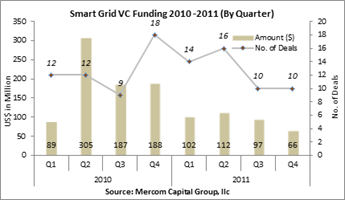

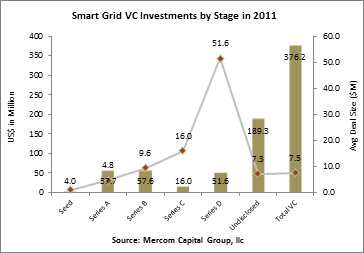

Venture Capital (VC) funding in 2011 brought in $377 million in 50 deals (24 disclosed) compared to $769 million in 51 deals in 2010 (27 disclosed). The average VC funding round dropped by 50 percent in 2011 to $7.5 million compared to almost $15 million in 2010. Early rounds of disclosed funding (Seed and Series A) accounted for 16 of the 50 deals in 2011.

“Venture capital funding in smart grid was anemic at best in 2011. Even though the number of transactions were about the same as last year, the average deal size dropped in half,” said Raj Prabhu, managing partner at Mercom Capital Group. “Interestingly, the number of VC investors increased to 92 from 87 in 2010, pointing to continued investor interest but lower risk appetite. Strong M&A activity was driven by power giants like Siemens, Schneider Electric, ABB and GE.”

Top VC deals in 2011 were iControl Networks, a broadband home management company ($51.6 million), SmartSynch, a smart grid company that uses cellular networks for utility smart grid projects ($25.7 million), Silver Spring Networks, a provider of utility networking equipment for smart grid deployment ($24 million), Gridpoint, an energy management solutions provider ($23.6 million), and JouleX, a provider of energy management systems for data centers and distributed office environments ($17 million).

Top venture capital investors in 2011 were GE with six deals, Emerald Technology Ventures with five deals and Kleiner Perkins Caufield & Byers with five deals. The same investors were also the top three in 2010, however, with double the amount of deals each last year. Other top investors were Foundation Capital, Intel Capital and Rockport Capital with four deals each.

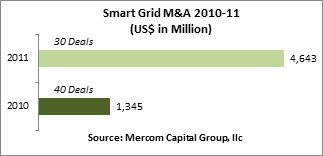

There were some major M&A transactions in 2011, specifically the $2.3 billion acquisition of smart meter company Landis+Gyr by Toshiba and the $2 billion acquisition of Telvent, a real-time IT solutions and information provider, by Schneider Electric. Though acquisition details were not disclosed, the acquisition of eMeter, a meter data management system company, by Siemens, was another significant transaction.

Only four acquisition transactions were disclosed out of 30 total transactions, pointing to a much higher total amount than the $4.6 billion reported in M&A activity. This follows the same pattern as 2010 when only four transactions out of 40 were disclosed.

To get a copy of this report, please email us at info@mercomcapital.com.