Annual and Q4 2025 Solar Funding and M&A Report

$599.00 – $799.00

Click here to download the Executive Summary.

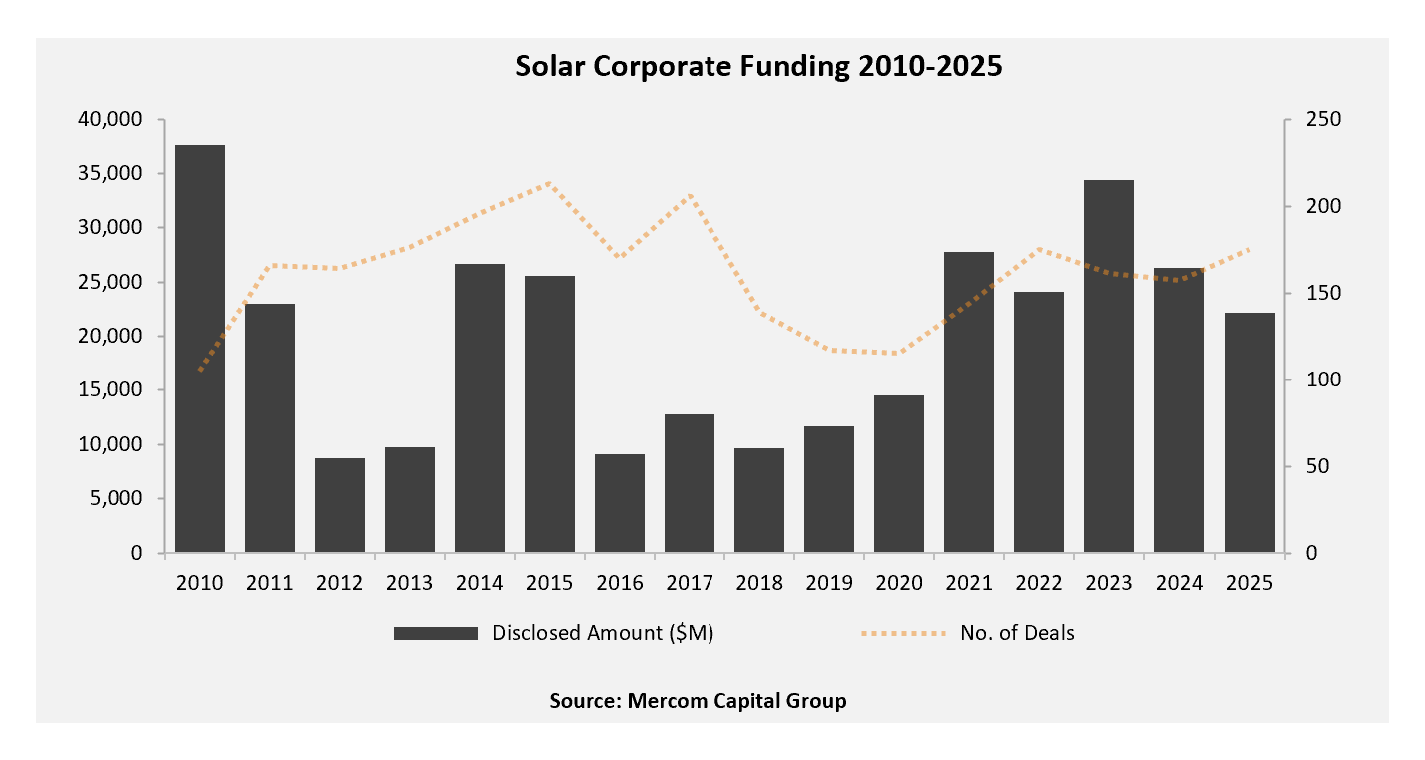

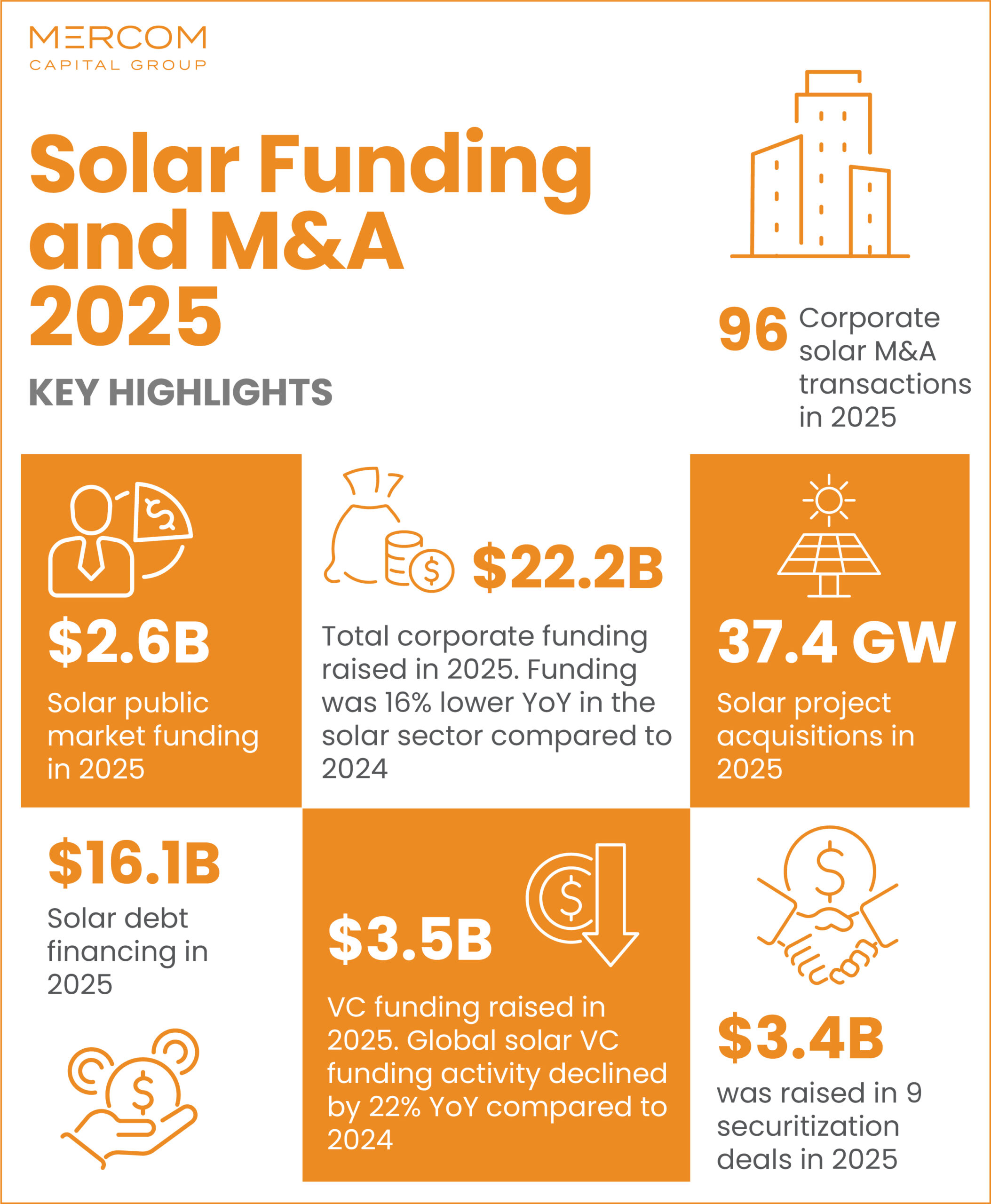

Total corporate funding, including venture capital (VC) funding, public market, and debt financing into the solar sector, decreased 16% year-over-year (YoY) in 2025, with $22.2 billion raised in 175 deals, compared to $26.3 billion in 157 deals in 2024.

“2025 was a year of recalibration for the solar industry, shaped by policy uncertainty, trade and tariff risks, and higher interest rates that weighed on overall funding levels. Despite these challenges, corporate funding activity was resilient, with deal counts increasing to multi-year highs even as total capital raised declined, reflecting a shift toward smaller and more selective transactions. Policy clarity in the second half of the year helped improve market visibility for investors and supported increased activity in lower-risk, execution-ready deals. Corporate and project M&A were bright spots in 2025, reflecting sustained demand for solar assets driven by rising energy demand,” said Raj Prabhu, CEO of Mercom Capital Group.

Global VC and private equity funding in the solar sector in 2025 came to $3.5 billion in 75 deals, 22% lower than the $4.5 billion raised in 60 deals in 2024. There were eight VC funding deals of $100 million or more in 2025.

Public market financing in the solar sector in 2025 totaled $2.6 billion, 13% lower than the $3 billion raised in 2024. Nine companies went public in 2025, bringing in $926 million, compared to the same number of companies that raised $1.3 billion in 2024.

In 2025, announced debt financing came to $16.1 billion, 14% lower compared to $18.8 billion in 2024. Securitization deals totaled $3.4 billion across nine deals.

M&A activity was 17% higher YoY in 2025, with 96 corporate M&A transactions compared to 82 in 2024. The largest transaction was by Ares Management Corporation (Ares), an alternative investment manager, which announced that Ares Alternative Credit funds (Ares Alternative Credit) and other affiliated Ares funds have completed the acquisition of a 20% stake in Plenitude, a subsidiary of Eni Renewable Energy that develops, owns, and operates utility-scale solar PV projects, integrating solar generation with clean power retail and electric mobility solutions, for $2.3 billion at an implied enterprise value of over $13.8 billion.

