Datavant, a healthcare data-sharing platform, and Ciox Health, a clinical data exchange platform, signed a definitive agreement to merge the two companies in a transaction valued at $7 billion.

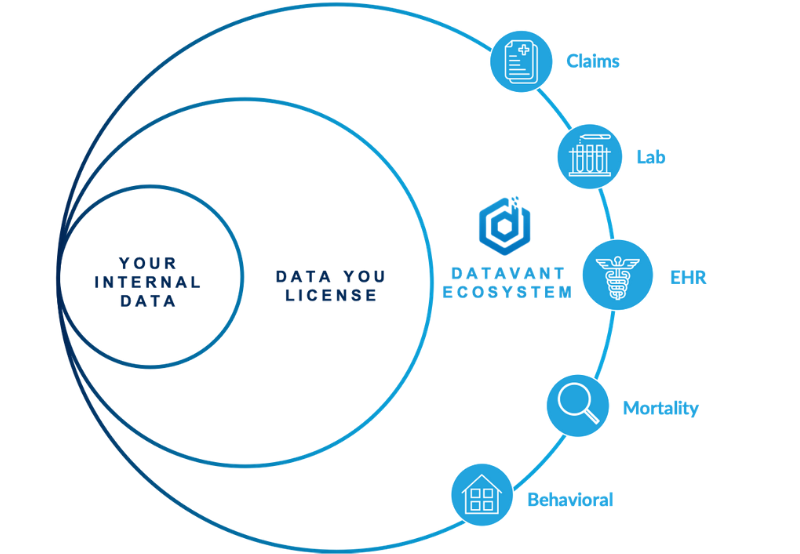

The combined entity named Datavant will enable patients, providers, payers, health data analytics companies, patient-facing applications, government agencies, and life science companies to exchange their patient-level data securely. Datavant will offer access, exchange, and connect data among the thousands of organizations in its ecosystem for use cases ranging from better clinical care and value-based payments to health analytics and medical research.

Datavant will have revenue of more than $700 million.

“The fragmentation of health data is one of the single greatest challenges facing the healthcare system today,” said Pete McCabe, CEO of Ciox Health. “Each of us has many dozens of interactions with the healthcare system throughout our lives, and that information is retained in siloed databases across disparate institutions. Every informed patient decision and every major analytical question in healthcare requires pulling that information from across the health data ecosystem while protecting patient privacy.”

“We are thrilled to join forces with the Datavant team to connect health data to improve patient outcomes. Together, we are well-positioned to navigate the technical, operational, legal, and regulatory challenges to doing so, and are committed to acting as a neutral connectivity solution for our many customers and partners,” added Pete McCabe.

The merger transaction is supported by an existing investor group, led by New Mountain Capital, Roivant Sciences, Transformation Capital, Merck Global Health Innovation Fund, Labcorp, Cigna Ventures, Johnson & Johnson Innovation – JJDC, and Flex Capital.

The transaction also includes a significant new investment by Sixth Street with participation from Goldman Sachs Asset Management’s West Street Strategic Solutions fund. Sixth Street will join the new company’s Board of Directors after the transaction.

The merger is subject to regulatory approvals and is expected to close in the third quarter of 2021. Deutsche Bank, Goldman Sachs, and Triple Tree served as the financial advisors to New Mountain and Ciox. Ropes & Gray served as legal advisor to New Mountain and Ciox; Goodwin Procter acted as legal advisor to Datavant. Sidley Austin served as legal advisor to Sixth Street and Goldman Sachs.

Upon closing the transaction, current Ciox Chief Executive Officer Pete McCabe will lead the new company as CEO. Current Datavant CEO Travis May will assume the role of President and join the Board of Directors.

A total of 63 digital health companies were acquired in Q1 2021, compared to 52 in Q4 2020, according to Mercom’s Q1 2021 Digital Health Funding and M&A Report.