Arevon Energy, a solar and storage project developer, secured more than $1 billion in aggregate funding commitments for its Eland 2 Solar-plus-Storage Project in Kern County, California. The 374 MW (MWdc) solar project coupled with 150 MW/600 MWh of energy storage system is under early-stage construction, and the commercial operations are scheduled for the first quarter of 2025.

The company obtained a $431 million tax equity commitment from Wells Fargo and $654 million of debt funding, including a construction-to-term loan, a tax equity bridge loan, and a letter of credit facilities.

Canadian Imperial Bank of Commerce (CIBC) served as the Administrative Agent and Coordinating Lead Arranger, Green Loan Coordinator, and Bookrunner. Other Coordinating Lead Arrangers included BNP Paribas, CoBank, Commerzbank AG, Commonwealth Bank of Australia, and National Bank of Canada.

J.P. Morgan served as Joint Lead Arranger, Collateral, and Depositary Agent. Amis, Patel & Brewer represented Arevon as Sponsor Counsel; Milbank served as Lender Counsel; and Sheppard Mullin served as Tax Equity Counsel.

“Following the successful financing of Eland 1, CIBC is proud to continue its support of Arevon as Bookrunner, Coordinating Lead Arranger, Green Loan Coordinator, and Administrative Agent on the financing of Eland 2,” said Ines Serrao, MD, and Head of US Renewables at CIBC.

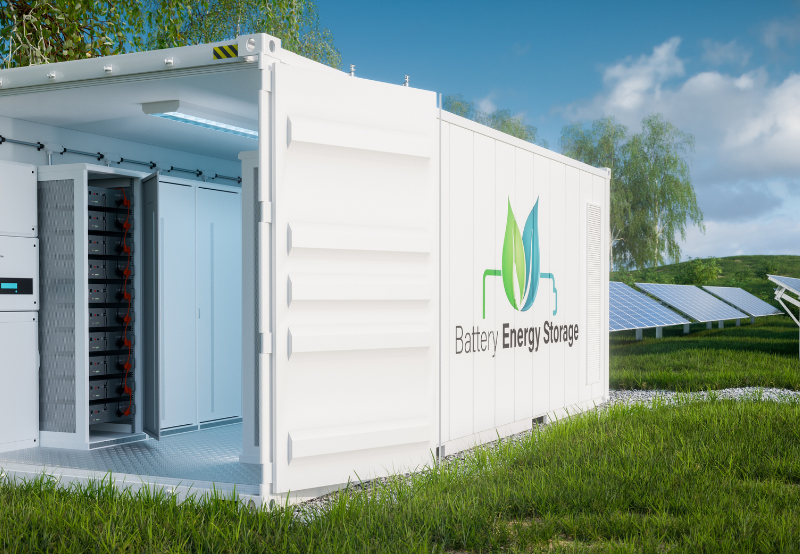

Under a long-term power purchase agreement with Southern California Public Power Authority, Eland 2 will provide 200 MW of electricity to serve the power needs of Southern California, utilizing Tesla’s Megapack 2 XL battery energy storage to provide electricity over an extended period each day. San Diego-based SOLV Energy is the project’s engineering, procurement, and construction contractor.

According to Mercom’s Q4 and Annual Solar Funding and M&A report, large-scale solar project funding deals announced in 2023 came to $44.5 billion in 229 deals, of which 196 were disclosed.

Recently, ENERPARC AG, a solar project developer, secured bridge financing for a 325 MW project portfolio consisting of solar PV and hybrid projects, including energy storage projects. The French investment firm, Eiffel Investment Group, provided the financing.