1H and Q2 2021 Digital Health Funding and M&A Report

$299.00 – $549.00

Venture Capital Funding

in Digital Health Sector

Reaches $15 Billion in 1H 2021

Click here to download the Executive Summary.

The report covers both consumer-centric and patient-centric technologies and sub-technologies, including: Social Health, Mobile Health (mHealth), Telehealth, Personal Health, Rating & Shopping, Health Information Management, Revenue Cycle Management, Service Providers and Security.

Click to see the complete list of technologies covered in this report.

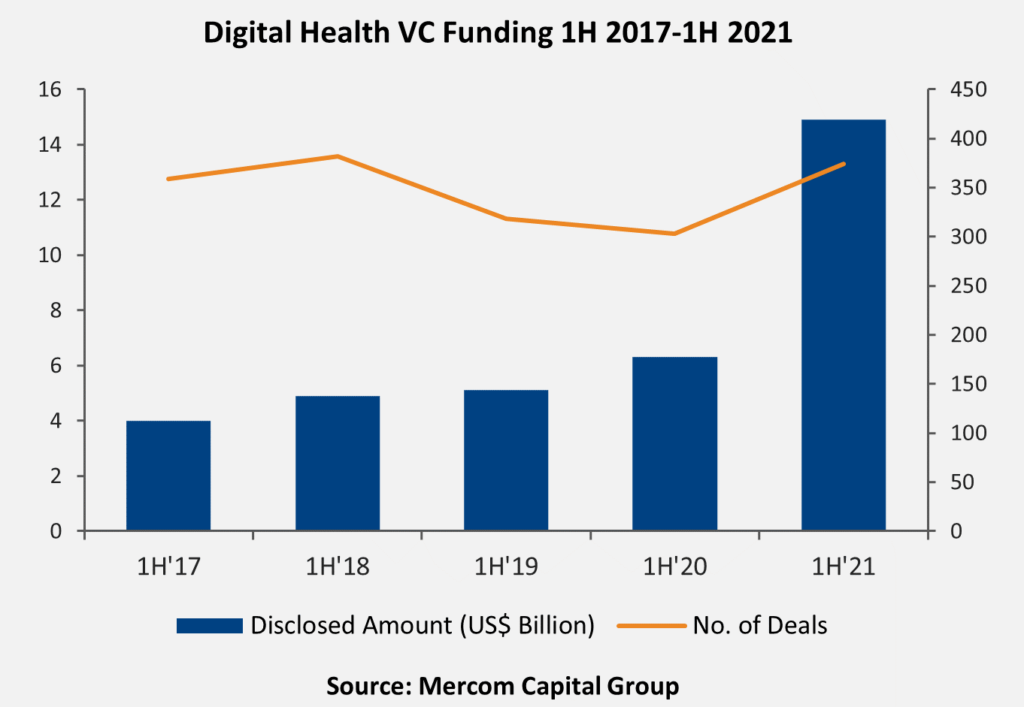

Global VC funding for Digital Health companies in the first half (1H) of 2021 shattered all previous 1H funding records, with $15 billion. Funding activity was up by 138% during 1H 2021, compared to $6.3 billion raised in 1H 2020.

“The digital health sector had a spectacular first half of 2021. Venture investments in digital health during 1H 2021 have already surpassed funding raised in all of 2020 and is the largest amount raised in a single year since 2010. Telehealth again led funding activity, accounting for almost 30% of the funding raised in 1H 2021. An even more impressive data point in the first half of the year was the record M&A activity, which has been flat in previous quarters despite the funding surge. A record 12 companies went public during the first six months of the year,” said Raj Prabhu, CEO of Mercom Capital Group.

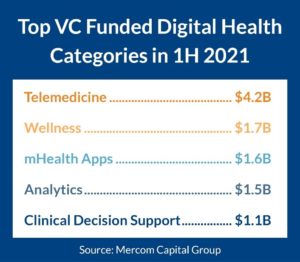

The top-funded Digital Health VC funded categories in 1H 2021 were: Telemedicine with $4.2 billion, Wellness with $1.7 billion, mHealth Apps with $1.6 billion, Analytics with $1.5 billion, and Clinical Decision Support with $1.1 billion.

Early round venture capital funding (Seed, Series A) came to $1.6 billion in 1H 2021. Most of the VC funding in early rounds went into Telemedicine, mHealth Apps, and Data Analytics companies.

Seven hundred and seven (707) investors participated in funding deals in Q2 2021 compared to 547 investors in Q1 2021. General Catalyst led Digital Health financing activity during Q2 2021 with 11 funding rounds. Oak HC/FT and Optum Ventures each made six investments, and another 100 investors made two or more investments during Q2 2021.

A record 1,254 investors participated in 1H 2021, compared to 921 investors in 1H 2020.

In 1H 2021, a total of 136 Digital Health M&A transactions were announced compared to 83 in 1H 2020. This is the highest number of M&A transactions recorded in the first half of any year. In Q2 2021, there were 73 M&A transactions compared to 63 M&A transactions in Q1 2021.

Notable M&A transactions in 1H 2021 were: Microsoft’s acquisition of Nuance for $19.7 billion, Optum’s acquisition of Change Healthcare for $13 billion, Datavant’s acquisition of Ciox Health for $7 billion, KKR’s acquisition of Therapy Brands for $1.5 billion, and Boston Scientific’s acquisition of Preventice Solutions for $925 million.

This report is 126 pages in length, contains 70 charts, graphs, and tables, and covers 1,052 investors and companies.

The 1H and Q2 2021 Digital Health (Healthcare IT) Funding and M&A Report also contains year-over-year (YoY) and quarter-over-quarter (QoQ) information on market activity displayed in easy-to-digest charts, graphs and tables, as well as data-driven analysis covering:

- Venture capital (VC) funding deals, including top investors, QoQ trends, and charts and graphs broken down by technology and stage;

- Practice-focused technology and subgroups;

- Consumer-focused technology and subgroups;

- VC funding by country and U.S. state;

- VC funding trends in early stage deals (below $2 million) and trends in deals over $2 million;

- Debt and public market financing deals;

- Mergers and acquisitions (M&A), including QoQ trends, a breakdown of charts and graphs by technology and geography;

- New Healthcare IT funds

This report also contains comprehensive lists of all announced Q2 2021:

- VC deals with investors and transaction details;

- Debt and public market financing deals and investors;

- M&A transactions and acquirers.