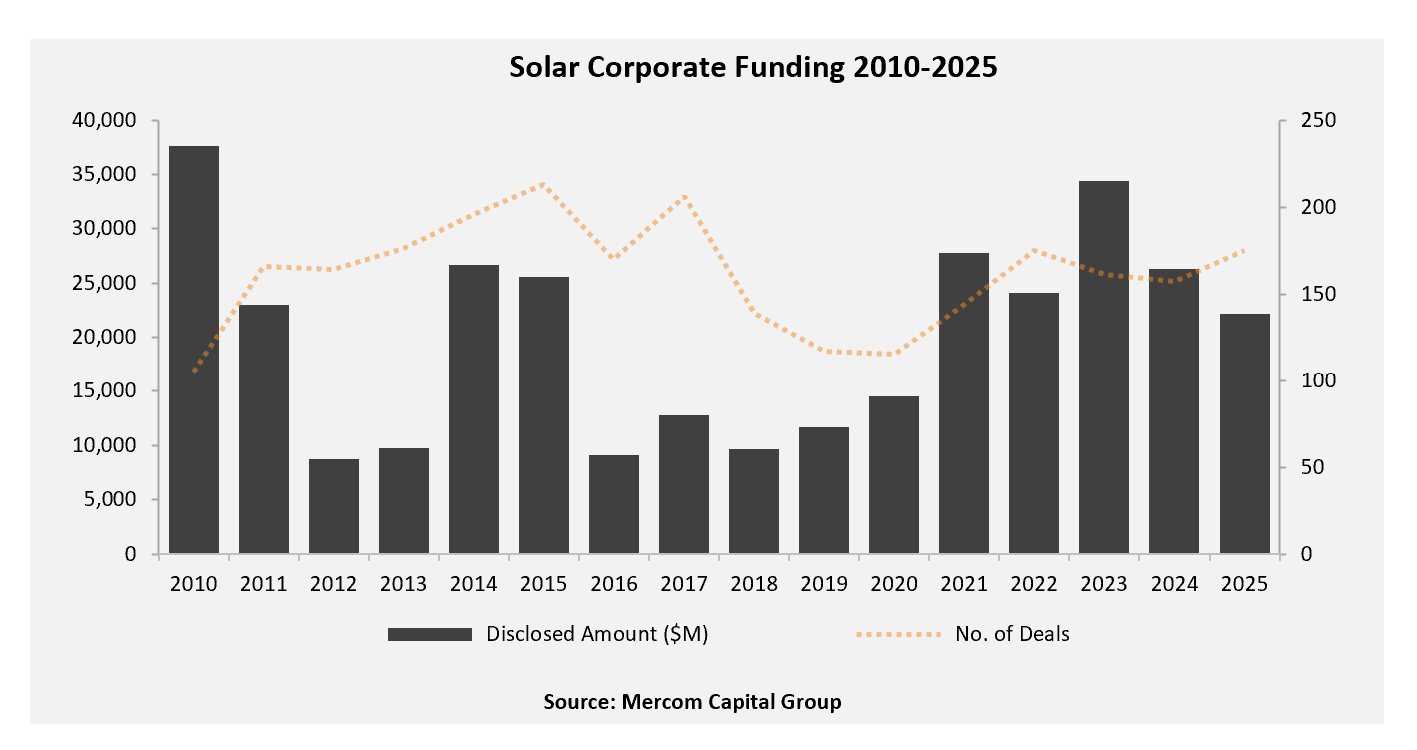

Total corporate funding, including venture capital (VC) funding, public market, and debt financing into the solar sector, decreased 16% year-over-year (YoY) in 2025, with $22.2 billion raised in 175 deals, compared to $26.3 billion in 157 deals in 2024.

To learn more about Mercom’s 2025 Annual Solar Funding and M&A Report, visit: https://mercomcapital.com/product/annual-and-q4-2025-solar-funding-and-ma-report

“2025 was a year of recalibration for the solar industry, shaped by policy uncertainty, trade and tariff risks, and higher interest rates that weighed on overall funding levels. Despite these challenges, corporate funding activity was resilient, with deal counts increasing to multi-year highs even as total capital raised declined, reflecting a shift toward smaller and more selective transactions. Policy clarity in the second half of the year helped improve market visibility for investors and supported increased activity in lower-risk, execution-ready deals. Corporate and project M&A were bright spots in 2025, reflecting sustained demand for solar assets driven by rising energy demand,” said Raj Prabhu, CEO of Mercom Capital Group.

