Energy Dome, a provider of utility-scale long-duration energy storage solutions, raised $11 million in a bridge funding round.

The convertible funding was led by the Evolution Fund of CDP Venture Capital Sgr, together with existing investor Barclays, through their Sustainable Impact Capital program and Novum Capital Partners, an existing shareholder in Energy Dome.

With the closing of this convertible round, the company has raised a total of $25 million since February 2020.

“This important achievement will sustain our ambitious growth,” said Claudio Spadacini, founder and CEO of Energy Dome.

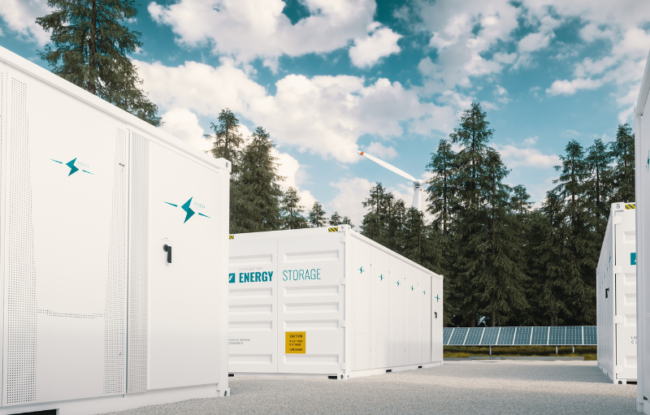

Energy Dome is an energy storage solution provider aiming to unlock renewable energy by making solar and wind power dispatchable using the CO2 Battery. The company’s emission-free energy storage method uses CO2 as a working fluid in a closed loop to store renewable energy from four to 24 hours and then dispatch it back to the grid when needed.

The convertible funding follows the Series A funding round in November 2021, which was also $11 million and led by 360 Capital, Barclays, Novum Capital Partners, and Third Derivative. The funding supported the company in completing its 2.5 MW/4 MWh commercial demonstration plant in Sardinia, Italy.

This latest bridge funding allows the company to accelerate its development in advance of the Series B round by placing purchase orders for the long lead time turbomachinery equipment associated with its utility-scale (20 MW, 200 MWh, 10-hour duration) energy storage projects. A Memorandum of Understanding for this first utility-scale project has been signed with A2A, a European utility.

“Energy Dome’s technology plays an important role in the transition to renewables, addressing the need for viable energy storage solutions. Their launch into the market is an exciting next step in Energy Dome’s journey, and we are delighted to continue our partnership as they scale up for the future,” said James Ferrier, Head of Sustainable Impact Capital at Barclays.

Recently, Singapore-based start-up NEU Battery Materials, a lithium recycling company, raised $5400,000 in a seed funding round.

According to Mercom’s Q1 2022 Funding and M&A Report for Storage, Grid, and Efficiency, in Q1 2022, announced debt and public market financing for Battery Storage technologies were higher, with $11.7 billion in five deals compared to $2.4 billion in six deals in Q4 2021 and $3.7 billion in four deals in Q1 2021.