e-Zinc, an electrochemical technology developer of energy storage solutions, raised $25 million in Series A financing. The financing round was led by Anzu Partners, with additional funding from BDC Capital, Toyota Ventures, and Eni Next.

Existing investors, including Seed Round lead investor Energy Foundry, also participated.

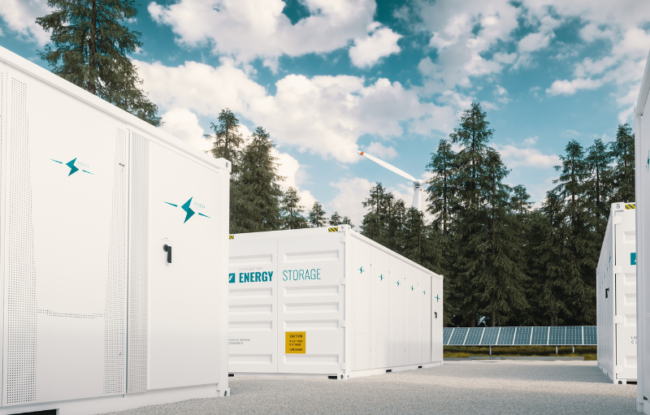

The investment will be used to commence its first pilot production of commercial energy storage systems for field deployment.

e-Zinc’s Series A investors include leading firms that will serve as valuable partners and advisors to drive growth for the company. Toyota Ventures will provide guidance to help e-Zinc scale its manufacturing and supply chain efforts.

Eni Next is the corporate venture capital vehicle of Eni, one of the world’s largest energy companies with renewable energy assets across the globe where e-Zinc can potentially deploy its technology. Anzu Partners and BDC Capital offer deep technical, investment, and operational expertise that will assist e-Zinc in developing its business strategy and commercializing its technology.

“Since raising seed funding in 2020, we have refined our technology and achieved many critical technical milestones, such as demonstrating how our system pairs to solar and grid generation, developing the Balance of System (BoS) and implementing a software and controls layer,” said James Larsen, CEO of e-Zinc. “With this Series A financing, we now have the opportunity to execute high-value commercial pilot projects that provide in-field validation for our batteries.”

According to Mercom Research, in Q1 2021, e-Zinc raised $2.3 million in funding led by BDC Capital’s Cleantech Practice.

According to Mercom Capital Group’s 2021 Q4 and Annual Funding and M&A report for Storage, Grid & Efficiency, smart grid companies raised $1.2 billion in VC funding in 35 deals in 2021, a 55% increase compared to $748 million raised in 38 deals in 2020.