Boralex, a Quebec-based renewable energy company, has announced the acquisition of Infinergy interests in the UK. The transaction includes Infinergy’s portfolio of projects in development and its 50% interest in a joint venture formed with Boralex in 2017, as well as the integration of the Infinergy team into Boralex.

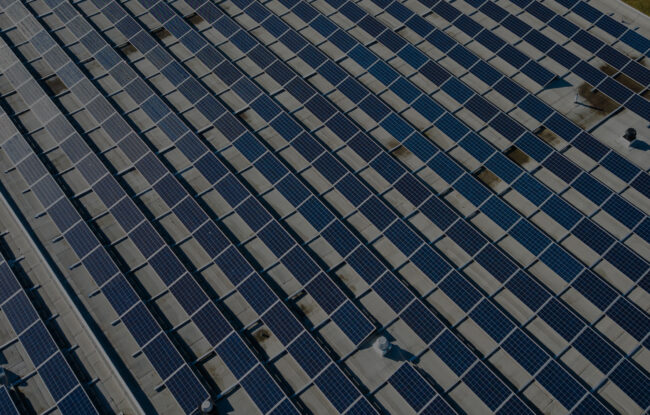

Boralex and Infinergy have co-developed a portfolio of onshore wind projects in a 50/50 joint venture since 2017. As a result of the transaction, Boralex gains full access to a portfolio of wind, solar, and energy storage projects of 338 MW.

This agreement will also give Boralex access to 100% of the joint venture’s cash flows.

With the acquisition, Boralex aims to strengthen its European presence and its plan to double its installed capacity worldwide to 4.4 GW by 2025.

“This transaction will allow us to accelerate organic growth in a high-potential market in addition to contributing to the geographic diversification of our activities, two key elements of our 2025 Strategic Plan,” said Patrick Decostre, President, and Chief Executive Officer of Boralex.

“Building from the fact that Scotland has a very favorable political climate for renewable energy development, we have identified the UK market as a high-potential target for developing onshore wind as well as solar and energy storage facilities. We are confident that Boralex can draw on its experience as a wind farm developer and operator to carry on the high-quality work started by the staff at Infinergy, whom I would like to warmly welcome to the Boralex team,” said Nicolas Wolff, Vice President and General Manager of Boralex, Europe.

Infinergy’s activities in the Netherlands and Australia will remain unchanged and are not covered by the agreement.

According to Mercom’s Q1 2022 Solar Funding and M&A report, Large-scale solar project acquisition activity remained strong, with over 23 GW of solar projects acquired in Q1 2022 compared to 13.1 GW in Q4 2021. Year-over-year, 15 GW were acquired in Q1 2021. Large-scale solar project acquisitions in Q1 2022 were the second-highest recorded to date.