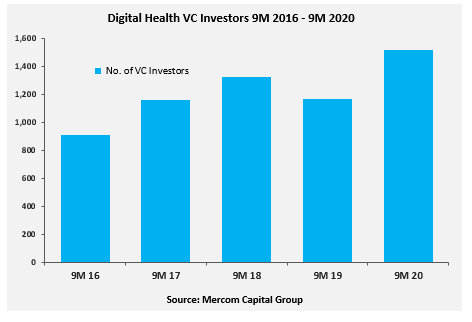

A total of 1,522 investors invested $10.3 billion in 500 digital health companies in 9M 2020, according to the latest Mercom’s 9M & Q3 2020 Digital Health Funding and M&A Report. Two hundred and forty-five investors made two or more investments during 9M 2020.

By comparison, 1,171 investors invested $7.2 billion in 474 digital health companies in 9M 2019.

To learn more about the investor data, please visit:

https://mercomcapital.com/product/9m-and-q3-2020-digital-health-healthcare-it-funding-and-ma-report/

Oak HC/FT, a venture growth equity fund that invests in digital health and financial services technology, led the investment activity. The firm has invested almost $700 million in 11 digital health companies focused on mHealth Apps, Data Analytics, Practice Management Solutions, and Telemedicine. The investment portfolio includes DispatchHealth, Sema4, Olive, Truepill, Olive, and Komodo Health.

Oak HC/FT, a venture growth equity fund that invests in digital health and financial services technology, led the investment activity. The firm has invested almost $700 million in 11 digital health companies focused on mHealth Apps, Data Analytics, Practice Management Solutions, and Telemedicine. The investment portfolio includes DispatchHealth, Sema4, Olive, Truepill, Olive, and Komodo Health.

GV (formerly Google Ventures), Alphabet’s venture capital investment arm, invested almost $600 million in eight digital health companies focused on Data Analytics and Telemedicine. The investment portfolio includes Verana Health, DNAnexus, Aledade, Science 37, and Ready Responders (Ready). GV invested about $2 billion in over 40 digital health companies since 2010, according to the Mercom database.

General Catalyst, a venture capital firm focused on early-stage and growth investments, invested over $550 million in eight digital health companies focused on Telemedicine, Practice Management Solutions, Telemedicine, and Wellness. The investment portfolio includes Roman, Olive, Mindstrong, Tempo, and SonderMind.

Optum Ventures, a venture capital firm that invests in healthcare technology companies, invested over $500 million in 11 digital health companies. Most of the investments were made in companies focused on telehealth and mHealth apps. The investment portfolio includes – DispatchHealth, Mindstrong, Truepill, LetsGetChecked, and Lumeon.

Y Combinator, a seed money startup accelerator investor, invested over $100 million in ten digital health companies focused on Wellness, Data Analytics, Clinical Decision Support, Mobile Wireless, and mHealth Apps. The investment portfolio includes – Tempo, H1 Insights, Endpoint Health, Bodyport, and Quit Genius.

Other investors who made five or more investments include UnityPoint Health Ventures, Khosla Ventures, Founders Fund, Andreessen Horowitz, Venrock, Lux Capital, Ascension Ventures, Bessemer Venture Partners, F-Prime Capital, Cigna Ventures, and HLM Venture Partners.