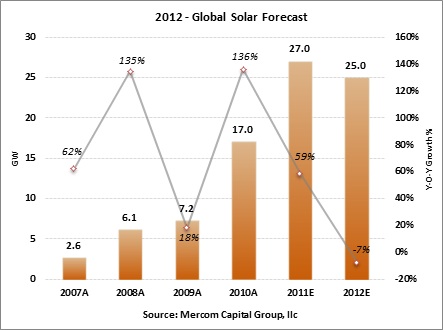

With almost 27GW of photovoltaic (PV) installed worldwide, 2011 was a year of extremes for the solar industry – record installations, a dramatic fall in module prices and a record number of companies closing their doors.

After all the ups and downs, the 2011 solar market ended strong mainly due to Germany’s unexpected 3GW of installations in December. With final PV installation numbers still trickling in, it looks like the year will total around 27GW, up almost 10GW from 2010’s 17GW installed. With rapidly falling PV module prices a key demand driver in 2011, Germany and Italy installed about 17GW between the two countries, accounting for most of the demand in 2011.

Severe oversupply has been the primary driver behind the huge drop in module prices. PV module prices in January 2011 for tier 1 Chinese suppliers averaged around $1.80 and by the end of the year, these same tier 1 Chinese modules were quoted in the $0.90-$1.00 range, a 50 percent drop in module prices in one calendar year. With the dramatic and rapid fall in prices, policies and rate adjustments simply could not keep up in most markets resulting in a rush for installations as the project rate of returns became very attractive.

All indications are that 2012 will be extremely challenging – a “correction” year. The oversupply situation continues and, adding to the woes, the major markets in 2012—Germany and Italy—may barely install half of what they did in 2011, especially if Germany goes along with the proposed cuts in its feed-in-tariff with a hard cap. The question is: who will pick up the slack in 2012? Indications are that policies are being re-worked and tariffs are being cut or reduced around the world in response to the massive uptick in installations in 2011. What does this mean for the industry?

With political pressure in Europe to reduce debt, solar is squarely in the cross hairs of the European economic crisis. Although analysts predicted that Europe’s market share of solar installations would fall in 2011, it did not happen. In fact, Europe’s share might be about the same as it was in 2010: ~75 percent of the global market.

Important events to watch in 2012 include the final policy decisions in Germany, the U.S.- China anti-dumping case, the Chinese push to spur domestic demand, the EU financial crisis, knee-jerk reactions by many countries to cut subsidies, and protectionist policies with local content preferential rules.

Germany

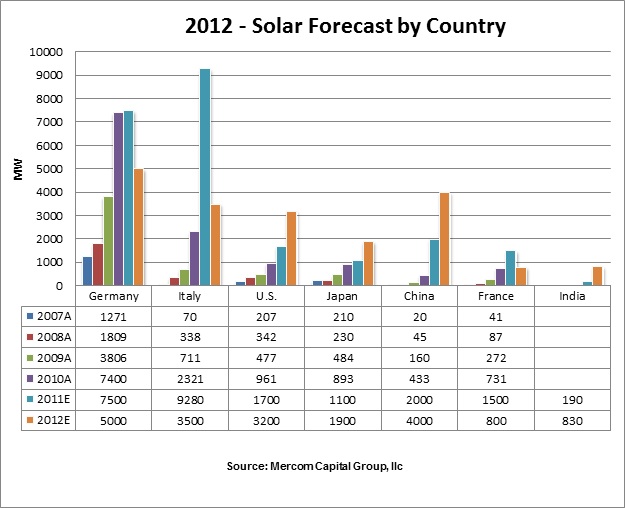

In 2011, there were record number of installations—7.5GW—which triggered a series of events that could drive significant policy adjustments around the world. Of the 7.5GW, Germany installed 3GW in December alone, spurred by record low module prices and looming tariff cuts that was expected in January of 2012.

