9M and Q3 2019 Digital Health (Healthcare IT) Funding and M&A Report

$299.00 – $549.00

Digital Health VC Funding Hits

$7.2 Billion in 9M 2019

– Get the Details!

Click here to download the Executive Summary.

The report covers both consumer-centric and patient-centric technologies and sub-technologies, including: Social Health, Mobile Health (mHealth), Telehealth, Personal Health, Rating & Shopping, Health Information Management, Revenue Cycle Management, Service Providers and Security. Click here to see our complete list of technologies.

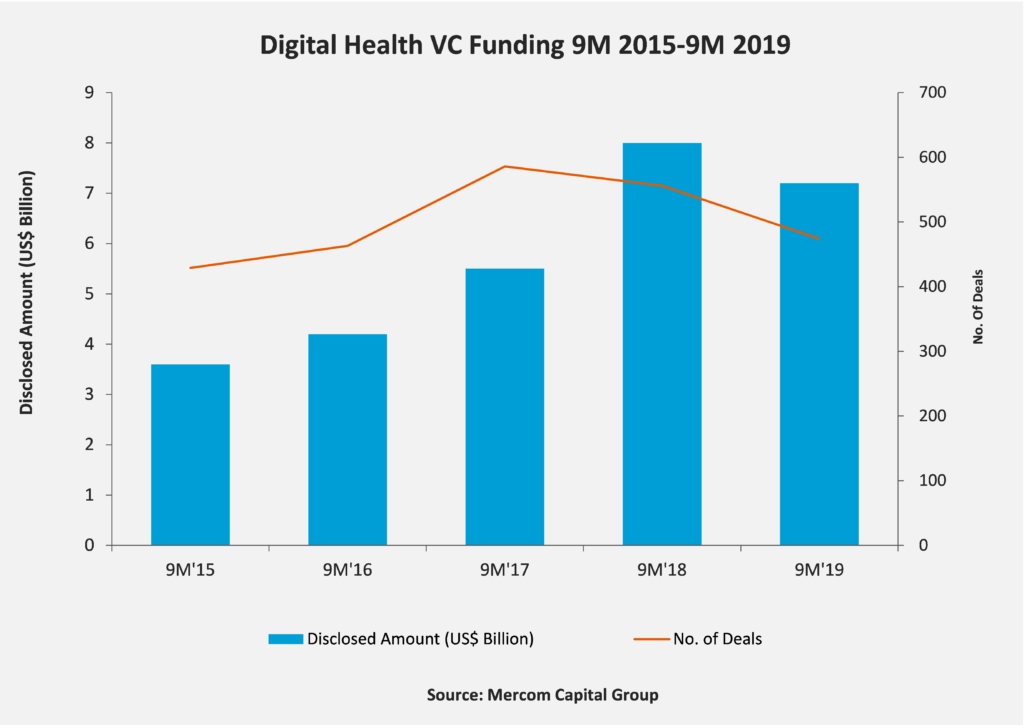

Global Venture Capital (VC) funding – including venture capital, private equity, and corporate venture capital – for Digital Health companies in 9M 2019 was 10% lower year-over-year (YoY) with $7.2 billion in 474 deals compared to $8 billion in 556 deals in 9M 2018. In Q3 2019, Digital Health companies raised $2 billion in 156 deals compared to $3.1 billion in 173 deals in Q3 2018, a 35% decline.

Digital Health companies have now received ~$42 billion in VC funding in 4,622 deals, according to Mercom.

Total corporate funding (including VC, public market, and debt financing) in 9M 2019 declined 19% with $8.9 billion compared with $11 billion in 9M 2018. Total corporate funding in Q3 2019 was down slightly with $3.4 billion compared to $3.6 billion Q3 2018.

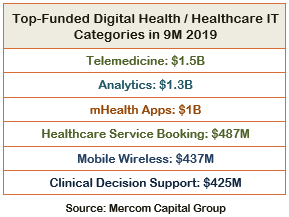

The top funded categories in 9M 2019 were: Telemedicine with $1.5 billion, Analytics with $1.3 billion, and mHealth Apps with $1 billion. Other Digital Health categories that received substantial funding were: Healthcare Service Booking $487 million, Mobile Wireless $437 million, and Clinical Decision Support with $425 million.

The top funded categories in Q3 2019 were: Telemedicine with $651 million, mHealth Apps with $391 million, Analytics with $201 million, Mobile Wireless with $173 million, Healthcare Service Booking with $151 million, Clinical Decision Support with $138 million, and Practice Management Solutions with $119 million.

In 9M 2019, there were 125 Digital Health M&A transactions compared to 172 transactions in 9M 2018. M&A activity in Q3 2019 was also down with 34 M&A transactions compared to the 56 M&A transactions in Q3 2018.

Top M&A transactions in 9M 2019 included: French company Dassault Systemes’ acquisition of Medidata for an enterprise value of $5.8 billion. The EQT VIII Fund (EQT) and Canada Pension Plan Investment Board (CPPIB) acquired Waystar for $2.7 billion, followed by Golden Gate Capital, which acquired a controlling stake in Ensemble Health Partners for $1.2 billion. Baring Private Equity Asia acquired CitiusTech for more than $1 billion, Nordic Capital acquired ArisGlobal for $700 million, JPMorgan Chase acquired InstaMed for $500 million, and Thomas H. Lee Partners (THL) acquired Nextech Systems for $500 million.

The 9M and Q3 2019 Digital Health (Healthcare IT) Funding and M&A Report contains annual, quarter-over-quarter (QoQ) information on market activity displayed in easy-to-digest charts, graphs and tables, as well as data-driven analysis covering:

- Venture capital (VC) funding deals, including top investors, QoQ trends, and charts and graphs broken down by technology and stage;

- Practice-focused technology and subgroups;

- Consumer-focused technology and subgroups;

- VC funding by country and U.S. state;

- VC funding trends in early stage deals (below $2 million) and trends in deals over $2 million;

- Debt and public market financing deals;

- Mergers and acquisitions (M&A), including QoQ trends, a breakdown of charts and graphs by technology and geography;

- New Healthcare IT funds

- Half-year trends and analysis

This report also contains comprehensive lists of all announced Q3:

- VC deals with investors and transaction details;

- Debt and public market financing deals and investors;

- M&A transactions and acquirers.

This report is 94 pages in length, contains 69 charts, graphs and tables, and covers 513 investors and companies.