Total corporate funding, including venture capital (VC) funding, public market, and debt financing, in 9M 2023 stood at $28.9 billion, 55% higher than $18.7 billion raised in 9M 2022. However, the number of deals decreased by 5% year-over-year (YoY), with 124 in 9M 2023 compared to 131 in 9M 2022.

“Despite inflationary challenges, financing in the solar industry has remained robust through the first three quarters of 2023 thanks to a strong global push toward decarbonization and substantial incentives created by the Inflation Reduction Act,” remarked Raj Prabhu, CEO of Mercom Capital Group. “M&A activity, on the other hand, has faced adverse effects, especially in the realm of project acquisitions, due to increased due diligence, higher costs, delays, and a tight labor market.”

To get the report, visit: https://mercomcapital.com/product/9m-q3-2023-solar-funding-ma-report/

In 9M 2023, VC funding activity rose 4% YoY, with $5.7 billion in 51 deals compared to the $5.5 billion raised in 72 deals in 9M 2022.

Solar downstream companies led financing activity with 28 deals worth $3.8 billion in 9M 2023.

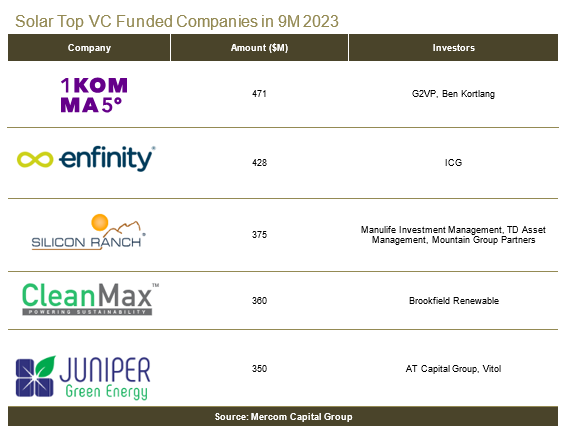

The top VC deals in 9M 2023 were: $471 million raised by 1KOMMA5°, $428 million raised by Enfinity Global, $375 million raised by Silicon Ranch, $360 million raised by CleanMax, and $350 million raised by Juniper Green Energy.

A total of 159 VC investors participated in solar funding in 9M 2023.

Solar public market financing in 9M 2023 came to $7.2 billion in 19 deals, 47% higher compared to $4.9 billion in 11 deals in 9M 2022.

Announced solar debt financing activity in 9M 2023 totaled $16 billion in 54 deals, 93% higher than 9M 2022 when $8.3 billion was raised in 48 deals.

In 9M 2023, 10 securitization deals totaled $3.2 billion, a 39% increase YoY compared to the $2.3 billion raised in eight deals in 9M 2022.

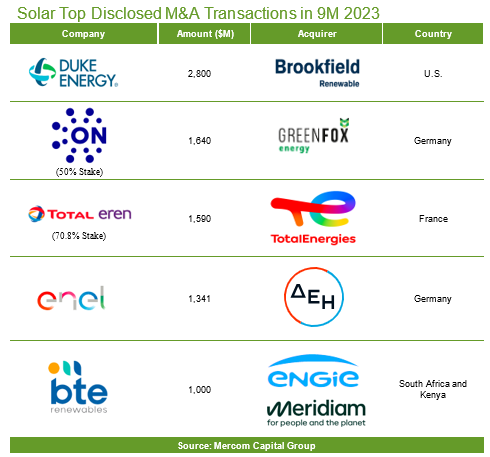

In 9M 2023, there were 75 solar M&A transactions compared to 90 transactions in 9M 2022. The largest deal was in the second quarter by Brookfield Renewable, which agreed to acquire Duke Energy’s unregulated utility-scale commercial renewables business in the U.S. for approximately $2.8 billion.

In 9M 2023, there were a total of 166 project acquisitions for 31.6 GW compared to 207 projects acquired for 52.1 GW in 9M 2022.

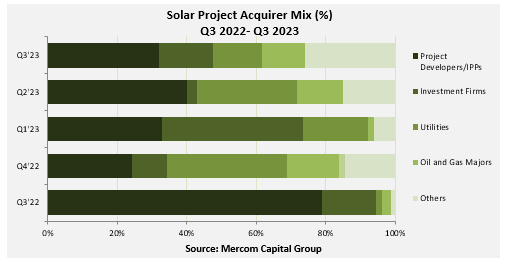

Project Developers and Independent Power Producers (IPPs) were the most active acquirers of solar projects in Q3 2023, picking up 2 GW, followed by insurance companies, pension funds, energy trading companies, industrial conglomerates, and IT firms with a total of 1.6 GW. Investment firms acquired 959 MW; electric utilities acquired 877 MW; and oil and gas companies acquired 759 MW of projects.

There are 267 companies and investors covered in this report. It is 100 pages long and contains 74 charts and tables.

To learn more about the report, visit: https://mercomcapital.com/product/9m-q3-2023-solar-funding-ma-report/