Energy Storage

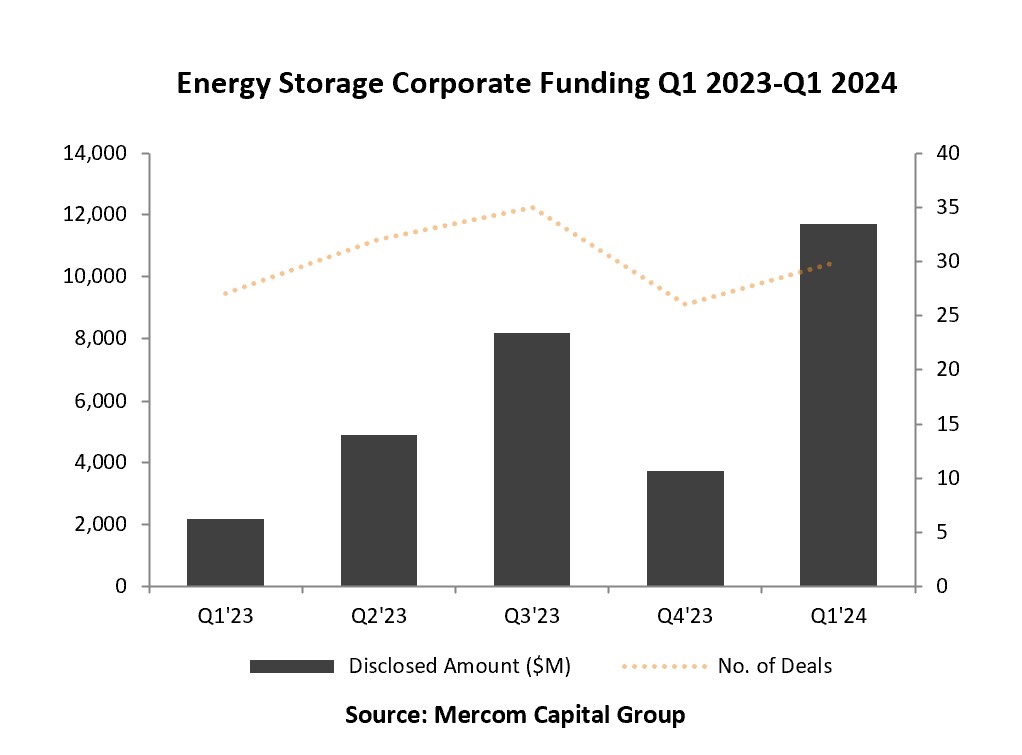

Corporate funding in Energy Storage came to $11.7 billion in 29 deals in Q1 2024, an increase of 432% year-over-year (YoY) compared to $2.2 billion in 27 deals in Q1 2023. In a quarter-over-quarter (QoQ) comparison, funding increased 216% compared to the $3.7 billion raised in 26 deals in Q4 2023.

Northvolt’s $5 billion debt funding, along with Automotive Cells Company’s (ACC) $4.7 billion debt funding deal, contributed 83% of Q1 2024 corporate funding.

To get a copy of the report, visit: https://mercomcapital.com/product/q1-2024-funding-ma-report-storage-grid/

