9M and Q3 2020 Solar Funding and M&A Report

$299.00 – $499.00

9M 2020 Total Corporate Funding

Totals $7.9 Billion

– See the Details!

Click here to download the Executive Summary.

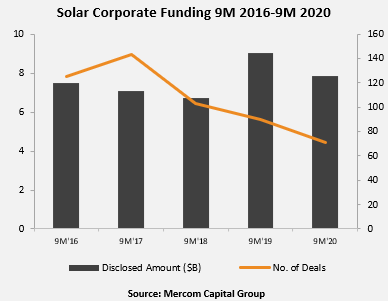

Total corporate funding (including venture capital funding, public market, and debt financing) in 9M of 2020 came to $7.9 billion compared to $9 billion in 9M 2019, a 13% drop year-over-year (YoY).

“After declining in Q2, financing activity was up across the board, whether it was VC, private equity, public market, or debt financing, a clear sign the market is bouncing back after a prolonged shutdown. Transactions in the works that could not make progress in Q1 and Q2 were getting closed in Q3, resulting in a funding surge. Project acquisition activity – an important indicator of the financial health in the solar sector, bounced back strongly in Q3,” said Raj Prabhu, CEO of Mercom Capital Group.

“Solar stocks are on an incredible run so far this year. Of the 24 solar stocks Mercom track’s globally, 12 were up over 100% at the end of Q3 – an unprecedented number,” Prabhu added.

In 9M 2020, global VC funding (venture capital, private equity, and corporate venture capital) in the solar sector was 61% lower with $394 million compared to $1 billion raised in 9M 2019.

Solar debt financing activity in 9M 2020 was 6% lower, with $5.4 billion in 32 deals compared to 9M 2019. Six solar securitization deals brought in almost $1.6 billion in 9M 2020.

Project acquisition activity was up 52% in 9M 2020, with 24.3 GW of solar projects acquired, compared to 16 GW acquired in the same period last year. 9.5 GW of solar projects were acquired in Q3 2020, 244% higher compared to 2.8 GW in Q2 2020. Investment Firms were the most active project acquirers in Q3 2020, picking up 4.2 GW, followed by Project Developers and Independent Power Producers, who acquired 3.8 GW of projects.

There were 309 companies and investors covered in this 95 pages report, which contains 83 charts, graphs, and tables.

Mercom Capital Group’s Quarterly Solar Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends, and analysis. These reports help bring clarity to professionals in the current financial landscape of the solar industry.

Also available:

Custom Excel Sheets with all transactions for the quarter, and

Custom Research with data from the past 10 years!

Contact us to learn more and get pricing!

Quarterly market and deal activity displayed in easy-to-digest charts, graphs and tables, alongside data-driven analysis.

The report covers all types of deals and financing activity, including:

- Venture capital funding deals, including top investors, QoQ and YoY trends, and a breakdown of charts and graphs by technology, sector, stage and country;

- Large-scale project funding deals, including top investors, QoQ and YoY trends and breakdown charts and graphs by technology and country;

- Public market financing, including equity financing, private placements and rights issues;

- Debt and other funding deals, as well as QoQ and YoY trends;

- Third-party residential/commercial project funds;

- Large-scale project acquisitions and active project acquirers;

- Large-scale project announcements in various levels of development throughout the world;

- Mergers and acquisitions (M&A), including QoQ and YoY trends, a breakdown of charts and graphs by technology and sector, as well as project M&A activity;

- New cleantech and solar funds;

- New large-scale project announcements;

- Large-scale project costs per MW.

This report also contains comprehensive lists of all announced Q3:

- VC funding, debt financing, public equity financing, and project funding deals;

- VC and project funding investors;

- M&A transactions;

- Project acquisitions by amounts and megawatts;

- M&A, and project M&A transactions;

- Large-scale project announcements.

Mercom’s comprehensive report covers deals of all sizes across the globe. Have questions about the report? Email us here.