Q2 2017 Healthcare IT / Digital Health Funding and M&A Report

$299.00 – $549.00

Digital Health Companies Log Their

Best-Funded Quarter and First Half Ever

– Find Out Why!

Click here to download the executive summary.

Mercom Capital Group’s Q2 2017 Health IT Funding and M&A Report is a comprehensive high-quality report delivering superior insight, market trends and analysis. This report helps bring clarity to professionals as to the current financial landscape of the Health IT / Digital Health industry covering deals of all sizes globally.

The report covers both consumer-centric and patient-centric technologies and sub-technologies, including: Social Health, Mobile Health (mHealth), Telehealth, Personal Health, Rating & Shopping, Health Information Management, Revenue Cycle Management, Service Providers and Security. Click here to see our complete list of technologies.

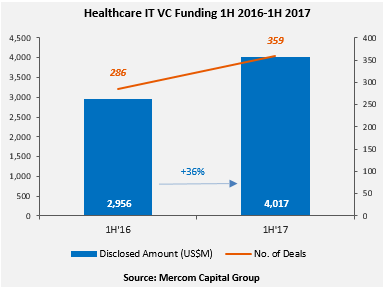

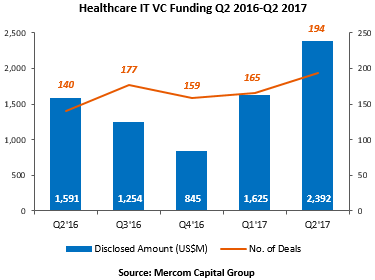

Global VC funding for Healthcare IT / Digital Health companies in 1H of 2017 was 36 percent higher year-over-year (YoY) with a record $4 billion raised in 359 deals compared to the $3 billion raised from 286 deals in 1H 2016. Q2 2017 VC funding also was at it’s highest ever, increasing 47 percent to $2.4 billion in 194 deals compared to the $1.6 billion raised in 165 deals in Q1 2017. Q2 2017 had the second most deals recorded (194) in a quarter since 2010. In Q3 2014, there were 212 deals.

The Digital Health sector has now received $22.5 billion in 3,031 VC funding deals Mercom has tracked since 2010.

Total corporate funding in Health IT companies – including VC, debt, and public market financing – came to $2.4 billion in Q2 2017 compared to $1.8 billion in Q1 2017.

“This was the best half and best quarter ever for digital health companies as a result of a few very large deals. We are now comfortably on pace to have the biggest funding year for digital health companies,” commented Raj Prabhu, CEO and Co-Founder of Mercom Capital Group. “Even with such robust funding, there is still no sign of any digital health IPOs and M&A activity is yet to catch up to the funding momentum.”

Healthcare practice-centric companies received 31 percent of the funding in Q2 2017, raising $745 million in 63 deals compared to $574 million in 50 deals in Q1 2017. Consumer-centric companies accounted for 69 percent of the funding this quarter, raising $1.6 billion in 131 deals compared to $1 billion in 115 deals in Q1 2017.

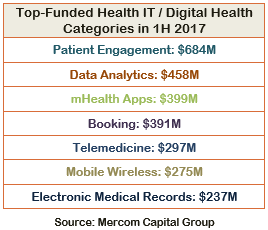

The top funded areas in 1H 2017 were: Patient Engagement Solutions $684 million, Data Analytics $458 million, mHealth Apps $399 million, Booking $391 million, Telemedicine $297 million, Mobile Wireless $275 million, and Electronic Medical Records $237 million.

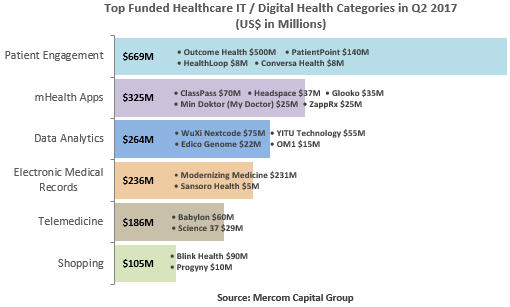

The top funded categories in Q2 2017 were: Patient Engagement companies with $669 million, mHealth Apps companies with $325 million, Data Analytics companies with $264 million, and Electronic Medical Records companies with $236 million.

There were 68 early stage deals in Q2 2017, including two accelerator and incubator deals.

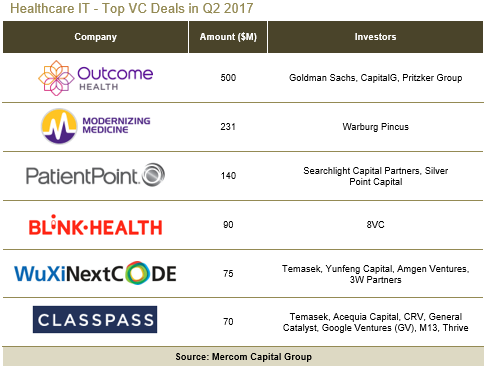

The Top VC deals in Q2 2017 included: $500 million raised by Outcome Health, $231 million raised by Modernizing Medicine, $140 million raised by PatientPoint, $90 million raised by Blink Health, $75 million raised by WuXi Nextcode, and $70 million raised by ClassPass.

A total of 454 investors (including two accelerators/incubators) participated in funding deals in Q2 2017 compared to 309 investors in Q1 2017, of which four were accelerators/incubators.

Twenty-five different countries recorded Healthcare IT VC funding deals in Q2 2017.

In 1H 2017, there were a total of 90 Healthcare IT M&A transactions, compared to 110 in 1H 2016. M&A activity in the second quarter of 2017 was down with 41 M&A transactions (five disclosed) compared to the 49 M&A transactions (seven disclosed) in Q1 2017.

Practice Management Solutions and Data Analytics companies were involved in the most M&A transactions in Q2 2017 with five each, followed by Medical Imaging companies with three transactions.

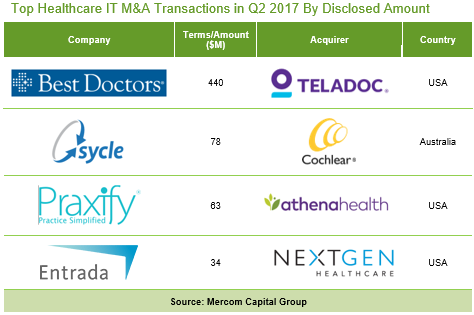

Prominent M&A transactions in Q2 2017 included: the acquisition of Best Doctors for $440 million by Teladoc, Cochlear’s acquisition of Sycle for $78 million, athenahealth’s acquisition of Praxify Technologies for $63 million, and the acquisition of Entrada by NextGen Healthcare (a subsidiary of Quality Systems) for $34 million.

This report is 102 pages in length, contains 66 charts, graphs and tables, and covers 732 investors and companies.

Mercom’s comprehensive report covers deals of all sizes across the globe. Have questions about the report? Email us: reports@mercomcapital.com.