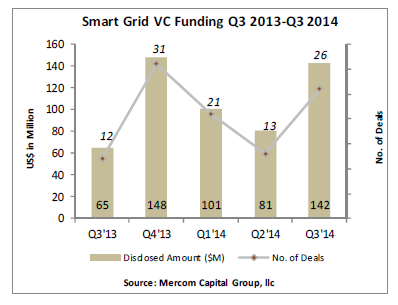

Venture capital (VC) funding for smart grid companies came in at $142 million in 26 deals in Q3 2014, compared to $81 million in 13 deals in Q2 2014.

To get a copy of this report, please email us at info@mercomcapital.com.

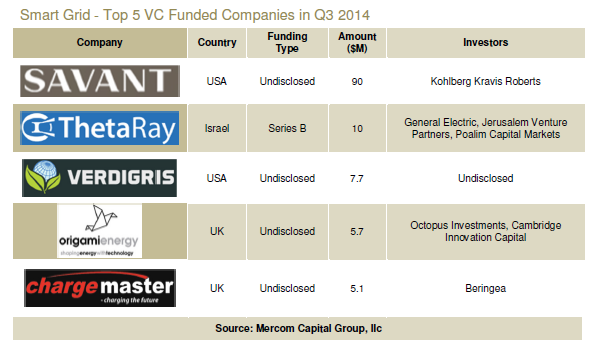

The Top VC funded companies in Q3 2014 were led by Savant Systems, a home automation solutions provider, which raised $90 million. ThetaRay, a big data analytics and cyber security solutions provider whose solutions also include industrial SCADA and critical manufacturing networks, raised $10 million, Verdigris Technologies, a provider of cloud analytics software to optimize energy consumption for buildings, raised $7.7 million, and Origami Energy, provider of a technology platform for the intelligent active management of distributed energy assets allowing renewable energy generators, storage providers and energy users to trade at a micro-grid level, received $5.7 million. Rounding out the Top 5 was Chargemaster, provider of an electric vehicle charging infrastructure, which raised $5.1 million.

Twenty-seven investors participated in smart grid VC funding rounds in Q3 2014, including two accelerators.

Twelve Smart Grid Communication technology companies raised a combined $104 million and two Data Analytics companies raised $12 million. One Security company raised $10 million, while three Smart Charging (for Plug-in Hybrid Vehicles (PHEV)) and Vehicle to Grid (V2G) companies raised $8 million. Three Demand Response companies raised $6 million and three Distributed Generation and Integration companies brought in $2 million.

There were six Smart Grid M&A transactions (four disclosed) in Q3 2014 totaling $222 million. The top disclosed transactions were the $200 million acquisition of SmartThings, a provider of an open platform for the smart home and the consumer Internet of Things, by Samsung Electronics, a multinational electronics company, followed by the $10 million acquisition of Basset, a provider of revenue management and billing solutions to telecommunications operators and electric utilities, by Enghouse Systems, a provider of enterprise software solutions, the $7.5 million acquisition of Ambient Corporation, a provider of smart grid communications technology for utilities, by Ericsson, a multinational communications technology and services provider, and the $4.9 million acquisition of the grid operations of Echelon, a smart meter manufacturer and control networking solutions provider for the Industrial Internet of Things, by S&T AG, a European IT systems provider with a focus on smart energy products and services.

We have expanded our coverage this year and our Smart Grid funding report now also includes Storage/Battery and Energy Efficiency sectors.

Companies in the Battery/Storage space received $99 million in 10 deals, compared to $90 million in six deals in Q2. Top deals included the $25 million raise by Powin Energy, followed by the $25 million raise by Aquion Energy, the $18 million brought in by Eos Energy Storage and the $10 million raise by PowerGenix. There was one deal each for Sodium-ion, Flow Batteries, Zinc-air, Supercapacitor, Nickel-based Batteries and Compressed Air Energy Storage in Q3, while Li-ion Battery companies recorded four deals.

There were also six debt and public market financing deals in Battery/Storage totaling $219 million including one Initial Public Offering in Q3 2014. There were also two storage funds announced to finance no money upfront, behind-the-meter storage projects.

There were five M&A transactions in Battery/Storage, of which only one transaction was disclosed totaling $32 million.

Efficiency companies raised $336 million in 27 deals in Q3, compared to $113 million in 16 deals in Q2 2014. Top deals included the $83 million that went to Lextar Electronics, the $80 million raised by Lattice Power, Renovate America’s $50 million raise, the $40 million raise by Avogy and the $20 million raise by Enlighted. Lighting companies had nine deals; Temperature Control companies had four deals; Efficient Home/Building, Audit/Retrofit and Software companies had three deals each; and Finance, Components, Data Center, Energy Monitors/Dashboard and Appliance companies had one deal each.

There were five M&A transactions this quarter in the Efficiency category.

To get a copy of this report, please email us at info@mercomcapital.com.