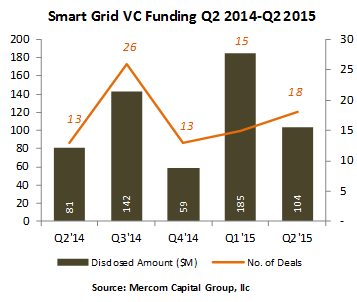

Venture capital (VC) funding (including private equity) for Smart Grid companies was down with $104 million in 18 deals in Q2 2015, compared to $185 million in 15 deals in Q1 2015. Smart Grid companies have now raised $289 million in the first half of this year compared to $183 million raised in the same period in 2014.

For a copy of the report, visit: https://mercomcapital.com/product/q2-2015-smart-grid-batterystorage-and-efficiency-funding-and-ma-report/

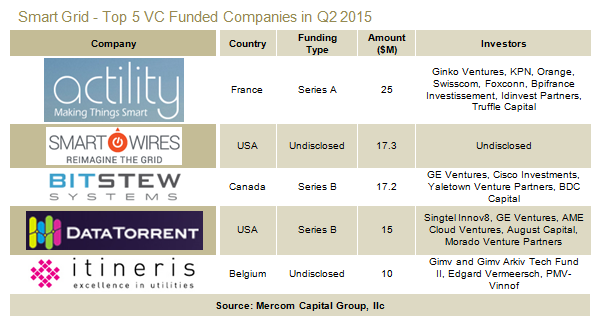

The Top VC funded company in Q2 2015 was Actility, a provider of smart energy management, demand response, machine-to-machine and internet of things (IoT), which raised $25 million. Other top deals were Smart Wires, a grid optimization solutions provider, which raised $17.3 million; Bit Stew Systems, a provider of data analytics and integration solutions for the utility industry, raised $17.2 million; and DataTorrent, a developer of a real-time stream analytics platform for smart grid, utilities and other industries received $15 million. Rounding out the Top 5 was Itineris, a provider of customer care and business process outsourcing solutions for the utility industry, which raised $10 million.

Thirty-seven investors participated in smart grid VC funding rounds in Q2 2015, including two accelerators. Within Smart Grid, Data Analytics companies raised the most funding. GE Ventures was the only investor participating in multiple deals this quarter with two.

There was one IPO this quarter: Alarm.com, a provider of cloud based services for home automation, energy management solutions, and monitoring services, raised $98 million through its IPO in June 2015. The shares are listed on the NASDAQ.

There were three Smart Grid M&A transactions in Q2 2015 totaling $15 million. The only disclosed M&A transaction was the acquisition of t-mac Technologies, an energy management systems provider, by Utilitywise, an energy and water cost management company.

Battery/Storage

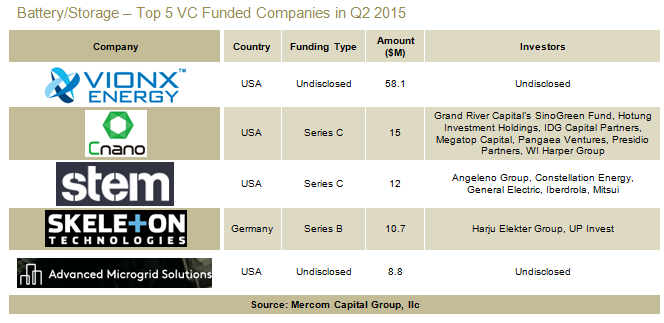

Companies in the Battery/Storage space received $126 million in VC funding in 13 deals, significantly higher compared to $69 million in seven deals in Q1 2015. Battery/Storage companies raised $194 million in the first half of 2015 compared to $282 million raised in the first half of 2014.

Top Battery/Storage deals included the $58.1 million raise by VionX Energy, a manufacturer of vanadium redox flow batteries; followed by Cnano Technology, a manufacturer and developer of multi-wall carbon nanotube products for the energy storage, structural and electronics industries, which raised $15 million. Stem, a provider of behind-the-meter energy storage systems, raised $12 million; Skeleton Technologies, a developer and manufacturer of ultra-capacitors, raised $10.7 million; and Advanced MicroGrid Solutions, a company that designs, finances, installs and manages advanced energy storage solutions for commercial, industrial and government building owners, received $8.8 million.

There were 24 investors who participated in VC funding rounds this quarter. Within Battery/Storage, Flow Battery companies raised the most funding.

There were seven debt and public market financing deals in the Battery/Storage category totaling $69 million in Q2 2015.

There was one M&A transaction in Battery/Storage; Electrovaya, a manufacturer of portable lithium-ion battery power solutions acquired Evonik Litarion, a manufacturer of lithium-ion cells, for an undisclosed amount.

Efficiency

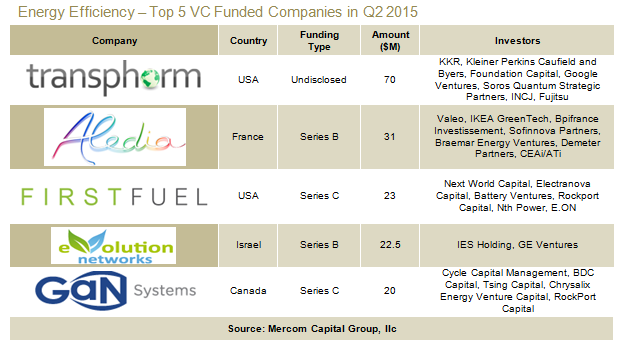

Energy Efficiency companies received $211 million in VC funding in 18 deals in Q2 2015, which was up compared to $140 million in 15 deals in the last quarter. Efficiency companies have brought in $351 million in the first half of 2015 compared to $269 million in the same period last year.

Top Efficiency deals included the $70 million raise by Transphorm, a developer of efficient power conversion devices; followed by Aledia, a developer and manufacturer of 3D LEDs, which raised $31 million; and FirstFuel Software, a developer of a building analytics platform to enable and track energy efficiency in commercial buildings, which received $23 million. eVolution Networks, an energy consumption solution provider for mobile network operators, raised $22.5 million, and GaN Systems, a developer and manufacturer of gallium nitride transistors for efficient power conversion in solar, wind, smart-grid, electric and hybrid vehicles, and power supply applications, raised $20 million.

There were 42 investors who participated in VC funding rounds, of which four companies participated in two deals each: BDC Capital, E.ON, RockPort Capital and CEA Investissement.

There were five debt and public market financing deals in the Efficiency category for $355 million this quarter compared to $183 million in three deals in Q1 2015. The largest deal was the $240 million raised by Renovate America, a provider of residential Property Assessed Clean Energy (PACE) financing in the U.S. for energy efficiency solutions through the issuance of bonds.

There were ten M&A transactions (four disclosed) for $301 million this quarter in the Efficiency category. The largest disclosed deal this quarter was the $263 million acquisition of a 59 percent stake in Lattice Power, an LED manufacturer, by Shunfeng International Clean Energy, a solar project developer.