2018 Q4 and Annual Funding and M&A Report for Storage, Grid & Efficiency

Price range: $599.00 through $799.00

A Combined $2.8 billion was Raised in 2018

– Get the Report!

Click here to download our Q4 and Annual 2018 Funding and M&A Executive Summary on Battery Storage, Smart Grid, and Efficiency

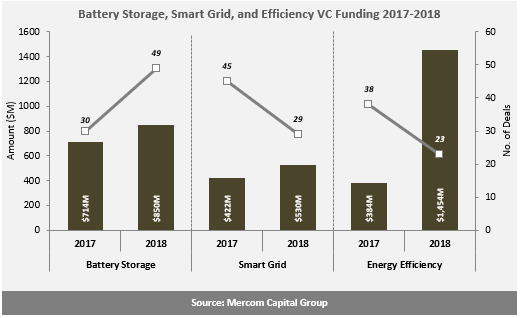

Mercom found that in 2018, a combined $2.8 billion was raised by Battery Storage, Smart Grid, and Energy Efficiency companies, an increase from the $1.5 billion raised in 2017.

Battery Storage

In 2018, VC funding into Battery Storage companies increased by 19 percent to $850 million in 49 deals compared to $714 million raised in 30 deals in 2017. Total corporate funding, including debt and public market financing, increased to $1.3 billion in 2018 compared to $890 million in 2017.

Lithium-ion based battery technology companies received the most funding with $236 million followed by Energy Storage Systems companies with $193 million.

There were 16 M&A transactions in the Battery Storage category in 2018, of which only three disclosed transaction amounts. In 2017, there were three M&A transactions, two of which disclosed transaction amounts.

Smart Grid

Smart Grid companies raised $530 million in VC funding in 29 deals in 2018, a 26 percent increase compared to the $422 million raised in 45 deals in 2017. Total corporate funding, including debt and public market financing, came to $1.8 billion in 33 deals, compared to $1.2 billion in 50 deals in 2017.

Smart Charging of plug-in hybrid electric vehicle (PHEV), vehicle-to-grid (V2G) companies, had the largest share of VC funding in 2018 with $348 million in nine deals, followed by Grid Optimization companies with $59 million in two deals.

In 2018, there were 12 undisclosed M&A transactions recorded in the Smart Grid sector. In 2017, there were 27 transactions (seven disclosed) for $2.5 billion.

Efficiency

VC funding for Energy Efficiency companies jumped to $1.5 billion in 23 deals in 2018 compared to $384 million in 38 deals in 2017. Total corporate funding, including debt and public market financing, reached more than $1.7 billion in 2018, compared to $3.3 billion in 2017.

M&A activity for Efficiency companies in 2018 dropped to seven transactions, one of which disclosed the transaction amount. In 2017, there were 10 M&A transactions with three that disclosed transaction amounts.

Mercom Capital Group’s Battery Storage, Smart Grid, and Efficiency Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends and analysis. These reports help bring clarity to professionals in the current financial landscape of the smart grid industry.

The Quarterly Funding and M&A Reports contain quarter-over-quarter (QoQ) information on market activity displayed in easy-to-digest charts, graphs and tables, as well as data-driven analysis covering:

- Venture capital funding deals including top investors, QoQ trends, and a breakdown of charts and graphs by stage;

- VC funding by technology;

- Debt and other funding deals;

- Mergers and Acquisitions (M&A) including QoQ trends, with charts and graphs by technologies;

- Battery and storage funding deals;

- Smart Grid funding deals;

- Energy Efficiency funding deals;

- New cleantech funds;

This report also contains comprehensive lists of all announced deals and transactions during the quarter, including:

- VC deals and investors;

- M&A transactions and acquirers;

- New cleantech funds.

There were 127 companies and investors covered in this report. The report is 129 pages in length and contains 124 charts, graphs and tables.