Grenergy, a renewable energy company, has entered into an agreement to sell the fourth phase of its Oasis de Atacama project in Chile to funds managed by CVC DIF, the infrastructure investment arm of global private equity firm CVC Capital Partners. The transaction is expected to total an enterprise value of up to $475 million, including earn-outs and financial adjustments.

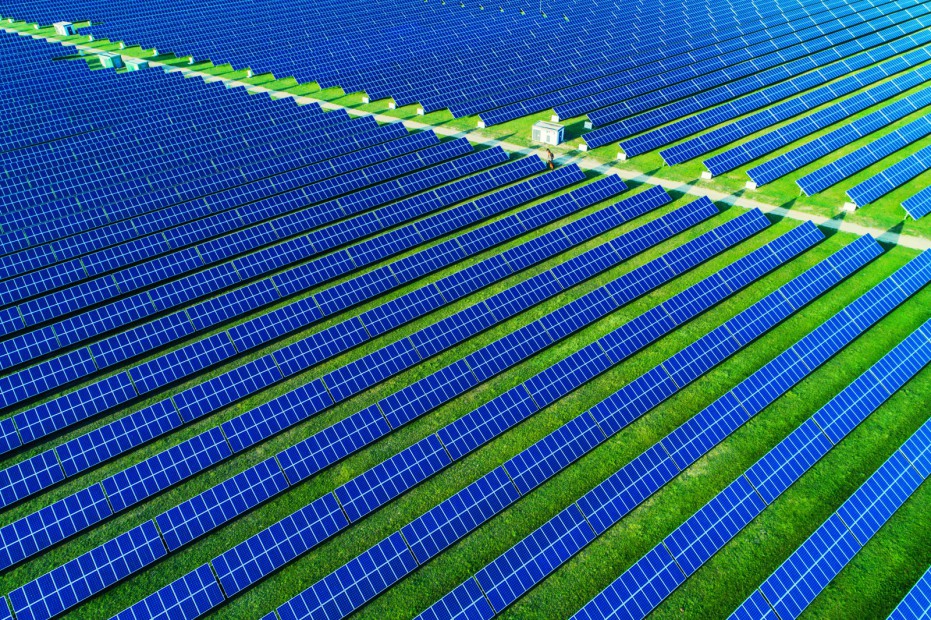

The fourth phase, named Gabriela, represents 10% of the total Oasis de Atacama project, consisting of 272 MW of solar and 1,100 MWh of battery storage capacity.

The project is currently under construction and is backed by a signed hybrid power purchase agreement. The asset transfer will occur after the commercial operation date, scheduled for the first half of 2026.

Grenergy has already secured $324 million in green construction financing through a syndicate of major international banks. The loan was arranged with participation from BNP Paribas, Natixis, Société Générale, Scotiabank, and SMBC. More recently, additional banks joined the syndicated financing, including Bank of America, BBVA, JP Morgan, KfW IPEX, Rabobank, and ICO.

Under the terms of the sale, Grenergy will continue to provide operations and maintenance services for a period of five years.

This transaction, along with the one completed with ContourGlobal in December 2024, covers 33% of the original Oasis de Atacama project. Grenergy retains 1.2 GW of installed capacity and 7.3 GWh of storage.

According to Mercom’s 1H and Q2 2025 Solar Funding and M&A report, approximately 19.9 GW of solar projects were acquired in the first half of 2025, compared to 18.5 GW in the first half of 2024.

In August, Bluefield Solar (BSIF), the London-listed U.K. income fund focused primarily on acquiring and managing solar energy assets, announced the sale of a portfolio of solar and storage projects totaling 250 MW to Lyceum Solar, a joint venture with 25% ownership by BSIF and 75% ownership by GLIL Infrastructure.