Doral Renewables, a utility-scale renewable energy project developer, secured a $400 million minority equity investment from Dutch pension APG on behalf of Dutch pension fund ABP. APG said it would provide its pro rata share of corporate credit support and funding for the company’s energy business, amounting to an additional $185 million in capital over time.

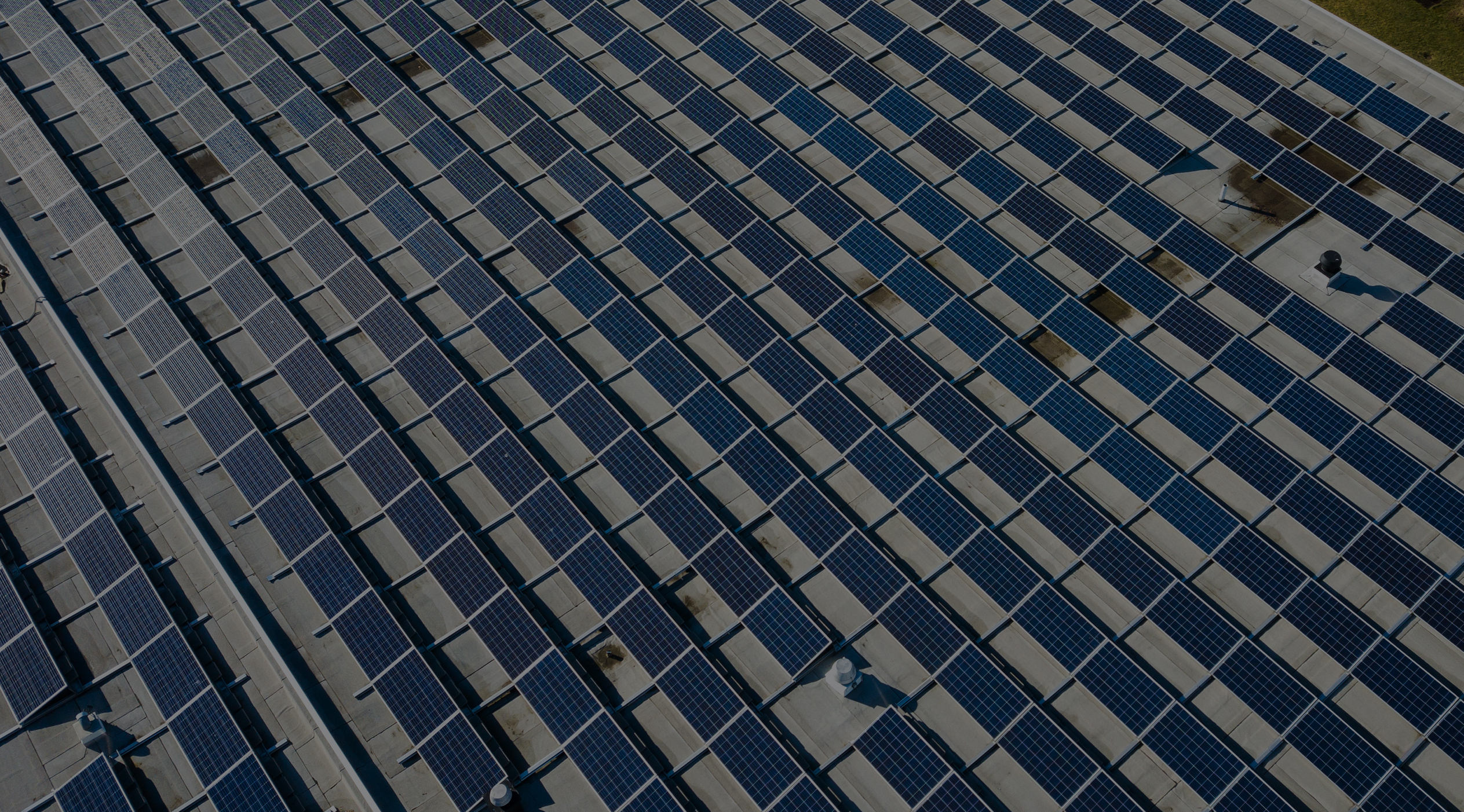

Doral Renewables has over 13 GW of solar and storage projects, 1.35 GW of which are under construction, and approximately two additional GW of mature projects are slated to start construction within the next 12 months.

The remaining 10 GW of Doral’s portfolio is comprised of solar, storage, and solar-plus-storage projects across the PJM, MISO, SPP, TVA, ERCOT, NYISO, WECC, and NEISO markets.

“We are thrilled to welcome APG as a partner and now the largest individual shareholder in our company,” said Evan Speece, Chief Financial Officer of Doral Renewables. “APG’s sophistication as an investor and its experience in the U.S. renewable energy market will, together with the strength and support of our existing partners, continue to propel our success. With over 3 GW of projects in the process of being commercialized over the coming few years, we are excited to enter this next phase of growth with APG’s backing.”

Early this year, Doral Renewables closed a construction debt facility for its Great Bend solar project. The company secured $114 million in financing from the sole lender, HSBC, for the project, which consists of a $36 million construction-to-term loan facility, a $57 million tax equity bridge loan, and a $21 million letter of credit facility.

According to Mercom’s Q1 2024 Solar Funding and M&A report, global VC funding for the solar sector in Q1 2024 came to $406 million in 13 deals, an 81% decline YoY compared to $2.1 billion raised in 18 deals in Q1 2023. Funding declined 68% QoQ compared to the $1.3 billion raised in 19 deals in Q4 2023.