2020 Q4 and Annual Funding and M&A Report for Storage, Grid & Efficiency

$599.00 – $799.00

A combined $8.1 billion

Corporate Funding was raised in 2020

– Get the Report!

Click here to download our 2020 Q4 and Annual Funding and M&A Executive Summary on Battery Storage, Smart Grid, and Efficiency.

Total corporate funding (including venture capital funding, public market, and debt financing) for the Battery Storage, Smart Grid, and Energy Efficiency sectors in 2020 was up by 112%, with $8.1 billion compared to $3.8 billion in 2019.

Global VC funding (venture capital, private equity, and corporate venture capital) for Battery Storage, Smart Grid, and Efficiency companies in 2020 was 12% higher with $2.6 billion compared to $2.3 billion raised in 2019.

Battery Storage

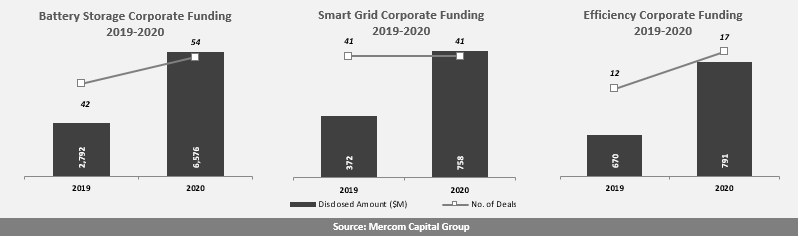

Total corporate funding in the battery storage sector was up 136% with $6.6 billion in 54 deals in 2020. However, VC funding for Battery Storage companies totaled $1.5 billion in 32 deals compared to $1.7 billion raised in 32 deals in 2019.

Lithium-ion based battery technology companies received the most VC funding in 2020, with $649 million. Other categories that received funding included Solid-state batteries, Energy storage downstream, Energy storage systems, and Flow batteries.

There were 19 M&A transactions in the Battery Storage category in 2020, of which two disclosed transaction amounts.

Smart Grid

Smart Grid companies raised $748 million in VC funding in 38 deals in 2020, a 149% increase compared to the $300 million raised in 38 deals in 2019. Total corporate funding, including debt and public market financing, came to $758 million in 41 deals compared to $372 million in 41 deals in 2019.

Smart Charging companies had the largest share of VC funding in 2020 with $324 million in 13 deals, followed by Smart Grid Communications companies with $119 million in six deals, and Demand Response companies with $104 million in three deals.

In 2020, there were 21 M&A transactions (four disclosed) recorded in the Smart Grid sector compared to 29 in 2019.

Efficiency

VC funding for Energy Efficiency companies came to $291 million in 16 deals in 2020 compared to $298 million in nine deals in 2019. Total corporate funding, including debt and public market financing, reached $791 million in 2020 compared to $670 million in 2019.

M&A activity for Efficiency companies in 2020 decreased with four transactions, two of which disclosed the transaction amount. In 2019, there were nine M&A transactions with two that disclosed the transaction amount.

Mercom Capital Group’s Battery Storage, Smart Grid, and Efficiency Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends and analysis. These reports help bring clarity to professionals in the current financial landscape of the smart grid industry.

The Quarterly Funding and M&A Reports contain quarter-over-quarter (QoQ) and year-over-year (YoY) information on market activity displayed in easy-to-digest charts, graphs and tables, as well as data-driven analysis covering:

- Venture capital funding deals including top investors, QoQ and YoY trends, and a breakdown of charts and graphs by stage;

- VC funding by technology;

- Debt and other funding deals;

- Mergers and Acquisitions (M&A) including QoQ and YoY trends, with charts and graphs by technologies;

- Battery and storage funding deals;

- Smart Grid funding deals;

- Energy Efficiency funding deals;

- New cleantech funds;

This report also contains comprehensive lists of all announced deals and transactions during the quarter, including:

- VC deals and investors;

- M&A transactions and acquirers;

- New cleantech funds.

There were 116 companies and investors covered in this report. The report is 132 pages in length and contains 134 charts, graphs and tables.