Venture Capital funding into Digital Health companies rose for three consecutive years (2015-2018) before tapering off slightly in 2019. According to Mercom’s Funding database, the sector has raised $44 billion in VC funding since 2010.

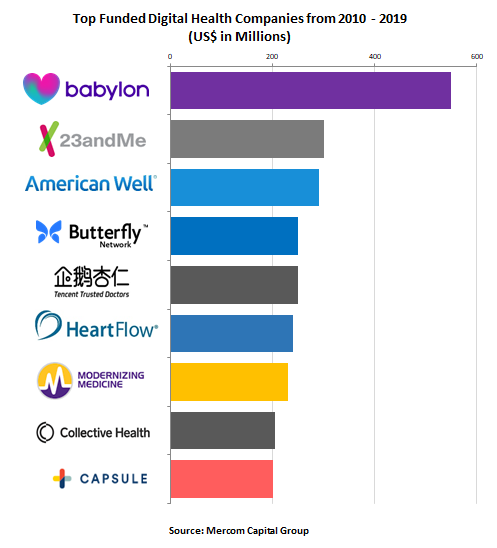

Top 10 VC funded digital health companies since 2010:

Babylon, a telemedicine company that uses AI technology to provide remote consultations, raised $550 million, valuing the company at over $2 billion. The company has raised a total of $650 million to date. According to Mercom data, telemedicine companies raised a total of $5 billion.

Recently the Center for Connected Health Policy published a telehealth billing guide directed at helping healthcare providers on reimbursement.

Genomics data analytics company 23andMe raised $300 million from GlaxoSmithKline. 23andMe acquired CureTogether to complement its offerings. Healthcare data analytics companies raised $6.2 billion.

American Well, a provider of telehealth services, connecting providers, insurers, patients, and innovators to deliver affordable, higher quality care raised $291 million.

Tencent-backed online health care platform Tencent Trusted Doctors raised $250 million, valuing the company at $1 billion.

Capsule, a digital pharmacy startup that takes electronic prescriptions from doctors through a mobile app and delivers the medication to a patient’s home or office, raised $200 million. mHealth apps raised $6 billion according to Mercom data.

Butterfly Network, a developer of tablet-connected full-body ultrasound device named Butterfly iQ, raised $250 million. According to IDC, worldwide wearable markets set to reach nearly 500 Million Units by 2023.

Heartflow, a non-invasive solution that enables clinicians to select a definitive, personalized treatment plan for each patient and reduce the need for additional invasive testing, closed on a $240 million.

Modernizing Medicine, creator of a mobile cloud-based specialty-specific EMR system, raised $231 million.

Collective Health, a web-based predictive analytics platform that helps employers manage health insurance benefits, raised $205 million.

IPO Path:

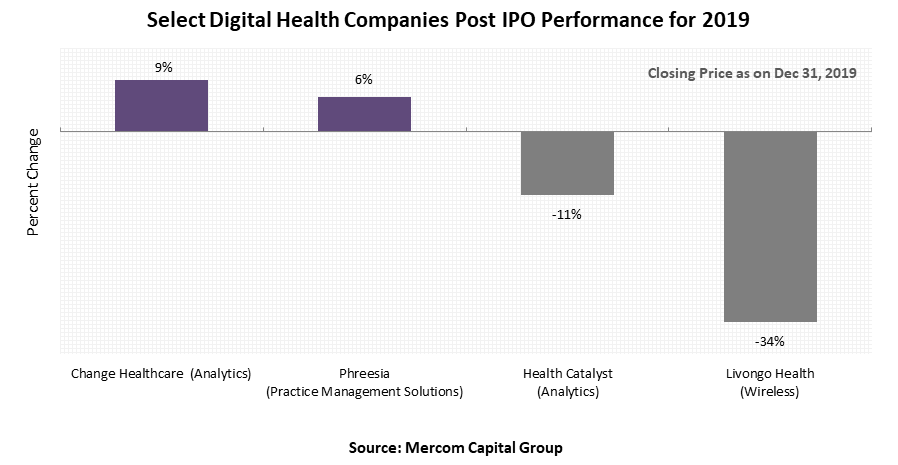

As many as five companies went public in 2019 (four in the United States and one in China) for a total of $1.4 billion. Change Healthcare raised $557 million, followed by Livongo Health with $335 million, Health Catalyst with $182 million, So-Young International with $179 million, and Phreesia with $167 million.

These IPOs are closely watched by the rest of the digital health sector to see if an IPO is a viable path for exits. The performance of four of the U.S.-based companies has been underwhelming so far (as of December 31, 2019). Change Healthcare was up 9%, Phreesia was up 6%, Livongo Health was down 34%, and Health Catalyst was down 11%.

With the stock markets gyrating wildly due to Coronavirus scare, the top-funded private companies could remain private for quite some time.