Yes Health, a provider of personalized type 2 diabetes prevention, nutrition counseling, and weight loss programs through an AI-powered mobile app, raised $6 million in new Series A funding.

Khosla Ventures, a venture capital firm, led the financing round. The firm has invested over $1 billion in over 50 digital health companies since 2010, according to Mercom funding data.

The company plans to use the new funds to expand its team, develop its platform, and scale its business operation.

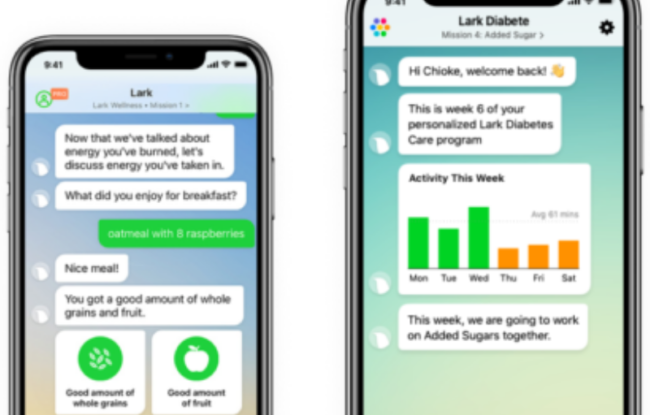

The app automates patient’s reporting requirements by letting them take a picture of their meals rather than entering their everyday food intake into a system. Its app recognizes meals from the images and converts that information into data that physicians and patients can use to monitor their progress.

The company, founded in 2014, is working with Blue Shield of California and other healthcare partners. Yes Health has thousands of paying members and is offered directly to consumers or through their employers or health plans.

According to data from the CDC, roughly 34 million Americans had diabetes in 2018, and another 88 million are pre-diabetic. The cost of caring for these diabetes conditions in the U.S. healthcare system costs $327 billion every year, and patients struggling with diabetes have healthcare costs that are over 230% of the average American.

“Americans are more conscious than ever about their health, and digital health has become one of the most important markets for innovation,” said Samir Kaul, founding partner and managing director of Khosla Ventures. “Yes Health is proven to tackle difficult and costly chronic conditions through an AI-augmented and all-mobile solution, aligning it with our firm’s thesis in healthcare.”

Earlier this year, Bigfoot Biomedical, a developer cloud-based type 1 diabetes management system, raised $45 million in Series C funding, which was led by Abbott with backing from existing investors, including Quadrant Capital Advisors, Senvest Capital, Janus Henderson, and Cormorant Asset Management.