Q1 2018 Healthcare IT / Digital Health Funding and M&A Report

$299.00 – $549.00

Healthcare IT Funding Jumps

To $2.5 Billion During Q1 2018

– Get the Details!

Click here to download the Executive Summary.

The report covers both consumer-centric and patient-centric technologies and sub-technologies, including: Social Health, Mobile Health (mHealth), Telehealth, Personal Health, Rating & Shopping, Health Information Management, Revenue Cycle Management, Service Providers and Security. Click here to see our complete list of technologies.

Total corporate funding for Digital Health companies – including VC, debt, and public market financing – came close to $3 billion in Q1 2018 compared to $1.8 billion in Q4 2017.

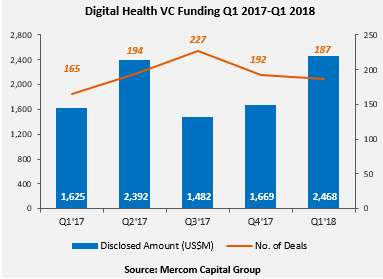

Venture capital (VC) funding, including private equity and corporate venture capital, into Digital Health (Healthcare IT) companies in Q1 2018 surged to a record $2.5 billion raised in 187 deals. Q1 2018 was only the second quarter since 2010 in which Digital Health companies surpassed $2 billion in VC funding.

The Digital Health sector has now accumulated $28 billion in disclosed VC funding since 2010.

“Digital Health VC is off to a record start in 2018 with $2.5 billion beating the previous record of $2.4 billion from Q2 2017. Several large deals over $100 million pushed the funding total up in the quarter, with activity powered by over 400 investors,” commented Raj Prabhu, CEO and Co-Founder of Mercom Capital Group.

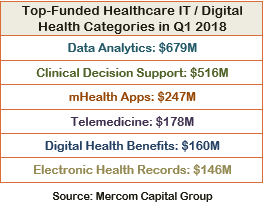

The top funded categories in Q1 2018 were: $679 million raised by Data Analytics companies, Clinical Decision Support with $516 million, mHealth Apps with $247 million, Telemedicine’s $178 million, Benefits with $160 million, and $146 million from Electronic Health Records.

The top VC deals in Q1 2018 included: $240 million raised by Heartflow, $200 million from Helix, $200 million raised by SomaLogic, $146 million by PointClickCare, and Collective Health’s $110 million raise.

There were 55 early-round deals in Q1 2018, including three accelerator and incubator deals.

A total of 412 investors (including one accelerator/incubator) participated in funding deals in Q1 2018 compared to 371 investors in Q4 2017, of which 13 were accelerators/incubators.

There were 48 M&A transactions (13 disclosed) in the Digital Health sector in Q1 2018. There was one IPO launched in Q1 from Chinese fitness tracker and smartwatch maker, Huami, which raised $110 million and listed on the New York Stock Exchange.

The top disclosed M&A transactions were: the $1.9 billion acquisition of Flatiron Health by Roche, ABILITY Network’s $1.2 billion acquisition by Inovalon, Intermedix’ $460 million acquisition by R1 RCM, Clearlake Capital Group’s acquisition of ProVation Medical for $180 million, and the $100 million acquisition of Practice Fusion by Allscripts.

A total of 698 companies and investors were covered in this report.

The Q1 Digital Health (Healthcare IT) Funding and M&A Report contains annual, quarter-over-quarter (QoQ) information on market activity displayed in easy-to-digest charts, graphs and tables, as well as data-driven analysis covering:

- Venture capital (VC) funding deals, including top investors, QoQ trends, and charts and graphs broken down by technology and stage;

- Practice-focused technology and subgroups;

- Consumer-focused technology and subgroups;

- VC funding by country and U.S. state;

- VC funding trends in early stage deals (below $2 million) and trends in deals over $2 million;

- Debt and public market financing deals;

- Mergers and acquisitions (M&A), including QoQ trends, a breakdown of charts and graphs by technology and geography;

- New Healthcare IT funds

This report also contains comprehensive lists of all announced Q1:

- VC deals with investors and transaction details;

- Debt and public market financing deals and investors;

- M&A transactions and acquirers.

This report is 98 pages in length, contains 61 charts, graphs and tables, and covers 698 investors and companies.