Virta Health, a type 2 diabetes management program provider through its virtual coaches, raised $65 million in Series D funding at over $1.1 billion.

Sequoia Capital Global Equities, which invests primarily in public companies and late-stage private companies, led the financing round with participation from Caffeinated Capital, which brings the company’s total funding to date to more than $230 million.

According to the company, the new funding will accelerate growth and scale its provider-led virtual care delivery platform (Continuous Remote Care).

With new funds, Virta will also expand research and development of evidence-based, non-pharmaceutical therapies for other complex and costly metabolic conditions.

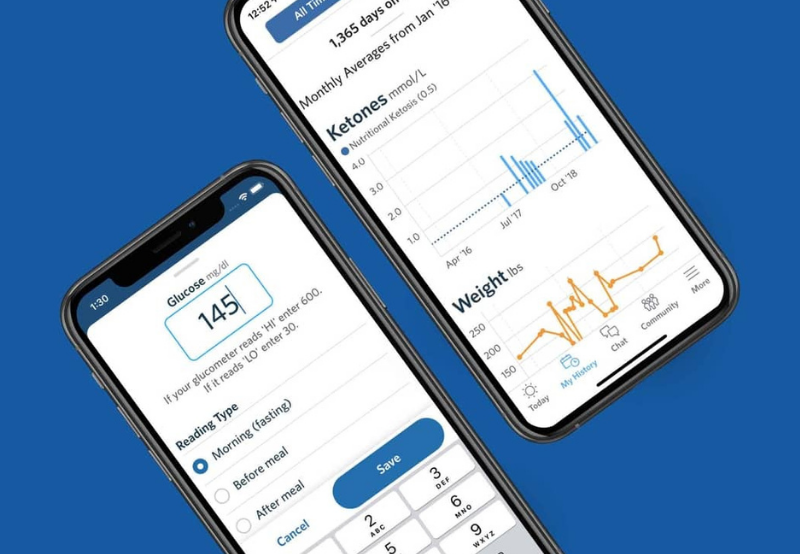

The Virta Health diabetes management program offers treatment to safely and sustainably reverse type 2 diabetes without medications or surgery. According to the company’s data, among the patients enrolled for its (one-year diabetes management program), 60% achieved diabetes reversal, and 94% of insulin users reduced or eliminated usage.

The program also helped improve other metabolic and cardiovascular health areas, with sustained improvements in blood pressure, inflammation, liver function, and BMI.

Delivered through Virta’s continuous remote care platform, the Virta treatment provides medical and behavioral support and transforms the lives of people living with type 2 diabetes, the company said.

“The option for disease reversal should be available to every person living with a chronic metabolic condition,” said Sami Inkinen, Virta Health co-founder and CEO. “This funding round is an important step forward in making this a reality and allowing people to regain their health, wherever they are on their metabolic journey.”

According to Mercom data, digital diabetes management companies have raised over $1.6 billion since 2011. Early this year, Oviva, a digital program provider for Type 2 diabetes patients, raised $21 million in Series B funding. MTIP led the round, with participation from new investor Earlybird and existing investors AlbionVC, F-Prime Capital, Eight Roads Ventures, and Partech.