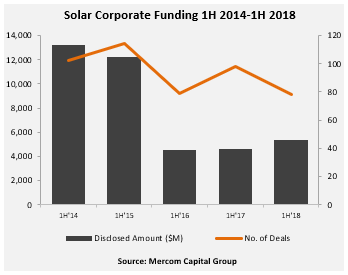

Total corporate funding (including venture capital funding, public market, and debt financing) in the first half (1H) of 2018 was up with $5.3 billion raised compared to the $4.6 billion raised in 1H 2017, a 15 percent increase year-over-year (YoY).

Corporate funding increased in Q2 2018 with $2.8 billion in 34 deals compared to the $2.5 billion in 44 deals in Q1 2018. Year-over-year funding in Q2 2018 was about 102 percent higher compared to the $1.4 billion in Q2 2017.

To learn more about the report, visit: https://mercomcapital.com/product/q2-2018-solar-funding-and-ma-report/

“The first half of 2018 has been a roller-coaster for the solar industry marked by uncertainty due to Trump tariffs followed by the recent Chinese subsidy pullback,” commented Raj Prabhu, CEO of Mercom Capital Group. “Though financial activity was better compared to the same period last year, the market is still sorting out the winners and losers that would come out of a potential slowdown in Chinese demand, which is expected to result in an oversupply situation and eventual price crash in components across the globe.”

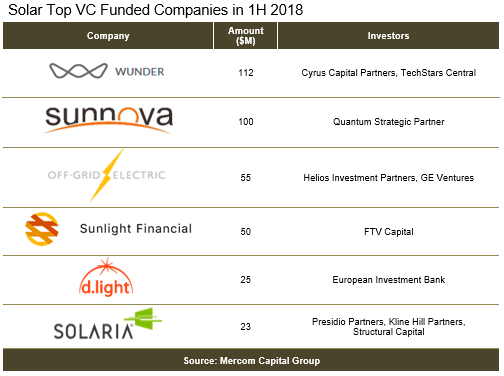

Global VC funding (venture capital, private equity, and corporate venture capital) for the solar sector in 1H 2018 was 36 percent lower with $458 million compared to the $716 million raised in the first half of 2017.

In Q2 2018, VC funding for the solar sector increased to $298 million in 12 deals compared to $161 million in 22 deals in Q1 2018. The funding amount was 133 percent higher YoY compared to the $128 million raised in 23 deals in Q2 2017.

Top VC deals in 1H 2018 included: $112 million raised by Wunder Capital, $100 million raised by Sunnova, $55 million secured by Off-grid Electric, Sunlight Financials’ $50 million, $25 million raised by d.light design, and the $23 million raise by Solaria. A total of 42 VC investors participated in solar funding in 1H 2018.

Solar public market funding in 1H 2018 was higher compared to the first half of 2017 with $1.25 billion raised in 12 deals compared to $934 million in 19 deals in 1H 2017, a 33 percent increase. Public market financing into the solar sector rose to $1.1 billion in eight deals in Q2 2018 compared to just $103 million in four deals in Q1 2018, and $473 million raised in six deals during Q2 2017.

Announced debt financing activity in the first half of 2018 ($3.6 billion in 32 deals) was 22 percent higher compared to the first half of 2017 when $3 billion was raised in 33 deals. Most of that increase was due to two securitization deals: Vivint solar raised $466 million through asset back notes and Dividend Finance secured $105 million in a similar deal.

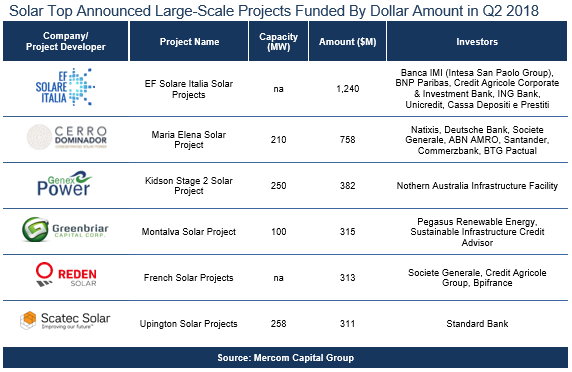

Large-scale project funding in the first half of 2018 saw $7.96 billion announced for 98 projects compared to 1H 2017 when a record $7.4 billion was raised in 81 project funding deals.

Announced residential and commercial solar funds totaled $625 million in 1H 2018 compared to $1.8 billion in the same period of 2017.

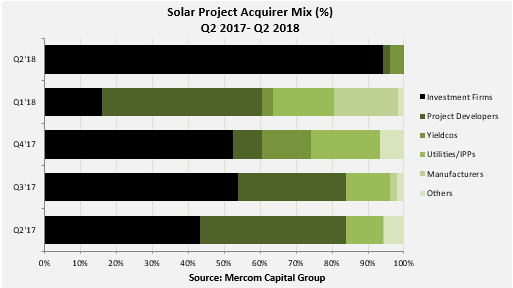

In 1H 2018 there were a total of 46 solar M&A transactions, compared to 41 transactions in 1H 2017. There were 27 solar M&A transactions in Q2 2018. By comparison, there were 19 solar M&A transactions in Q1 2018 and 12 transactions in Q2 2017. Of the 27 total transactions in Q2, 16 involved solar downstream companies, six involved PV manufacturers, three were equipment manufacturers, and two involved BoS companies.

There were 117 large-scale project acquisitions in 1H 2018 totaling 11.6 GW compared to 101 project acquisitions totaling 10.9 GW in the first half of 2017.

Investment firms and funds were the most active acquirers in 1H 2018, picking up projects totaling 4 GW.

There were 269 companies and investors covered in this report. It is 78 pages in length and contains 78 charts, graphs, and tables.

To learn more about the report, visit: https://mercomcapital.com/product/q2-2018-solar-funding-and-ma-report/

Image credit: Shutterstock