Membersy, a subscription-based dentistry management platform provider, has raised $66 million from Spectrum Equity, a growth equity firm focused on internet-enabled software and information services companies.

The company said that the investment would support its new product and service offerings to help dental service organizations provide greater price transparency to their patients through a modern membership experience.

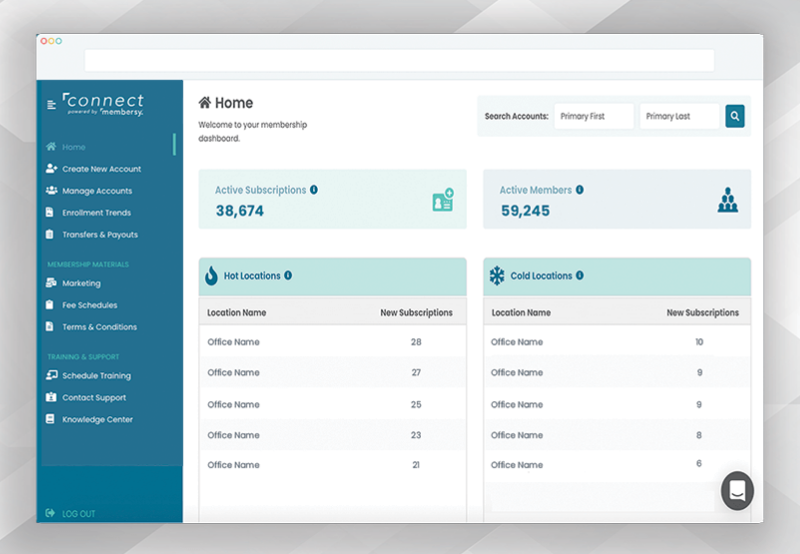

Membersy offers a dental subscription plan platform currently operating in 41 states and boasting membership approaching one million members spanning across 4,000 practice locations.

Operates as a platform-as-a-service solution for dental service organizations, membersy streamlines membership plan marketing, and administration to make dental care more approachable while providing dental teams with automated practice onboarding, recurring subscription payments and billing, and real-time analytics to manage and grow their member base.

“We’re preparing to rapidly expand our team, products, and services in response to a fast-growing DSO partner base,” said CEO and Founder Eric Johnson. “When we started in 2015, we knew there was a huge opportunity to make dentistry more approachable by modernizing the way consumers access and pay for dental care services, and we’re proud of the impact we’ve had up until this point. With new funding and an amazing partner in Spectrum Equity, we’re positioned to see that impact grow exponentially.”

“For several years, we’ve been investing in companies that are improving patient outcomes, reducing costs, and increasing price transparency in healthcare. We’re looking forward to applying our experience to support membersy’s continued growth trajectory,” said Jeff Haywood, Managing Director at Spectrum Equity.

Healthcare Practice Management Solutions companies raised $753 million in venture capital in the first half (1H) of 2021, compared to $233 million in 1H 2020, a 223% increase year-over-year (YoY), according to the latest Mercom Digital Health Funding and M&A Report.