This rush in installations took the German government by surprise, resulting in a scramble to re-haul existing policies. Their new proposal calls for annual feed-in-tariff cuts every January between 2013 and 2016. The proposed cuts are aggressive with a 20 to 27 percent feed-in-tariff reduction to be implemented immediately (now postponed until April) and a monthly digression of 15 euro cents from May through December 2012, followed by a yearly digression through 2016. A more important concern for the industry is the proposed installation cap—targeted at 2.5GW to 3.5GW per year for 2012 and 2013, followed by yearly reductions of 400MW—all of which would result in a reduction of installation levels of 900MW to 1900MW by 2017. For companies basing their business plans on any feed-in-tariff proposals beyond one year is a risky proposition.

Through its leadership, Germany has helped lay a solid foundation for the global solar industry to build on, but the time has come for other markets to step up demand as the blistering pace of installations in Germany has become unsustainable.

Italy

Technically, Italy had the most installations of any country in 2011 with 9,280MW. According to Gestore dei Servizi Energetici (GSE), total installations for the year included 3,740MW installed in 2010 but were operational in 2011.

In response to the high installation levels in 2011, it is likely that the government will review and lower the feed-in-tariff over the next few months. While the government can reduce the feed-in-tariff significantly, it likely won’t eliminate the PV subsidy entirely.

There are a few policy changes that happened under the January 20 Decree. Under Article 65, the government has stopped incentives for ground-mounted PV plants on agricultural lands. This new rule applies to all new ground-mounted PV installations, except for those that filed for request of authorization before, and provided operations start within one year from, the entry into force of the Decree. On the other hand, the government has increased incentives for PV installations on greenhouses. PV installed on greenhouses will receive the full tariff for rooftop PV instead of the current average between the tariffs for rooftop and ground-mounted facilities.

GSE also announced that the budget for the second half of 2012 for large solar PV plants has already been exhausted by excessive demand in 2011. As a consequence, there will be no registration procedure for the second half of 2012. Large PV solar plants that have not been registered previously with the GSE will now only be eligible for the 2013 feed-in-tariff.

France

France is another country in the middle of the Eurozone crisis with huge economic and political uncertainties with elections due in a few months. France was one of the first countries in Europe to shift from a feed-in-tariff system to a system based on bidding for large-scale projects (above 100kW). The only thing supporting the French market in 2011 was the exemption of about 3.5GW of grandfathered systems. France has had a 500MW hard cap on annual new installations.

The Commission de Regulation de l’Energie (CRE) announced in January that the tariffs for new installations connected in the first quarter of 2012 will decrease by up to 10 percent compared to the fourth quarter of 2011.

The French government plans to propose a new feed-in-tariff for photovoltaic solar plants offering a higher rate for those produced with domestic material. Under the new tariff, solar plants with more than 60 percent of added value produced in France will receive a premium of at least 10 percent. This has been a pretty common reaction around the world where local manufacturers continue to go out of business, unable to compete with low priced modules from Chinese companies.

United States

The United States installed about 1,700MW in 2011, almost double from 2010 primarily due to a strong push in the fourth quarter before the 30 percent cash grant expired. The U.S. solar market is expected to continue to do well in 2012 and could double again, making it one of the top solar markets in the world.

The big uncertainty factor hanging on the U.S. solar market is the anti-dumping case involving Chinese solar manufacturers. The U.S. Commerce Department just announced a delay in the decision on anti-dumping duties for Chinese solar imports due to the highly complex nature of the case.

The U.S. International Trade Commission took the step toward imposing additional duties on Chinese solar imports saying that U.S. solar manufacturers are being hurt by cheap Chinese imports. Countervailing duties are expected to offset the benefits Chinese companies have allegedly received from Chinese government subsidies.

The United States does not have a central solar incentive policy; instead, the market has been driven by state renewable portfolio standards (RPS), state and municipal rebate programs, and the 30 percent federal investment tax credit (ITC). While California, which is the largest solar market within the United States, is fueled by an aggressive RPS, states like New Jersey relied on Solar Renewable Energy Certificates (SREC) for growth. The market for projects in New Jersey has declined after the recent collapse in SREC prices in that state, which was the second largest solar market in the United States. Other SREC-dependent states may suffer a similar fate.

