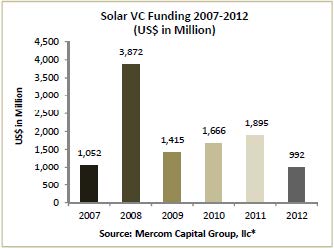

Venture capital (VC) investments plunged nearly 50 percent to $992 million in 103 deals in 2012 compared to $1.9 billion raised in 108 deals the previous year. The 2012 total represents the lowest amount since 2007.

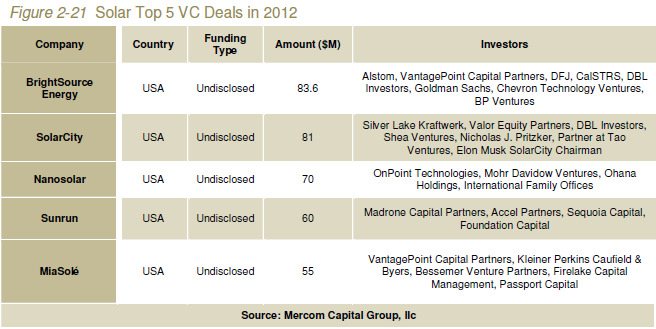

VC funding in Q4 2012 came in at $220 million in 27 deals compared to just $72 million in 14 deals in Q3. Twenty-five investors participated in the 27 deals in Q4, and no investor was involved in multiple deals. The leading VC deal this quarter was concentrating solar thermal company BrightSource Energy with $83.6 million.

“The slowdown in VC funding can be attributed to the grim prospects for thin-film, concentrating solar and concentrating PV technologies,” commented Raj Prabhu, Managing Partner of Mercom Capital Group. “With the drastic fall in crystalline-silicon PV prices over the last two years, most other technologies have struggled to compete.”

Thin-film companies saw the largest amount of VC funding in 2012, although the total fell 47 percent to $314 million compared to almost $600 million in 2011. Within thin-film, the copper indium gallium (di) selenide (CIGS) sub-category received 85 percent, or $274 million, of the total in 2012. Over the past three years, thin-film companies have received the most VC funding, with almost $1.5 billion, of which CIGS has received almost $1 billion. The solar sector’s drop in VC investments is directly related to the struggles of thin-film companies, especially CIGS, noted Prabhu.

On the other hand, solar downstream companies, especially solar lease companies, have benefitted from low module prices. VCs invested $269 million in 25 deals in solar downstream companies. The top 5 VC funding deals in 2012 were BrightSource Energy, a CSP company, for $83.6 million, SolarCity, a solar lease firm, for $81 million, CIGS company Nanosolar for $70 million, solar lease company Sunrun for $60 million, and MiaSolé, a CIGS company, for $55 million.

“The diminished funding activity is not a true reflection of the health of the solar sector, because the demand side of global solar installations has continued to grow,” said Raj Prabhu. “Global solar installations look set to grow by around 10-12 percent this year.”

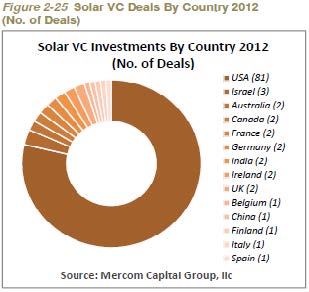

More than 140 investors participated in 2012. The most active investors in terms of deal numbers were New Enterprise Associates with four followed by Black Coral Capital, Firelake Capital Management, Kleiner Perkins Caufield & Byers and SunPower who participated in three deals each.

Corporate M&A activity in solar amounted to $6.7 billion in 52 transactions compared to $4 billion in 65 transactions in 2011. The two largest M&A transactions in 2012 were Eastman Chemical’s first-quarter acquisition of Solutia, a performance and specialty chemicals company with products in PV encapsulants, performance films for PV and heat transfer fluids for CSP plants, for $4.7 billion, and 3M Group’s $860 million purchase of ceramics maker Ceradyne, whose Solar Energy division produces fused silica crucibles for casting multicrystalline-silicon solar cells for the PV industry. Other notable M&A transactions were Korean conglomerate Hanwha Group’s acquisition of German PV manufacturer Q-Cells for $322 million, a price tag that included the assumption of $272 million in debt, the $275 million acquisition of Oerlikon Solar, a producer of equipment and turnkey manufacturing lines for thin-film amorphous-silicon and tandem-junction technology, by Tokyo Electron.

“It was a buyer’s market in 2012 – acquirers were targeting distressed companies with the goal of buying technology or equipment on the cheap,” commented Prabhu. “More than half the 52 M&A deals in 2012 involved solar manufacturers and equipment makers.”

There were 12 corporate M&A transactions in Q4 2012, totaling $953 million with only six transactions disclosing amounts.

Mercom’s report also includes announced large-scale project funding transactions, including investors and project M&A transactions. Active project investors in 2012 included the Development Bank of Southern Africa with 10 transactions, HSH Nordbank with six, International Finance Corporation (IFC) with five followed by Export Import Bank of the U.S., KfW Entwicklungsbank and Union Bank with four transactions each. Some of the active acquirers of projects in 2012 were investment funds who acquired more than 20 projects including the likes of The Carlyle Group, BNP Paribas Clean Energy Partners, ForVEI and Capital Dynamics among others. Other active investor groups were project developers, utilities, independent power producers and insurance companies.

Announced debt funding in 2012 came in at $6.9 billion in 34 deals, compared with $19.9 billion in 41 deals in 2011, and $35.7 billion in 29 deals in 2010. The largest debt deal in 2012 was the $1.6 billion credit facility received by Sky Solar, a Chinese developer of solar projects, by China Development Bank. Loans, credit facilities and framework agreements announced by Chinese banks to Chinese solar companies have reached $52.6 billion since 2010.

Bankruptcies and Insolvency

Mercom tracked 35 solar companies that filed for insolvency or bankruptcy protection over the course of 2012. More than 70 percent of these companies were active in manufacturing and all but a few were based in Europe and the United States. Thin-film manufacturers accounted for nearly 40 percent of the bankruptcies.

Bright Spot – Initial Public Offerings

In a sector devoid of successful exits, SolarCity’s IPO was one of the few bright spots in 2012. SolarCity, a venture-funded company, raised about $95 million in net proceeds. The other notable U.S. VC-backed solar IPO was Enphase Energy, whose debut at the end of March marked the first solar IPO in the United States since 2010.

To get a copy of this report, please email us at info@mercomcapital.com.