Global VC funding (venture capital, private equity, and corporate venture capital) for Battery Storage, Smart Grid, and Efficiency companies in 2019 was 18% lower with $2.3 billion compared to $2.8 billion raised in 2018.

To get a copy of the report, visit: https://mercomcapital.com/product/2019-q4-annual-funding-ma-report-storage-grid-efficiency

Total corporate funding (including venture capital funding, public market, and debt financing) for the Battery Storage, Smart Grid, and Energy Efficiency sectors in 2019 was down by 22% with $3.8 billion compared to $4.9 billion in 2018.

Battery Storage

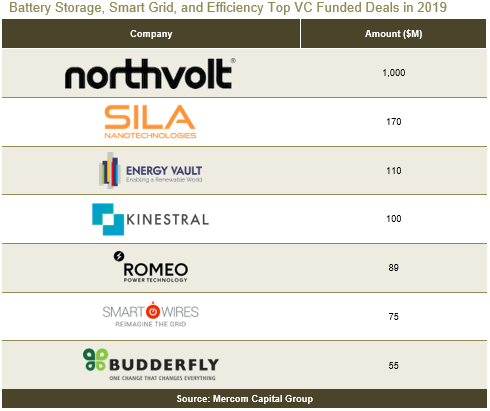

In 2019, VC funding into Battery Storage companies increased by 103% to $1.7 billion in 32 deals compared to $850 million raised in 49 deals in 2018. This increase was primarily due to Northvolt’s $1 billion deal in Q2 2019. Total corporate funding, including debt and public market financing, increased to $2.8 billion in 2019 compared to $1.3 billion in 2018.

Lithium-ion based battery technology companies received the most funding in 2019 with $1.4 billion. Other categories that received funding included Gravity storage, Flow batteries, CAES, Energy storage downstream, Fuel cells, Liquid metal batteries, Thermal energy storage, Solid-state batteries, Sodium-based batteries, and Zinc-air batteries.

The top VC funded companies in 2019 were: Northvolt with $1 billion, Sila Nanotechnologies with $170 million and $45 million in two separate deals, Energy Vault with $110 million, and Romeo Power with $89 million.

Seventy-eight VC investors participated in Battery Storage deals in 2019 compared to 73 in 2018. BASF Venture Capital, Breakthrough Energy Ventures, and Macquarie Capital were the top investors in 2019. Utilities and oil and gas companies were involved in seven battery storage funding deals in 2019.

In 2019, announced debt and public market financing for Battery Storage companies increased to $1.1 billion in 10 deals compared to $494 million in 12 deals in 2018. Northvolt’s $393 million loan was the largest debt financing deal in 2019.

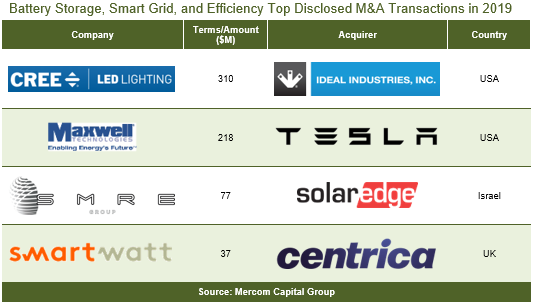

There were 10 M&A transactions in the Battery Storage category in 2019, of which only two disclosed transaction amounts. In 2018, there were 16 M&A transactions, three of which disclosed transaction amounts.

The most prominent M&A transaction in the battery storage space was the acquisition of Sonnen by oil major, Shell, early on in the year.

Smart Grid

Smart Grid companies raised $300 million in VC funding in 38 deals in 2019, a 43% decrease compared to the $530 million raised in 29 deals in 2018. Total corporate funding, including debt and public market financing, came to $372 million in 41 deals, compared to $1.8 billion in 33 deals in 2018.

The top VC funded companies in 2019 were Smart Wires, which brought in $75 million, eSmart Systems, which received $34 million, SmartRent, which secured $32 million, CleanSpark with $20 million, and Volta Charging with $20 million.

Seventy-eight investors funded Smart Grid companies in 2019, compared to 69 in 2018. The top VC investor in 2019 was Shell, which was involved in four funding deals followed by Energy Impact Partners with three deals. Other prominent investors included Total and Centrica with two deals each.

Grid Optimization companies had the largest share of VC funding in 2019 with $85 million in four deals, followed by Data Analytics companies with $58 million in six deals and Smart Grid Communications companies with $52 million in five deals.

In 2019, three debt and public market financing deals totaling $72 million were announced compared to $1.3 billion in four deals in 2018. There were no IPOs announced for Smart Grid companies in 2019.

In 2019, there were 29 M&A transactions (one disclosed) recorded in the Smart Grid sector. In 2018, there were 12 undisclosed transactions.

Efficiency

VC funding for Energy Efficiency companies fell sharply with $298 million in nine deals in 2019 compared to $1.5 billion in 23 deals in 2018, an 80% decrease largely due to the $1.1 billion deal raised by architectural dynamic glass developer, View, in Q4 2018. Total corporate funding, including debt and public market financing, reached more than $670 million in 2019 compared to $1.7 billion in 2018.

The top VC funded companies in 2019 were: Kinestral Technologies, which raised $100 million, followed by Budderfly with $55 million, CIMCON Lighting with $33 million, Carbon Lighthouse with $33 million, and Arcadia Power with $30 million.

A total of 38 investors participated in funding deals in 2019 compared to 72 investors in 2018. Energy Impact Partners was the most active investor in 2019.

In 2019, debt and public market financing announced by Energy Efficiency companies rose to $371 million in three deals compared to $277 million raised in the same number of deals in 2018.

In 2019, there were three Property Accessed Clean Energy (PACE) financing deals bringing in $709 million compared to the same number of deals that brought in $694 million in 2018.

M&A activity for Efficiency companies in 2019 increased with nine transactions, two of which disclosed the transaction amount. In 2018, there were seven M&A transactions with one that disclosed the transaction amount.

To get a copy of the report, visit: https://mercomcapital.com/product/2019-q4-annual-funding-ma-report-storage-grid-efficiency

Image credit: Ysc usc [CC BY]