A deals in 9M 2020 with 15 transactions. Data Analytics, mHealth Apps, and Telemedicine companies each recorded 14 transactions.

Notable M&A transactions in 9M 2020: Teladoc Health acquired Livongo Health for $18.5 billion, Blackstone acquired Ancestry for $4.7 billion, Invitae acquired ArcherDX for $1.4 billion, Healthcare Merger Corporation acquired Specialists On Call (dba SOC Telemed) for $720 million, and Teladoc Health acquired InTouch Health for $600 million.

This report is 115 pages in length, contains 67 charts, graphs, and tables, and covers 892 investors and companies.

Mercom’s comprehensive report covers deals of all sizes across the globe.

To learn more about the report, visit: https://mercomcapital.com/product/9m-and-q3-2020-digital-health-healthcare-it-funding-and-ma-report