ILOS New Energy, an Independent Power Producer, and Omnes Capital, a private equity firm, together have agreed to sell a 60% stake in ILOS Projects (ILOS) to AXA IM Alts, an alternative investment company. The transaction is subject to customary approvals and is likely to be completed towards the end of H1 2025.

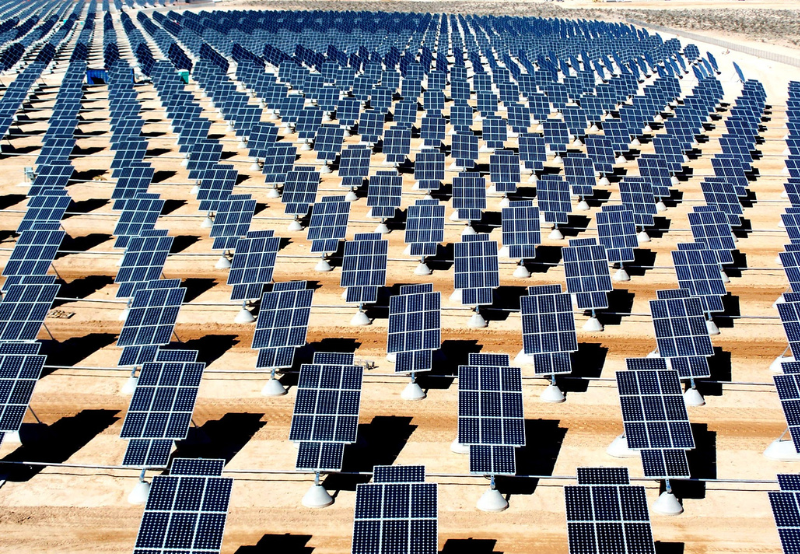

Founded in 2018, ILOS is a renewable energy independent power producer platform with nearly 5 GWp of solar PV projects in the pipeline across seven European regions. It has been backed by Omnes ILOS since 2020 through Capenergie 4. As part of this agreement, Omnes will now fully exit the business.

“Omnes is extremely proud of the journey it has completed together with founders Michael Winter, Nikolaus Krane, as well as the wider ILOS team since we first invested in the company in 2020. Over these last five years, the European market has undergone changes and faced crises, but ILOS has remained steadfastly focused on its goal of building a leading European renewable energy player”, said Yannic Trüb, Partner at Omnes Capital.

The transaction will bring together ILOS’ Management team’s significant development experience across Europe and AXA IM Alts’ expertise in building renewables platforms.

“ILOS, as an established pan-European solar developer and IPP, will give us access to high-growth, low-cost, zero carbon electricity generation. We look forward to working with the founders to grow its fleet as it transitions to an increasingly sophisticated independent power producer,” said Mark Gilligan, Head of Infrastructure at AXA IM Alts.

According to Mercom’s Annual and Q4 2024 Solar Funding and M&A report, M&A activity was 15% lower year-over-year in 2024, with 82 corporate M&A transactions compared to 96 in 2023.

In February, Altus Power, an independent developer, owner, and operator of commercial-scale solar facilities, announced it had entered into a definitive agreement to be acquired by TPG, a global alternative asset management firm, through its TPG Rise Climate transition infrastructure strategy for $5 per share of its Class A common stock. The all-cash transaction valued the company at approximately $2.2 billion.