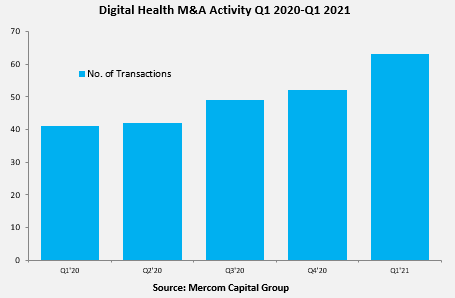

A total of 63 digital health companies were acquired in Q1 2021, compared to 52 in Q4 2020, according to Mercom’s Q1 2021 Digital Health Funding and M&A Report.

Practice management solution companies led M&A activity with ten transactions, followed by telemedicine companies with seven transactions. Clinical decision support and healthcare data analytics companies had six transactions each. Other digital health categories that recorded multiple acquisitions include patient engagement, mHealth apps, wearable sensors, wellness, population health management, and electronic health records, among others.

Top 5 M&A transactions (by disclosed amount) during Q1 2021:

UnitedHealth Group‘s Optum agreed to acquire Change Healthcare, a provider of revenue cycle management solutions for the healthcare industry, for a total valuation of $13 billion. Change Healthcare was backed by over $50 million venture capital from HLM Venture Partners, BlueCross BlueShield Venture Partners, Sandbox Industries, West Health Investment Fund, Mitsui, and others.

Boston Scientific, a medical technology company, agreed to acquire Preventice Solutions, the developer of wearable patches that monitor cardiac arrhythmias remotely, for $925 million. Preventice Solutions is backed by more than $137 million in funding from investors, including Vivo Capital, Novo Holdings A/S, Merck Global Health Innovation Fund, Boston Scientific, and Samsung Catalyst Fund. The company reported net sales of $158 million in 2020 – a 30% growth rate from the previous year.

Philips, a healthcare technology company, signed an agreement to acquire Capsule Technologies for $635 million from Francisco Partners. Capsule Technologies offers a suite of connected patient monitoring medical devices and data integration platforms that can combine device integration, vital signs monitoring, and clinical surveillance services. Capsule Technologies reported sales of over $100 million in 2020, with strong double-digit sales growth. The majority of sales is related to recurring software-as-a-service and licensing revenues.

Philips continues to expand its footprint in the digital health sector through acquisitions. Recently, Philips acquired BioTelemetry, a wearable cardiac monitoring patch, and connected glucose monitors for $2.8 billion. To date, Philips acquired 16 digital health companies, including Medumo, Direct Radiology, Carestream Health, and Xhale Assurance.

Appriss Health, a cloud-based care coordination software and analytics solutions focused on behavioral health and substance use disorders, entered into a definitive agreement to acquire care collaboration software platform PatientPing for approximately $500 million. In 2020, PatientPing raised $60 million in Series C funding to expand its care-coordination app. Including Series C funding, the company has raised more than $100 million to date.

Accolade, a provider of cloud-based, on-demand technology-enabled healthcare concierge services for employers, health plans, and health systems, agreed to acquire telemedicine company Innovation Specialists (dba 2nd.MD) for $460 million. Innovation Specialists reported unaudited revenue of $35 million in 2020.

According to the Mercom digital health M&A database, nearly 2,000 digital health companies have been acquired/merged since 2010. Learn more.