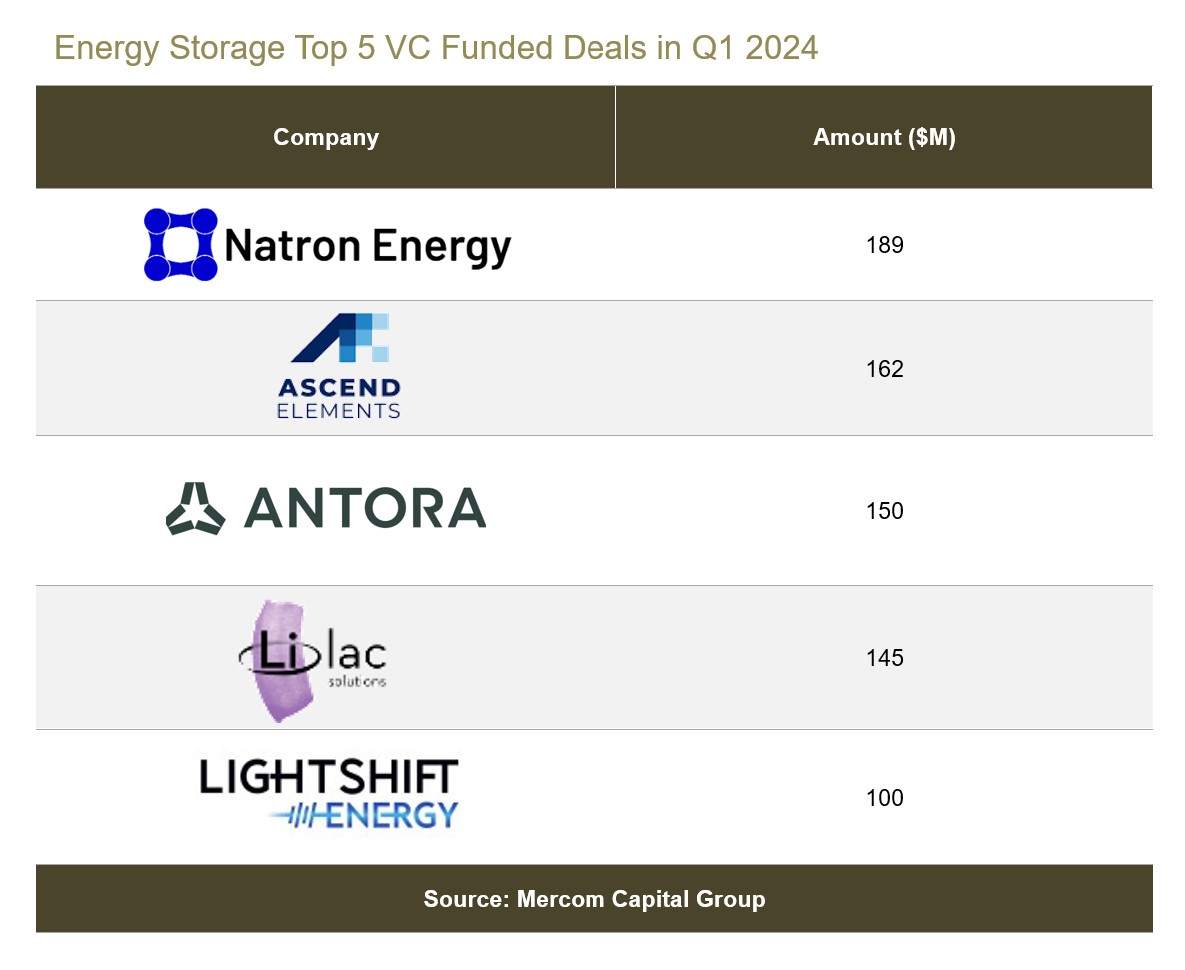

VC funding for Energy Storage companies increased by 9% YoY, with $1.2 billion in 23 deals in Q1 2024 compared to $1.1 billion raised in 19 deals in Q1 2023. In Q1 2024, funding increased by 92% quarter-over-quarter, rising from $625 million across 18 deals in Q4 2023. Various IRA incentives for energy storage continue to drive investments into the sector.

The top five VC funding deals were: Natron Energy, which raised $189 million; Ascend Elements, which secured $162 million; Antora Energy, which received $150 million; Lilac Solutions, which raised $145 million; and Lightshift Energy, which brought in $100 million.

In Q1 2024, announced debt and public market financing in the Energy Storage sector totaled $10.5 billion in six deals, primarily driven by Northvolt and ACC debt funding deals. In Q1 2024, we saw a funding increase of 855% YoY compared to Q1 2023, when $1.1 billion was raised in eight deals.

