Q3 2017 Healthcare IT / Digital Health Funding and M&A Report

$299.00 – $549.00

Healthcare IT & Digital Health Companies Raise

$5.5 Billion in VC Funding in Q1-Q3 2017

– View Investors

Click here to download the executive summary of Mercom’s Q3 2017 Healthcare IT / Digital Health Funding and M&A Report.

The report covers both consumer-centric and patient-centric technologies and sub-technologies, including: Social Health, Mobile Health (mHealth), Telehealth, Personal Health, Rating & Shopping, Health Information Management, Revenue Cycle Management, Service Providers and Security. Click here to see our complete list of technologies.

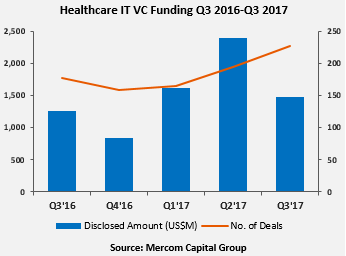

Global VC funding in 9M 2017 was 31 percent higher than the same period in 2016 with $5.5 billion raised in 586 deals compared to the $4.2 billion raised in 463 deals in 9M 2016. Q3 2017 VC funding came to $1.5 billion in 227 deals, a 38 percent decrease compared to the record $2.4 billion raised in 194 deals in Q2 2017. The 227 deals in Q3 2017 were the most recorded in a single quarter since 2010.

“The record breaking funding year continues for digital health companies. The 227 funding deals in Q3 was the most ever for a single quarter. Third quarter was all about Data Analytics with companies garnering almost a third of the funding in Q3 and artificial intelligence companies receiving more than $200 million,” commented Raj Prabhu, CEO and Co-Founder of Mercom Capital Group.

The top funded areas in 9M 2017 were: Data Analytics with $1 billion, Patient Engagement Solutions with $686 million, mHealth Apps with $549 million, Telemedicine with $529 million, Booking with $407 million, and Mobile Wireless with $407 million.

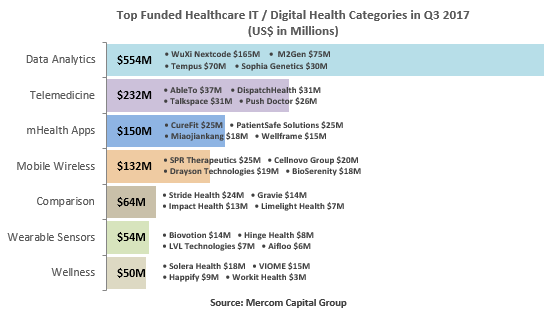

The top funded categories in Q3 2017 were: Data Analytics companies with $554 million, Telemedicine companies with $232 million, mHealth Apps companies with $150 million, and Mobile Wireless companies with $132 million.

There were 69 early stage deals in Q3 2017, including 29 accelerator and incubator deals.

The Top VC deals in Q3 2017 included: $165 million raised by WuXi Nextcode, $75 raised by M2Gen, $70 million raised by Tempus, $37 raised by AbleTo, and $34 million raised by HealthEdge.

A total of 401 investors (including seven accelerators/incubators) participated in funding deals in Q3 2017 compared to 454 investors in Q2 2017, of which two were accelerators/incubators.

Notable M&A transactions in Q3 2017 included: health information provider WebMD’s acquisition by KKR portfolio company Internet Brands for $2.8 billion; the acquisition of the healthcare technology and consulting business of Advisory Board Company by Optum for $1.3 billion. Konica Minolta acquired Ambry Genetics Corporation for $1 billion; Navicure acquired ZirMed for $750 million; FNFV Group acquired T-System for $200 million; and Allscripts acquired McKesson’s EHR and revenue cycle tools for $185 million.

This report is 103 pages in length, contains 64 charts, graphs and tables, and covers 738 investors and companies.

Mercom’s comprehensive report covers deals of all sizes across the globe. Have questions about the report? Email us: reports@mercomcapital.com.