The United States currently has over 25GW of utility-scale solar projects in various stages of development. Although many of these projects will not be successfully completed, it is still the most robust pipeline of projects compared to any other solar market.

China

China is estimated to have installed over 2GW of PV in 2011, much higher than initially expected. China claims to be targeting very aggressive installations of 4GW to 5GW in 2012. There was a recent announcement by China’s National Development and Reform Commission that the 2015 solar PV installation target in China’s 12th Five-Year Plan has been increased to 15GW, 50 percent higher than the previous target.

This focus on increasing domestic solar demand has largely been due to the number of Chinese manufacturers going out of business or incurring large losses. Extremely aggressive increases in manufacturing capacities among Chinese manufacturers, resulting in large oversupply, started the trend that resulted in huge price declines that affected every country in the world. This has also pushed most countries towards protectionist policies as their domestic companies continue to fail as they haven’t been able to compete with low solar module prices.

There has been some recent talk from Chinese government officials indicating support to curtail manufacturing capacity expansions. This could indicate a pull back from the government in supporting manufacturers with subsidies and loans going forward.

Japan

Japan installed around 1.1GW in 2011, not a significant increase compared to 2010. This is understandable due to supply chain disruptions and confusion after the Fukushima disaster. Solar can play an active role in helping get Japanese energy production back on track in the absence of nuclear power. There has been some delay in announcing new solar tariffs and the industry is waiting to see how supportive the tariffs will be.

Japan did announce a new clean-energy law coming into effect on July 1, 2012 but the feed-in-tariff levels are still unclear. The country’s parliament passed a bill on August 26, 2011 that guarantees feed-in-tariff rates for wind, solar, and geothermal energy, one of the first steps by Japan to promote the renewable energy industry after the Fukushima disaster. Under the law, the Trade and Industry Ministry will set rates and periods each year.

Japan may end up shutting down all of its 54 nuclear power reactors, according to Japanese Trade Ministry officials. The renewable energy companies are hoping that they will all benefit. Since nuclear power is base load and solar is not, solar cannot be the only answer. Japan, at the moment, is struggling with regular power shortages since the Fukushima disaster and has set a goal of achieving 28GW of cumulative PV by 2020.

India

From almost no solar installations a few years ago, India is poised to become a gigawatt market by the end of 2012. Solar demand in India is mainly supported by the Jawaharlal Nehru National Solar Mission (JNNSM) which is a central government policy to install 20GW of solar power by 2022. In the early phases of JNNSM, solar projects have been selected based on the lowest bid, which has led to aggressive bidding and the problems that come with it.

Complementing JNNSM are individual state policies, led by the state of Gujarat, which announced feed-in-tariffs for almost 1GW of solar power.

The challenge in India is and will be execution and financing. More than half of JNNSM projects have been late coming online and most of the projects in Gujarat have also been late. Indian solar bids have been one of the lowest in the world from companies that are mostly new to solar and in many cases new to the power sector. These low bids for projects are making it difficult to secure external funding, not to mention borrowing costs in India (13 -15 percent) are almost double borrowing costs in parts of Europe and United States.

Mercom’s forecast is based on current market conditions, policies and estimated pipelines in various countries as they stand today. A close eye should be kept on upcoming policy changes as forecasting will change with it.

This consensus forecast is based on Mercom’s views and methodology with data compiled from: Ardour Capital, Auriga, Barclays Capital, Bundesnetzagentur, Collins Stewart, Credit Suisse, EPIA, Gartner, IHS iSuppli, Jefferies & Co, Kaufman Bros, Lux Research, Macquarie Capital, GTM Research, Navigant Consulting, Oppenheimer & Co, IMS Research, BNEF, Deutsche Bank, IDC Energy Insights, IMS Research and Mercom Capital Group.