In Q1 2024, there were eight mergers and acquisitions (M&A) transactions in the Energy Storage sector, doubling from the four M&A transactions recorded in Q1 2023.

Six Energy Storage project M&A deals were transacted in Q1 2024, a 50% drop compared to 12 in Q1 2023.

Smart Grid

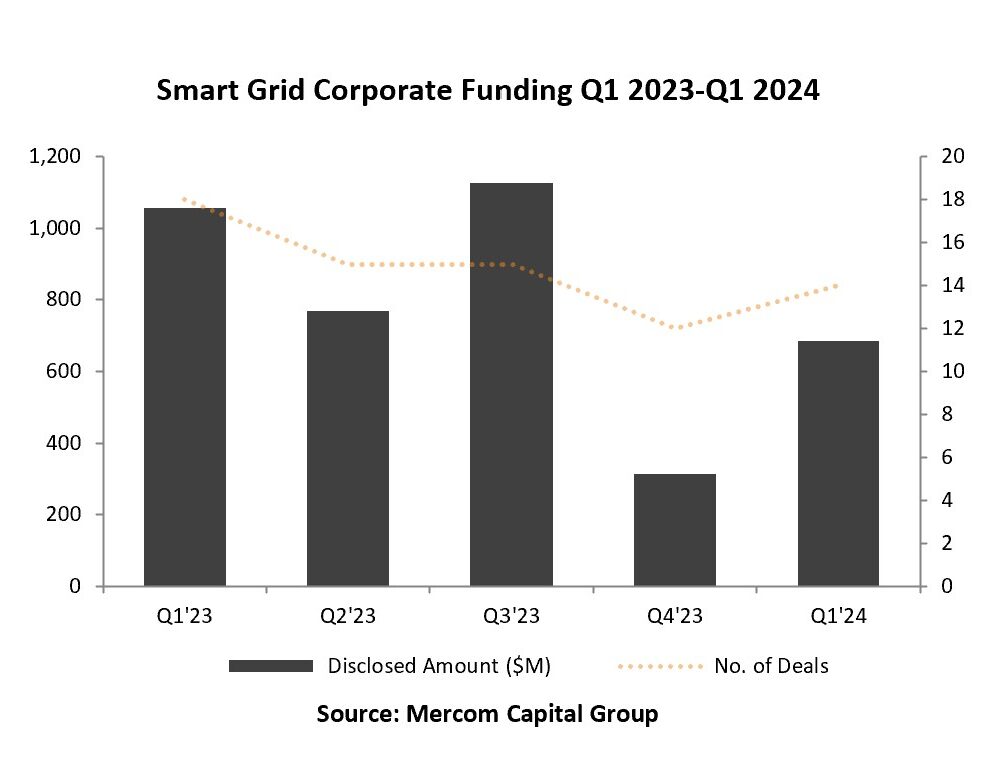

Smart Grid corporate funding came to $686 million in 14 deals in Q1 2024, compared to $1.1 billion in 18 deals in Q1 2023 and $314 million in 12 deals in Q4 2023.

Smart Grid VC funding increased 134% in Q1 2024, with $656 million raised in 12 deals compared to $280 million in 14 deals in Q1 2023. In a QoQ comparison, funding in Q1 2024 was 197% higher compared to Q4 2023, when $221 million was raised in 10 deals.

