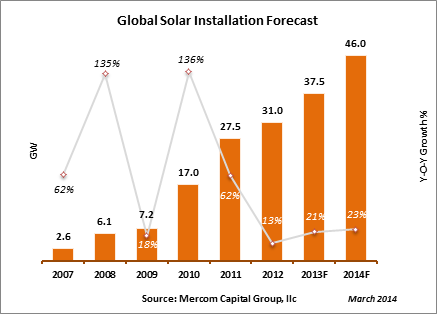

Demand outlook for the solar industry remains strong and global solar installations are forecasted to be around 46 GW in 2014, according to the latest quarterly update from Mercom Capital Group, llc, a global clean energy communications and consulting firm. Global installations in 2013 are estimated to come in at about 37 GW, in line with Mercom’s forecast.

Raj Prabhu, CEO and Co-Founder of Mercom Capital Group, commented that the revised forecast reflects the ever-shifting market conditions and the new Chinese installation goal. “China recently announced an aggressive 14 GW installation goal, a 2 GW increase since our previous update in December 2013.”

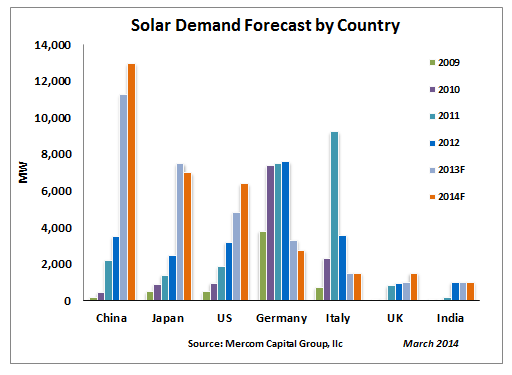

Within the new 14 GW goal, China has set an aggressive target of 8 GW for distributed generation and another 6 GW for utility-scale projects with specific quotas in individual provinces. Mercom expects Chinese installations to be in the 13 GW range in 2014.

The Chinese government decision to let Shanghai Chaori Solar Energy Science & Technology Co. default on its bond issue shows that they are serious about not bailing out companies that don’t fit strict manufacturing norms. Though the effect of this case on the larger solar market may be minimal, Mercom will be watching the Chinese financial markets closely as major economic indicators are currently weak.

Japan is expected to install solar in a similar range (7-7.5 GW) to last year. Japan faces some challenges, however, as the Ministry of Economy, Trade and Industry (METI) weeds out projects that, although approved, are unlikely to be built. In addition, the country’s generous feed-in-tariff (FiT) is likely to be reduced in the next month and a three percent sales tax increase could further dampen demand.

The U.S. solar market is forecasted to install 6.4 GW in 2014, spurred by utility-scale projects and an energetic residential sector. Solar lease has been the big driver of residential installations, with third party finance companies raising $3.3 billion in residential and commercial tax equity funds in 2013. System costs in the United States are still high compared to Germany, but innovative financial instruments, including asset-backed securities, third party finance and YieldCos, are helping bring the cost of capital down. Trade disputes, however, continue to be an issue with the United States.

PV installations in Germany are forecasted to be around 2.75 GW in 2014 . Germany’s role in the solar market continues to decline as policy support retreats. In a bid to reduce price hikes in electricity, the latest policy proposals include bringing the installation levels closer to 2,500 MW a year. There is a proposal to replace the FiT with a tender system in 2017 in addition to a requirement that new solar projects greater than 500 kW market and sell electricity directly to consumers.

The current crisis in Crimea illustrates the importance of energy independence and the vital role solar energy and other renewables can play if added prudently to the energy generation mix, Prabhu noted. “Energy security is a key reason for governments around the world to review their energy generation mix and invest in domestic solar and other renewables,” he said.

Other markets highlighted in the update include the United Kingdom and India, both of which installed approximately 1 GW in 2013 and are expected to install similar numbers in 2014. Mercom revises its forecast quarterly to reflect on-the-ground conditions.

Subscribers to Mercom’s weekly Solar Market Intelligence Report will have access to the full update. To become a subscriber, visit: http://bit.ly/MercomSubscribe.