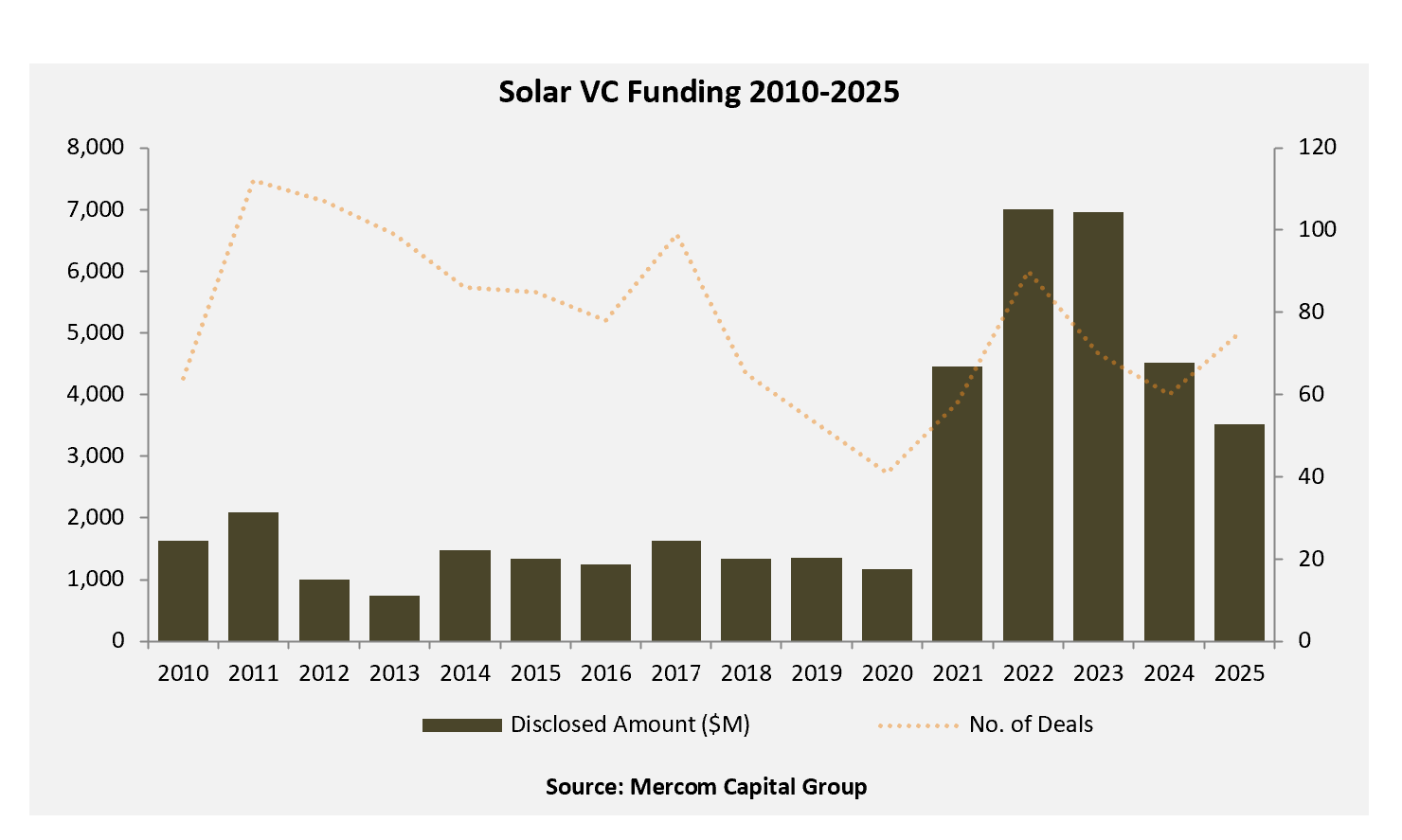

Global VC and private equity funding in the solar sector in 2025 came to $3.5 billion in 75 deals, 22% lower than the $4.5 billion raised in 60 deals in 2024. There were eight VC funding deals of $100 million or more in 2025.

Of the $3.5 billion in VC funding raised in 75 deals in 2025, $2.7 billion (77%) went to Solar Downstream companies. Solar PV companies raised $581 million; Balance of System (BOS) companies raised $99 million; Thin film companies raised $51 million; Manufacturers raised $46 million; Service Providers raised $16 million; and CSP companies raised $6 million.