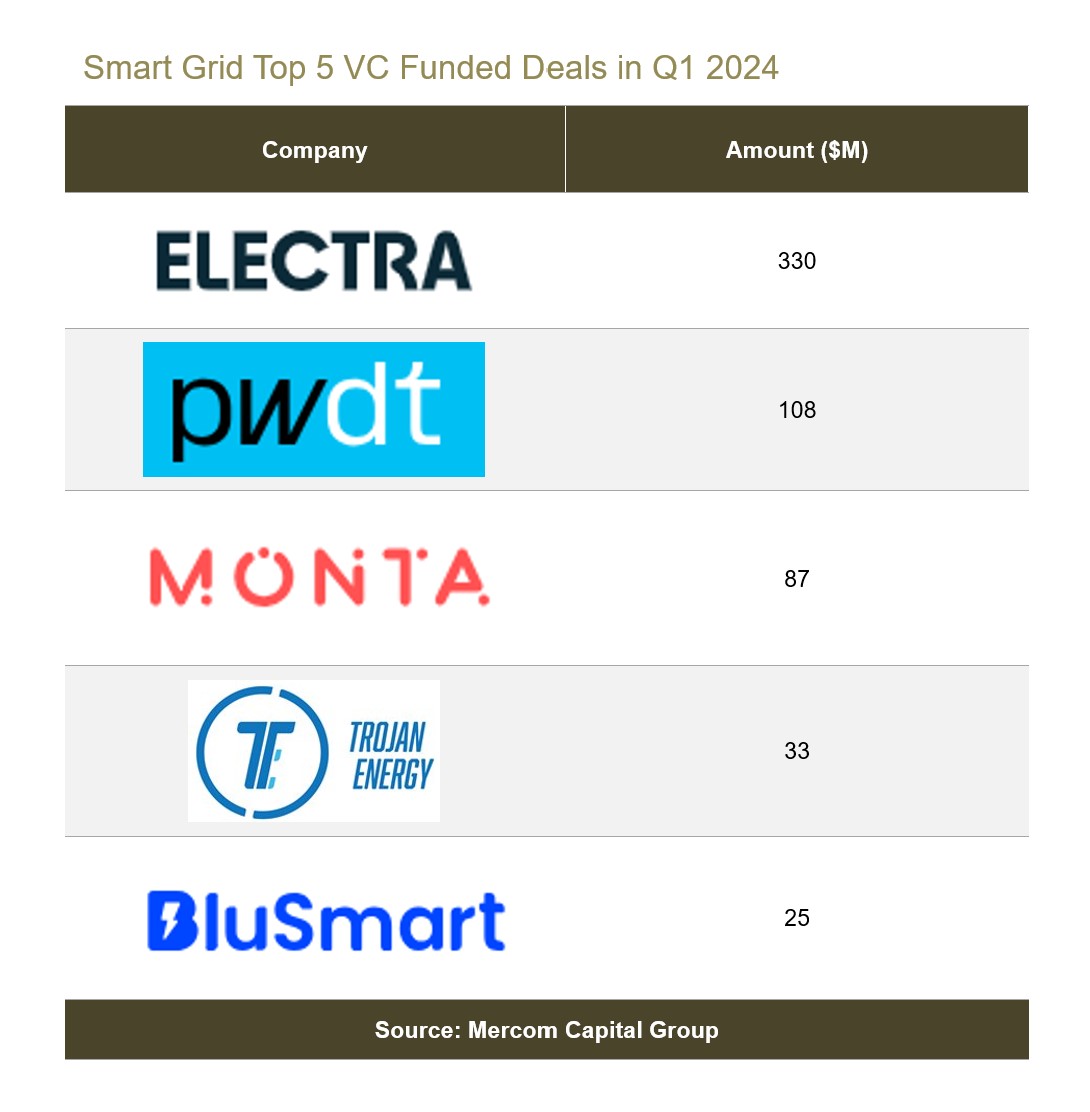

A significant portion of the funding in Q1 2024 went to smart charging companies.

The top 5 VC funding deals were: Electra, which raised $330 million; Powerdot, with $108 million; Monta, with $87 million; Trojan Energy, with $33 million; and BluSmart, with $25 million.

In Q1 2024, $30 million was raised in two public market financing deals. There were four $777 million public market financing deals in Q1 2023.

In Q1 2024, there was one corporate M&A transaction compared to four transactions in Q1 2023.

To get a copy of the report, visit: https://mercomcapital.com/product/q1-2024-funding-ma-report-storage-grid/