The number of large-scale solar project acquisitions in 2025 increased 13%, with 246 compared to 217 in 2024. The total acquired capacity also dropped to 37.4 GW, a 1% decrease compared to 37.7 GW the previous year.

There were 289 companies and investors covered in this report. It is 136 pages in length and contains 107 charts, graphs, and tables.

Mercom Capital Group’s Quarterly Solar Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends, and analysis. These reports help bring clarity to professionals in the current financial landscape of the solar industry.

Also available:

Custom Excel Sheets with all transactions for the quarter, and

Custom Research with data from the past 5 years!

Contact us to learn more and get pricing!

Quarterly market and deal activity displayed in easy-to-digest charts, graphs, and tables, alongside data-driven analysis.

The report covers all types of deals and financing activity, including:

- Venture capital funding deals, including top investors, QoQ and YoY trends, and a breakdown of charts and graphs by technology, sector, stage, and country;

- Large-scale project funding deals, including top investors, QoQ and YoY trends and breakdown charts and graphs by technology and country;

- Public market financing, including equity financing, private placements, and rights issues;

- Debt and other funding deals, as well as QoQ and YoY trends;

- Third-party residential/commercial project funds;

- Large-scale project acquisitions and active project acquirers;

- Large-scale project announcements in various levels of development throughout the world;

- Mergers and acquisitions (M&A), including QoQ and YoY trends, a breakdown of charts and graphs by technology and sector, as well as project M&A activity;

- New cleantech and solar funds;

- New large-scale project announcements;

- Large-scale project costs per MW.

This report also contains comprehensive lists of all announced Q4:

- VC funding, debt financing, public equity financing, and project funding deals;

- VC and project funding investors;

- M&A transactions;

- Project acquisitions by amounts and megawatts;

- M&A, and project M&A transactions;

- Large-scale project announcements.

Mercom’s comprehensive report covers deals of all sizes across the globe. Have questions about the report? Email us here.