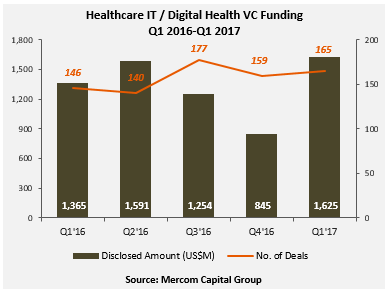

Venture capital (VC) funding, including private equity and corporate venture capital, in the Health IT sector almost doubled quarter-over-quarter (QoQ), coming in at $1.6 billion in 165 deals compared to $845 million in 159 deals in Q4 2016. VC funding in Q1 2017 was also up compared to Q1 2016 when nearly $1.4 billion was raised in 146 deals. The Digital Health sector has now received $20 billion in VC funding since 2010.

To learn more about the report, visit: https://mercom.wpengine.com/product/q1-2017-healthcare-digital-health-funding-ma-report/

Total corporate funding in Health IT companies – including VC, debt and public market financing came to $1.8 billion compared to $1 billion in Q4 2016.

Since 2010, VC funding in the Healthcare IT sector has now crossed $20 billion (2010 – Q1 2017).

“Digital Health funding is off to a fast start this year and there was no visible ‘Trump effect’ on investments in the sector, at least in the first quarter, and publicly-traded Digital Health companies actually fared much better in Q1 than last year,” commented Raj Prabhu, CEO and Co-Founder of Mercom Capital Group.

Healthcare practice-centric companies received 35 percent of the funding in Q1 2017, raising $574 million in 50 deals compared to $261 million in 42 deals in Q4 2016. Consumer-centric companies received 65 percent of the funding this quarter, bringing in $1 billion in 115 deals compared to $584 million in 117 deals in Q4 2016.

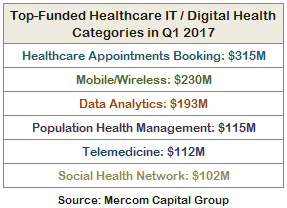

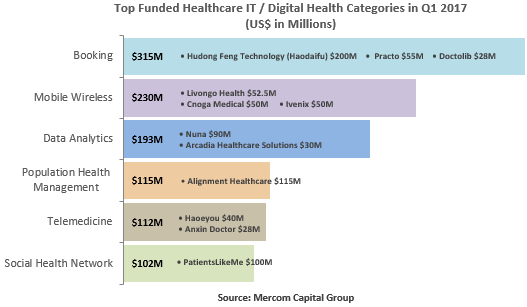

The top funded areas in Q1 2017 were: Appointment Booking $315 million, Mobile Wireless $230 million, Data Analytics $193 million, Population Health Management $115 million, Telemedicine $112 million, and Social Health Network $102 million.

There were 65 early round deals, including 14 Accelerator and Incubator deals.

The top VC deals this quarter included: $200 million raised by Hudong Feng Technology (Haodaifu), $115 million raised by Alignment Healthcare, $100 million raised by PatientsLikeMe, $90 million raised by Nuna, and $85 million raised by PointClickCare.

A total of 306 investors (including four accelerators/incubators) participated in funding deals in Q1 2017 compared to 340 investors in Q4 2016, of which two were accelerators/incubators.

Health IT VC funding deals were spread across 19 countries in Q1 2017.

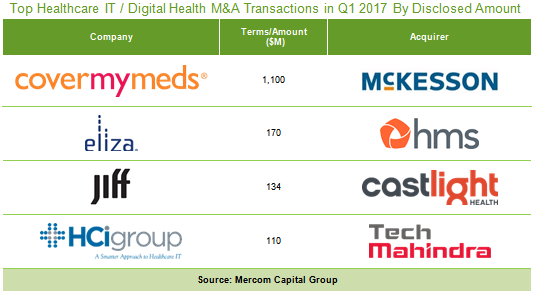

There were 49 M&A transactions (seven disclosed) in the Healthcare IT sector in Q1 2017 compared to 42 transactions (11 disclosed) in Q4 2016.

Practice Management Solutions companies were involved in the most M&A transactions with six, followed by Apps and Data Analytics with five each, then Consulting and Telemedicine with four apiece.

The top disclosed M&A transactions were: $1.1 billion acquisition of CoverMyMeds by McKesson, Parthenon Capital Partners (by HMS Holdings) acquisition of Eliza Corporation for $170 million, Castlight Health’s $134 million buy of Jiff, and the acquisition of HCI Group for $110 million by Tech Mahindra.

There were a total of 573 companies and investors covered in this report.

Mercom’s comprehensive report covers deals of all sizes across the globe.

To learn more about the report, visit: https://mercom.wpengine.com/product/q1-2017-healthcare-digital-health-funding-ma-report/

Correction made April 20, 2017. We updated the following paragraph: The top disclosed M&A transactions were: $1.1 billion acquisition of CoverMyMeds by McKesson, Parthenon Capital Partners (by HMS Holdings) acquisition of Eliza Corporation for $170 million, Castlight Health’s $134 million buy of Jiff, and the acquisition of HCI Group for $110 million by Tech Mahindra.