Q1 2018 Funding and M&A Report for Storage, Grid & Efficiency

$299.00 – $399.00

A Combined $472 million was Raised in Q1 2018

– Get the Report!

Click here to download our Q1 2018 Funding and M&A Executive Summary on Battery Storage, Smart Grid, and Efficiency

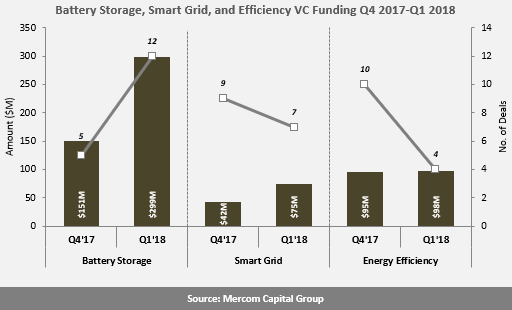

Mercom found that in Q1 2018, a combined $472 million was raised by Battery Storage, Smart Grid, and Energy Efficiency companies, an increase from the $289 million raised in Q4 2017.

Battery Storage

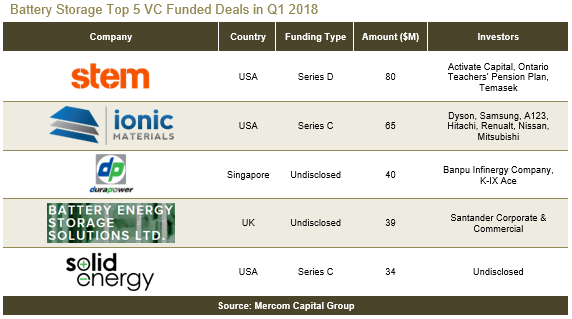

VC funding raised by Battery Storage companies in Q1 2018 jumped to $299 million in 12 deals from $151 million in five deals in Q4 2017. Total corporate funding, including debt and public market financing, came to $299 million in 12 deals compared to $154 million in six deals in Q4 2017.

Energy Storage System companies received the most funding with $91 million.

There were four M&A transactions involving Battery Storage companies in Q1 2018 compared to one M&A transactions in Q4 2017.

Smart Grid

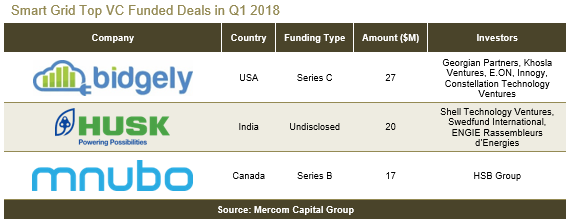

VC funding for Smart Grid companies increased 79 percent in Q1 2018 with $75 million in seven deals compared to $42 million in nine deals in Q4 2017. Total corporate funding, including debt and public market financing, came to $1.3 billion in nine deals compared to $796 million in 12 deals in Q4 2017.

Smart Grid Communications companies had the largest share of VC funding in Q1 2018 with $48 million in three deals.

There was one M&A transaction recorded in the Smart Grid sector in Q1 2018 compared to eight transactions in Q4 2017.

Energy Efficiency

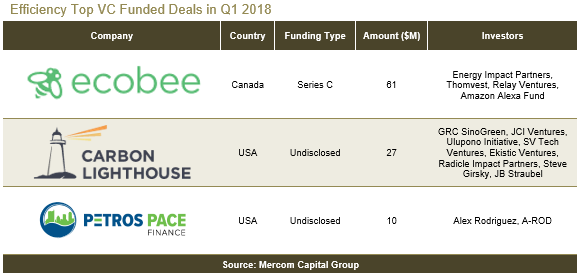

VC funding raised by Energy Efficiency companies in Q1 2018 remained steady at $98 million in four deals compared to $95 million in 10 deals in Q4 2017. Total corporate funding, including debt and public market financing, came to $104 million in five deals compared to $916 million in 14 deals in Q4 2017.

Temperature Control companies captured the most funding with $61 million in one deal in Q1 2018.

M&A activity for the Efficiency sector in Q1 2018 came to one transaction compared to three M&A transactions in Q4 2017.

Mercom Capital Group’s Battery Storage, Smart Grid, and Efficiency Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends and analysis. These reports help bring clarity to professionals in the current financial landscape of the smart grid industry.

The Quarterly Funding and M&A Reports contain quarter-over-quarter (QoQ) information on market activity displayed in easy-to-digest charts, graphs and tables, as well as data-driven analysis covering:

- Venture capital funding deals including top investors, QoQ trends, and a breakdown of charts and graphs by stage;

- VC funding by technology;

- Debt and other funding deals;

- Mergers and Acquisitions (M&A) including QoQ trends, with charts and graphs by technologies;

- Battery and storage funding deals;

- Smart Grid funding deals;

- Energy Efficiency funding deals;

- New cleantech funds;

This report also contains comprehensive lists of all announced deals and transactions during the quarter, including:

- VC deals and investors;

- M&A transactions and acquirers;

- New cleantech funds.

There were 76 companies and investors covered in this report. The report is 69 pages in length and contains 67 charts, graphs and tables.