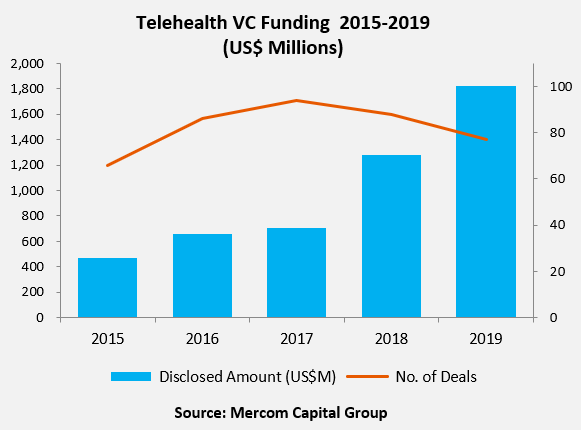

Telehealth technologies globally, including telemedicine and remote monitoring companies, received $1.8 billion in venture funding in 2019, which was the largest amount received by any digital health technology category in the year. Funding increased by 42% increase year-over-year compared to $1.3 million in 2018.

The Telehealth category drove the financing activity in 2019 due to two large funding deals by Babylon and Tencent Trusted Doctors.

Almost 200 investors participated in telehealth deals in 2019. Spring Lake Equity Partners, Sound Ventures, Aetna, Echo Health Ventures, Startup Health, and Y Combinator each invested in two telehealth companies in 2019.

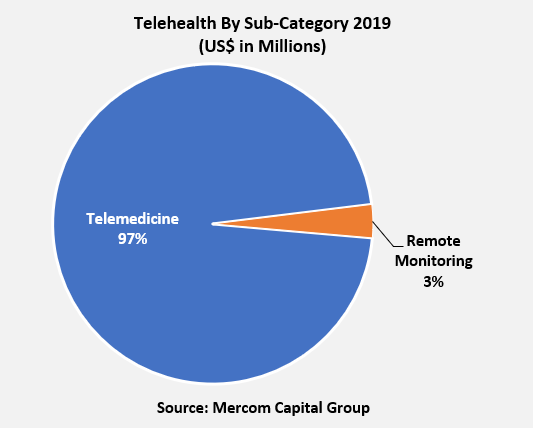

Within Telehealth, Telemedicine companies accounted for $1.7 billion in 2019, the highest so far since 2010, and remote monitoring companies received the remaining $61 million.

Of the $1.8 billion VC funding raised by the Telehealth companies in 2019, the companies originated in the United States secured $775 million, and the rest of the world accumulated over $1 billion.

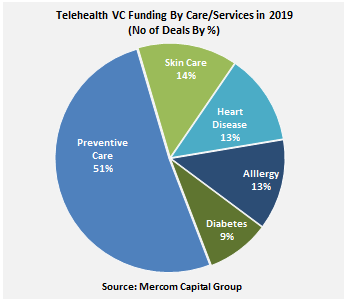

In 2019, Telehealth companies focused on Preventive Care led the funding activity with 40 deals.

What is driving telehealth investments

- Telehealth is convenient and reduces the cost of care

- Along with other digital health tools, telehealth is improving engagement and proactive management of health conditions

- Over ten telehealth technologies have received FDA approvals

- The most significant factor driving investments is the increased reimbursement for telehealth services by the US Centers for Medicare & Medicaid Services

- There is a viable revenue model for telehealth companies because of reimbursement for telehealth services, which is attractive for investors unlike other consumer-centric digital health products

In total, the Telehealth sector has gathered approximately $5.5 billion since 2010, according to Mercom data. Telemedicine companies accounted for almost 90% of the $5.5 billion.

Top 5 Telehealth funding deals in 2019:

Babylon, a London-based telemedicine company that uses AI, closed a $550 million round of funding at more than $2 billion valuation.

Tencent-backed online health care platform Tencent Trusted Doctors raised $250 million at more than $1 billion valuation.

Roman, an online telehealth platform for erectile dysfunction treatment and men’s health, raised $85 million at a $500 million valuation.

Cityblock, a telehealth company that serves qualifying Medicaid and Medicare beneficiaries who live in city neighborhoods, raised $65 million.

HaloDoc, a provider of telemedicine services via chat, video, and voice calls, raised $65 million.

In terms of exits, there were a total of 17 acquisitions in telehealth in 2019 compared to 13 in 2018.