Monarch Private Capital, an ESG investment firm that develops, finances, and manages a diversified portfolio of tax credit projects, and Invenergy, a renewable energy project developer, together announced the closing of nearly $170 million in tax equity financing for the Samson Solar Energy Center II project.

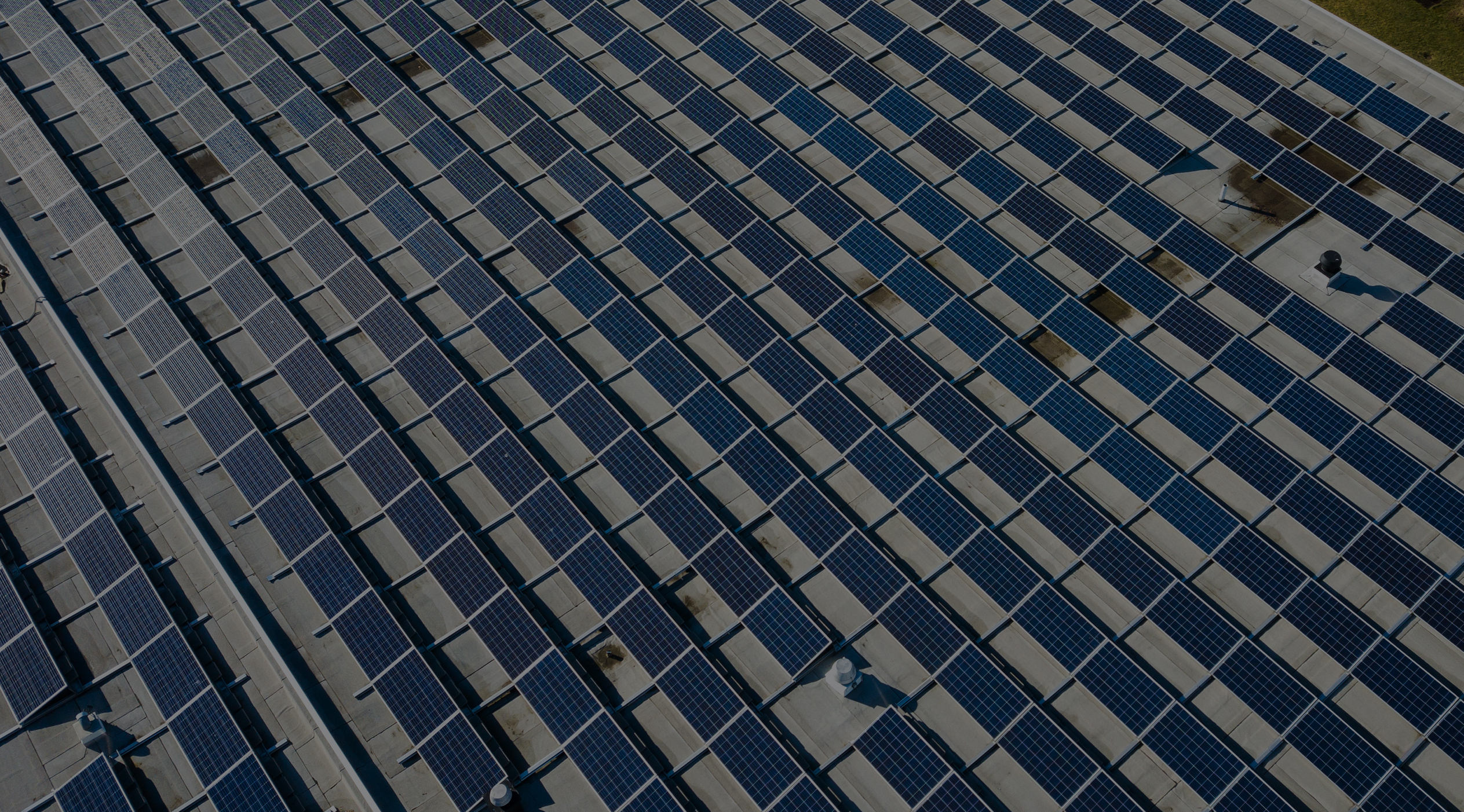

The Samson Solar Energy Center II is a 200 MW solar power project located in Lamar County, Texas. The project is being developed by Invenergy and is part of Invenergy’s Samson Solar Energy Center, a five-phase, 1,310-MW development considered one of the largest solar energy centers in Texas. Marathon Capital acted as Invenergy’s exclusive financial advisor on the transaction.

“We’re proud to have worked with Invenergy on the tax equity solution for the Samson Solar Energy Center II,” said Bryan Didier, Partner & Managing Director of Renewable Energy at Monarch Private Capital. “This investment is another important milestone for our team, and we’re excited to partner with Invenergy on a project that is providing skilled jobs and clean energy to a community that has experienced economic hardship.”

This project is slated to begin commercial operations later this year.

Mercom’s 1H and Q2 2024 Solar Funding and M&A report announced that large-scale project funding in 1H 2024 came to $19.9 billion in 117 deals compared to $14.9 billion in 113 deals in 1H 2023. This report underscores the growing investment and M&A activity in the solar energy sector.

In August, Origis Energy, the provider of a vertically integrated renewable energy platform and a solar project developer, announced the closing of $71 million in tax equity financing for the development of the 75 MW Rice Creek Solar project in Florida. The tax equity financing was secured from U.S. Bank subsidiary U.S. Bancorp Impact Finance, a renewable energy investor.