NextEra Energy, through its subsidiary NextEra Energy Resources, has entered into an agreement to sell a 50% non-controlling interest in an approximately 2,520 MW long-term contracted renewables portfolio to the Ontario Teachers’ Pension Plan Board.

The remaining 50% interest in the portfolio is under an agreement to be sold to NextEra Energy Partners pursuant to a purchase and sale agreement.

The sale proceeds are expected to be redeployed into the new wind, solar, and battery storage growth opportunities, including NextEra Energy Resources’ more than 18,000 MW renewables and storage backlog.

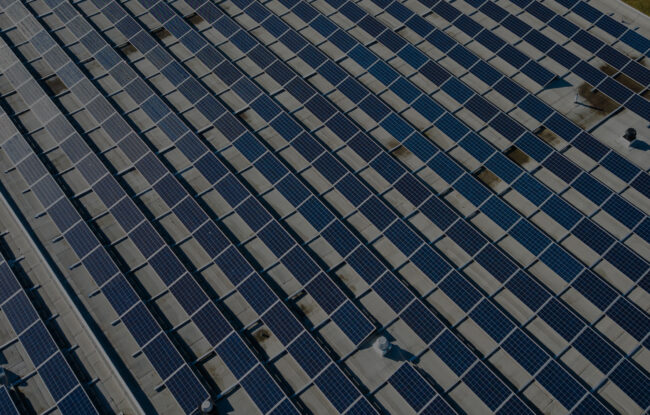

The contracted renewables portfolio of wind, solar and solar-plus-storage assets has a diverse mix of investment-grade counterparties and cash available for distribution (CAFD) – weighted remaining contract life of approximately 19 years.

The portfolio to be acquired consists of 50% of the indirect membership interests in:

- White Mesa Wind (501 MW) wind generation facility in Texas

- Irish Creek Wind (301 MW) wind generation facility in Kansas

- Hubbard Wind (300 MW) wind generation facility in Texas

- Cool Springs Solar (213 MW) solar generation and 40 MW solar storage facility in Georgia

- Little Blue Wind (251 MW) wind generation facility in Nebraska

- Dodge Flat Solar (200 MW) solar generation and 50 MW solar storage facility in Nevada

- Elora Solar (150 MW) solar generation facility in Tennessee

- Quitman II Solar (150 MW) solar generation facility in Georgia

- Fish Springs Ranch Solar (100 MW) solar generation and 25 MW solar storage facility in Nevada

- Minco Wind Energy III (107 MW) wind generation facility in Oklahoma

- Ensign Wind Energy (99 MW) wind generation facility in Kansas

- Borderlands Wind (99 MW) wind generation facility in New Mexico

- Quinebaug Solar (49 MW) solar generation facility in Connecticut

“This transaction is expected to generate significant value for NextEra Energy shareholders,” said Jim Robo, chairman, and CEO at NextEra Energy.

“In addition to generating attractive ongoing fee income, the sale of 50% of the portfolio to NextEra Energy Partners and 50% to a high-quality partner like Ontario Teachers’ provides an opportunity to take advantage of the robust demand for high-quality, long-term contracted renewable energy assets and efficiently recycle nearly $3.4 billion in total capital that is expected to be redeployed into new renewables growth opportunities. The transactions highlight the value of NextEra Energy Resources’ best-in-class development platform and position us well to continue to capitalize on the robust renewables development environment that is driving the clean energy transformation reshaping our industry,” he added.

NextEra Energy expects to sell the interests in the assets for a total consideration of approximately $849 million, subject to working capital and other adjustments, plus the investor’s share of the portfolio’s total tax equity financings, which is estimated to be approximately $866 million at the time of closing.

Earlier in November 2020, NextEra Energy Partners had entered into an agreement with a subsidiary of NextEra Energy Resources to acquire a 40% interest in an approximately 1,100 MW renewables portfolio.

Click here for reports on funding and m&a transactions in solar, wind, energy storage, smart grid, and efficiency sectors.