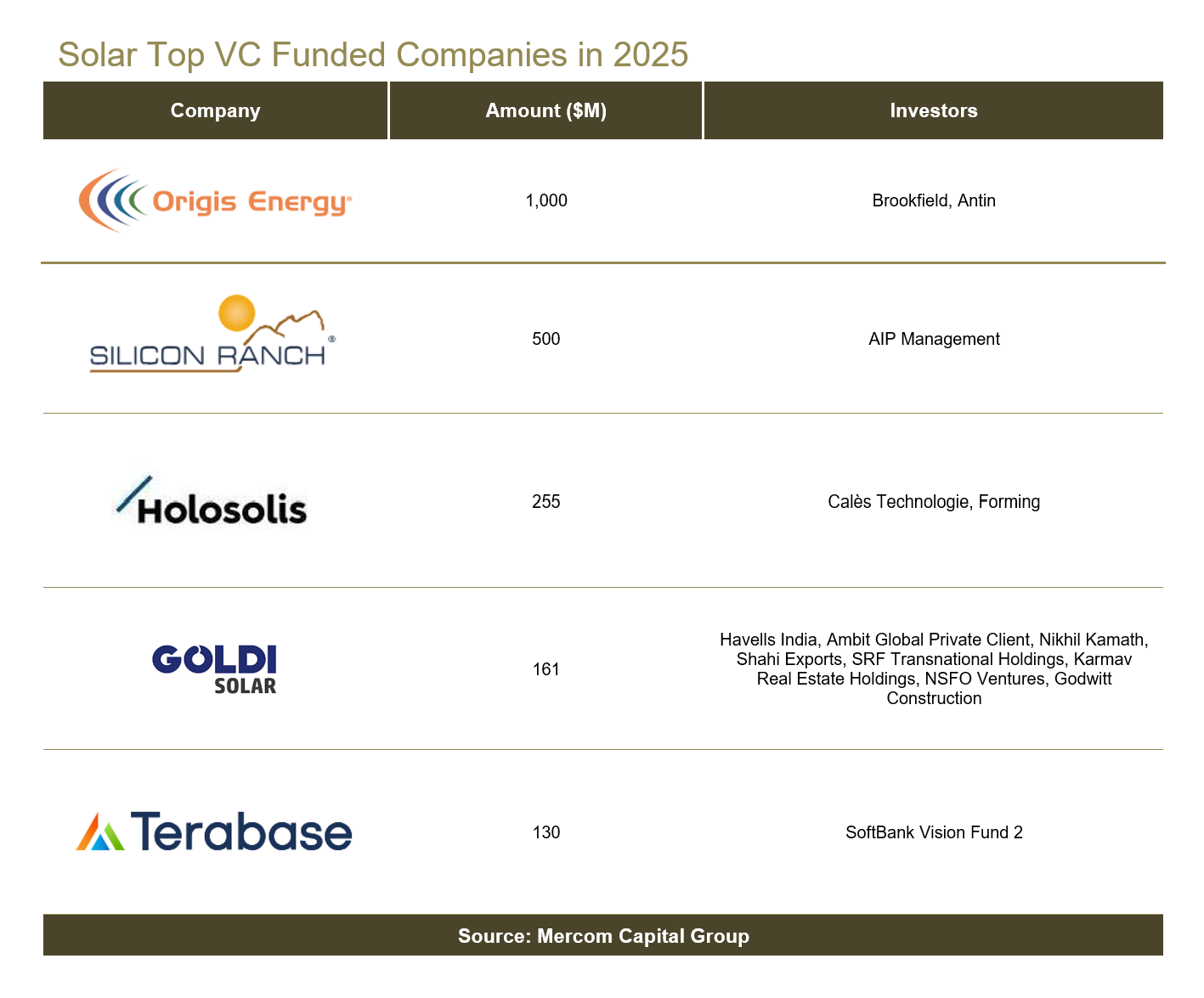

The top VC-funded companies in 2025 were Origis Energy ($1 billion), Silicon Ranch ($500 million), HoloSolis ($255 million), Goldi Solar ($161 million), and Terabase Energy ($130 million).

Public market financing in the solar sector in 2025 totaled $2.6 billion, 13% lower than the $3 billion raised in 2024. Nine companies went public in 2025, bringing in $926 million, compared to the same number of companies that raised $1.3 billion in 2024.

In 2025, announced debt financing came to $16.1 billion, 14% lower compared to $18.8 billion in 2024. Securitization deals totaled $3.4 billion across nine deals.

M&A activity was 17% higher YoY in 2025, with 96 corporate M&A transactions compared to 82 in 2024. The largest transaction was by Ares Management Corporation (Ares), an alternative investment manager, which announced that Ares Alternative Credit funds (Ares Alternative Credit) and other affiliated Ares funds have completed the acquisition of a 20% stake in Plenitude, a subsidiary of Eni Renewable Energy that develops, owns, and operates utility-scale solar PV projects, integrating solar generation with clean power retail and electric mobility solutions, for $2.3 billion at an implied enterprise value of over $13.8 billion.

Solar Downstream companies led corporate M&A activity in 2025, acquiring 72 companies, followed by Manufacturers with nine transactions, Balance of System (BOS) companies with five, Equipment and Service Providers companies with three transactions each, Materials companies with two and PV and CSP companies with one transaction apiece.

