9M and Q3 2021 Funding and M&A Report for Storage, Grid & Efficiency

$299.00 – $399.00

A combined $6.5 billion

VC Funding was raised in 9M 2021

– Get the Report!

Click here to download our 9M and Q3 2021 Funding and M&A Executive Summary on Battery Storage, Smart Grid, and Efficiency.

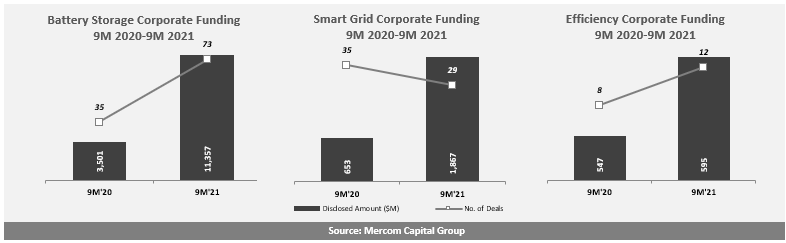

Mercom found that in the first nine months (9M) of 2021, $6.5 billion was raised in VC funding by Battery Storage, Smart Grid, and Efficiency companies compared to $1.9 billion in 9M 2020.

Battery Storage

VC funding in Battery Storage companies in 9M 2021 was up significantly (363%) with $5.5 billion in 59 deals compared to $1.2 billion in 21 deals in 9M 2020. This is the highest ever amount of funding received by Battery Storage companies in a 9M period. Northvolt’s $2.75 billion funding round in Q2 2021 was a big part of the increase.

A total of 223 VC investors participated in Battery Storage funding in 9M 2021.

In 9M 2021, there were 15 Battery Storage M&A transactions compared to 11 transactions in 9M 2020.

Smart Grid

VC funding in Smart Grid companies in 9M 2021 was 46% higher with a record $936 million compared to the $643 million raised in 9M 2020.

A total of 100 VC investors participated in Smart Grid funding in 9M 2021.

In 9M 2021, there were a total of 17 Smart Grid M&A transactions (one disclosed) compared to 18 transactions (four disclosed) in 9M 2020.

Efficiency

VC funding for Energy Efficiency companies in 9M 2021 was 95% lower with $5 million compared to the $95 million raised in 9M 2020.

A total of six VC investors participated in Energy Efficiency funding in 9M 2021.

In 9M 2021, there were two Efficiency M&A transactions ($300 million) compared to four transactions ($1.4 billion) in 9M 2020.

Mercom Capital Group’s Battery Storage, Smart Grid, and Efficiency Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends and analysis. These reports help bring clarity to professionals in the current financial landscape of the smart grid industry.

The Quarterly Funding and M&A Reports contain quarter-over-quarter (QoQ) information on market activity displayed in easy-to-digest charts, graphs and tables, as well as data-driven analysis covering:

- Venture capital funding deals including top investors, QoQ trends, and a breakdown of charts and graphs by stage;

- VC funding by technology;

- Debt and other funding deals;

- Mergers and Acquisitions (M&A) including QoQ trends, with charts and graphs by technologies;

- Battery and storage funding deals;

- Smart Grid funding deals;

- Energy Efficiency funding deals;

- New cleantech funds;

This report also contains comprehensive lists of all announced deals and transactions during the quarter, including:

- VC deals and investors;

- M&A transactions and acquirers;

- New cleantech funds.

There were 233 companies and investors covered in this report. The report is 124 pages in length and contains 92 charts, graphs and tables.