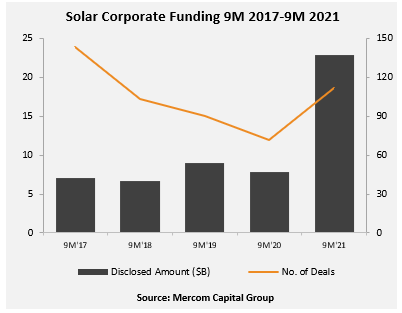

Total corporate funding (including venture capital funding, public market, and debt financing) increased 190% in 9M 2021, with $22.8 billion in 112 deals compared to $7.9 billion in 72 deals in 9M 2020. Financing activity was up across the board, including venture capital, debt, and public market financing.

Total solar corporate funding in Q3 2021 came to $9.3 billion in 41 deals, a 72% increase compared to $5.4 billion in 35 deals in Q2 2021.

Total solar corporate funding in Q3 2021 came to $9.3 billion in 41 deals, a 72% increase compared to $5.4 billion in 35 deals in Q2 2021.

To get the report, visit: https://mercomcapital.com/product/9m-q3-2021-solar-funding-ma-report/

“Investment activity continues to be robust across the solar sector and not just compared to 2020 (because of COVID). This will end up as one of the best years for solar financing since 2010. As the push toward the energy transition picks up speed worldwide, solar – one of the mature renewable energy resources – is benefitting enormously. Solar project acquisitions in the first nine months of 2021 have already surpassed all of 2020,” said Raj Prabhu, CEO of Mercom Capital Group.

Global VC funding in the solar sector totaled $593 million in 13 deals in Q3 2021, a 2% decrease compared to $608 million in 12 deals in Q2 2021. Funding increased 224% year-over-year (YoY) compared to $183 million in 15 deals in Q3 2020.

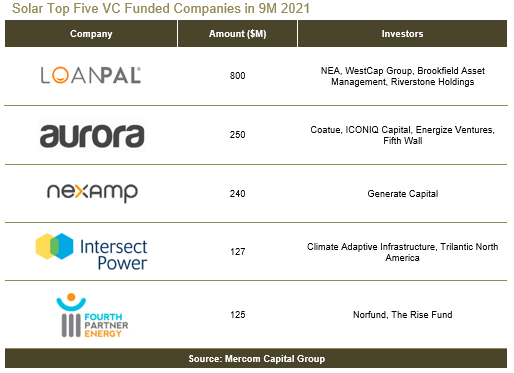

In 9M 2021, the solar sector brought in $2.2 billion in VC funding in 39 deals, 466% higher compared to $394 million in 29 deals in 9M 2020.

The top five VC deals in 9M 2021 were: $800 million raised by Loanpal; $250 million raised by Aurora Solar, $240 million raised by Nexamp, $127 million raised by Intersect Power, and $125 million raised by Fourth Partner Energy.

Fourty-one VC investors participated in solar funding rounds in Q3 2021.

Public market financing into the solar sector came to $2.7 billion in 10 deals in Q3 2021, 197% higher compared to $894 million in five deals in Q2 2021. Year-over-year, public market financing increased 106% compared to $1.3 billion in four deals in Q3 2020. Solar public market financing in 9M 2021 was 209% higher, with $6.3 billion raised in 23 deals compared to $2 billion in 10 deals in 9M 2020.

Public market financing into the solar sector came to $2.7 billion in 10 deals in Q3 2021, 197% higher compared to $894 million in five deals in Q2 2021. Year-over-year, public market financing increased 106% compared to $1.3 billion in four deals in Q3 2020. Solar public market financing in 9M 2021 was 209% higher, with $6.3 billion raised in 23 deals compared to $2 billion in 10 deals in 9M 2020.

There were seven solar initial public offerings (IPO) and SPACs announced in 9M 2021, which brought in $4.4 billion.

In Q3 2021, announced debt financing amounted to $6 billion in 18 deals, an increase of 54% compared to $3.9 billion raised in 18 deals in Q2 2021. Debt financing activity in Q3 2021 was 242% higher YoY compared to the $1.8 billion raised in 16 deals during Q3 2020.

Record securitization activity was a key contributor to the increase in debt financing activity during 9M 2021.

There were 29 solar M&A transactions in Q3 2021 compared to 34 M&A transactions in Q2 2021. By comparison, there were 17 transactions in Q3 2020. In 9M 2021, there were a total of 83 transactions compared to 42 deals in 9M 2020.

The largest M&A transaction in 9M 2021 was by Adani Green Energy Limited (AGEL), which agreed to acquire a 100% stake in SB Energy India from Soft Bank Group (80%) and Bharti Group (20%). The transaction values SB Energy India at an enterprise valuation of about $3.5 billion.

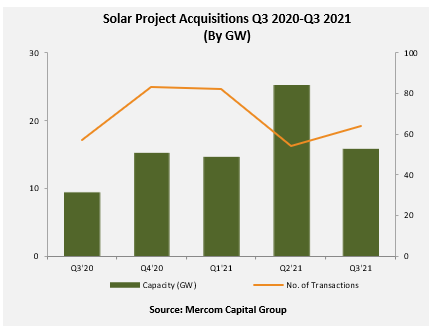

In 9M 2021, large-scale solar project acquisition activity was up 129% with 55.5 GW being acquired compared to 24.3 GW in 9M 2020. A total of 15.8 GW of solar projects were acquired in Q3 2021.

In 9M 2021, large-scale solar project acquisition activity was up 129% with 55.5 GW being acquired compared to 24.3 GW in 9M 2020. A total of 15.8 GW of solar projects were acquired in Q3 2021.

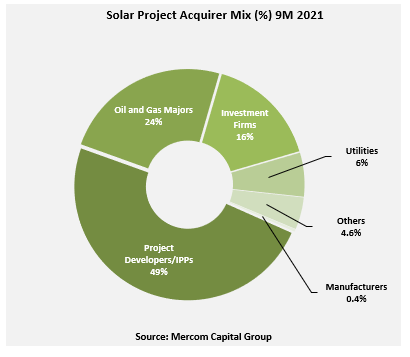

Project Developers were the most active solar project acquirers in 9M 2021, followed by Oil and Gas Majors, Investment Firms, and Utilities. Project Developers were also the most active solar project acquirers in Q3 2021, followed by Investment Firms.

Project Developers were the most active solar project acquirers in 9M 2021, followed by Oil and Gas Majors, Investment Firms, and Utilities. Project Developers were also the most active solar project acquirers in Q3 2021, followed by Investment Firms.

339 companies and investors are covered in this 95-page report. The report contains 80 charts, graphs, and tables. To learn more about the report, visit: https://mercomcapital.com/product/9m-q3-2021-solar-funding-ma-report/

339 companies and investors are covered in this 95-page report. The report contains 80 charts, graphs, and tables. To learn more about the report, visit: https://mercomcapital.com/product/9m-q3-2021-solar-funding-ma-report/