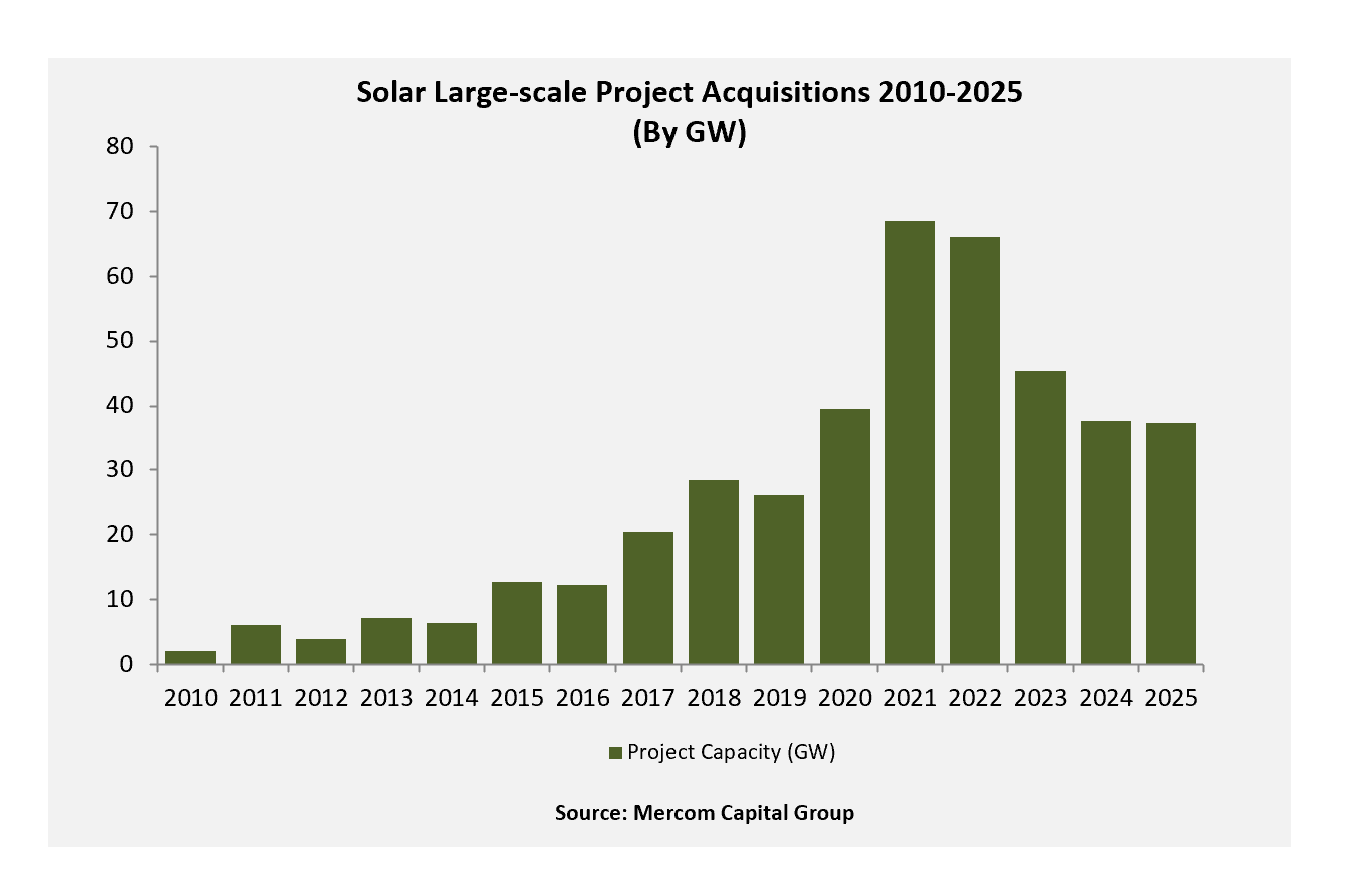

The number of large-scale solar project acquisitions in 2025 increased 13%, with 246 compared to 217 in 2024. The total acquired capacity dropped to 37.4 GW, a 1% decrease compared to 37.7 GW the previous year.

Of the 37.4 GW of large-scale solar projects acquired in 2025, 52% were acquired by Project Developers and IPPs. Investment Firms acquired 24.5%, followed by Others (energy trading companies, industrial conglomerates, energy cooperatives, mining, and IT firms) with 12.5% in 2025. Utilities, Oil and Gas companies, Installers, and Manufacturers acquired the remaining 11%.

Three hundred and ninety (390) companies and investors are covered in this 161-page report, which contains 110 charts, graphs, and tables.

To learn more about Mercom’s 2025 Annual Solar Funding and M&A Report, visit: https://mercomcapital.com/product/annual-and-q4-2025-solar-funding-and-ma-report