Energy Storage

Venture capital (VC/PE) funding in Energy Storage in 2023 was the highest ever recorded, increasing 59% year-over-year (YoY), with $9.2 billion in 86 deals compared to the $5.8 billion raised in 96 deals in 2022.

To get a copy of the report, visit: https://mercomcapital.com/product/annual-q4-2023-funding-ma-report-storage-grid

“Energy storage companies saw their highest VC funding in 2023, largely thanks to the Inflation Reduction Act’s Investment Tax Credit and other incentives like manufacturing credits for battery components. Despite this positive trend, M&A activity lagged due to high asset valuations, elevated interest rates, and investor caution,” said Raj Prabhu, CEO of Mercom Capital Group.

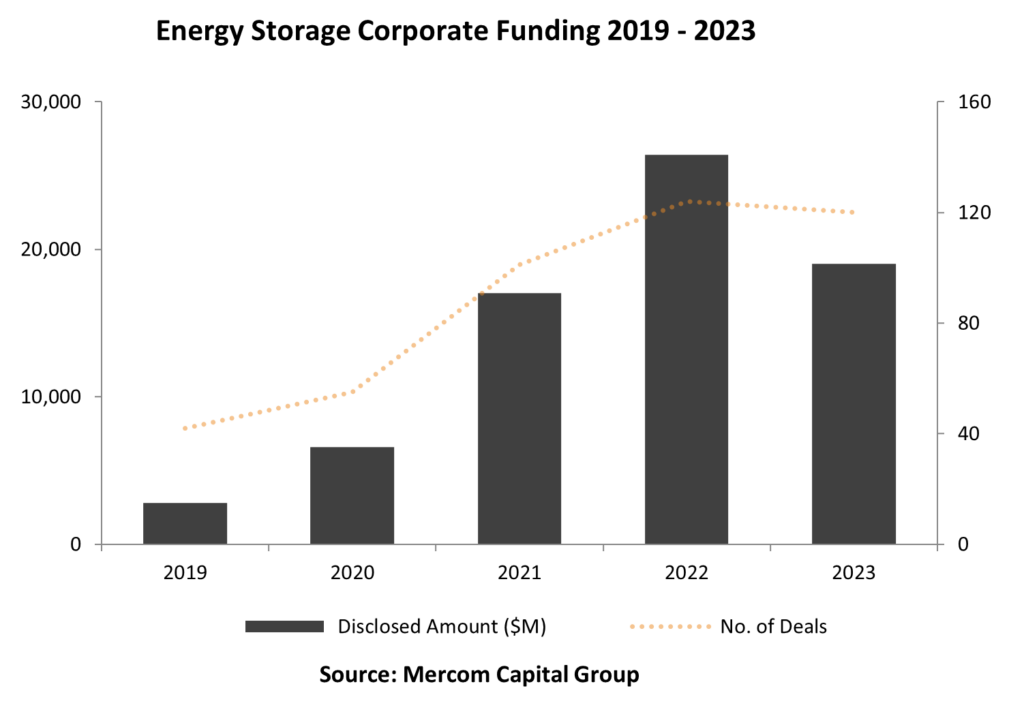

However, corporate funding in the Energy Storage sector, including VC/PE funding, decreased 28% YoY, with $19 billion raised in 120 deals compared to $26.4 billion raised in 124 deals in 2022. LG Energy Solution’s one-off $10.7 billion IPO in 2022 significantly inflated the total funding for that year.

Corporate funding for Energy Storage companies in Q4 2023 decreased 55% quarter-over-quarter (QoQ), with $3.7 billion in 26 deals compared to $8.2 billion in 35 deals in Q3 2023. In a YoY comparison, funding was down 14% compared to the $4.3 billion that was raised in 31 deals in Q4 2022.

Lithium-ion-based Battery Technology companies received the most VC funding in 2023. Other top-funded categories included Battery Recycling, Nickel-based Battery Technology, Energy Storage Downstream, and Materials and Components companies.

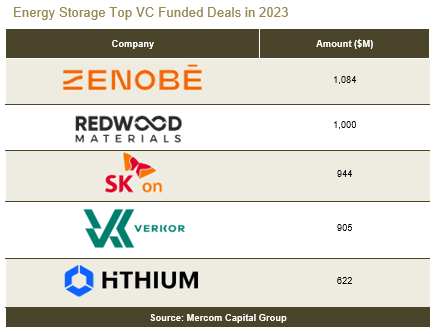

The Top 5 Energy Storage VC funding deals in 2023 were: Zenobe, which raised $1.1 billion; Redwood Materials, which raised $1 billion; SK On, which brought in $944 million; Verkor, which raised $905 million; and Hithium, which raised $622 million.

Announced debt and public market financing for Energy Storage companies in 2023 decreased 52% YoY with $9.8 billion in 34 deals compared to $20.6 billion in 28 deals in 2022, the year of LG Energy Solution’s $10.7 billion IPO.

Four Energy Storage companies went public in 2023 compared to six in 2022.

In 2023, 15 Energy Storage companies were acquired, compared to 28 in 2022.

There were 28 energy storage projects (8.7 GW) acquired in 2023, of which only four disclosed transaction amounts. In 2022, there were 45 project M&A transactions (14.5 GW), seven of which disclosed the transaction amount. Project acquisitions decreased 38% YoY.

Smart Grid

Corporate funding for Smart Grid companies was 30% lower YoY, with $3.3 billion in 60 deals compared to $4.7 billion in 58 deals in 2022.

VC funding in the Smart Grid sector decreased 55% YoY, with $1.5 billion in 47 deals in 2023 compared to $3.3 billion in 46 deals in 2022.

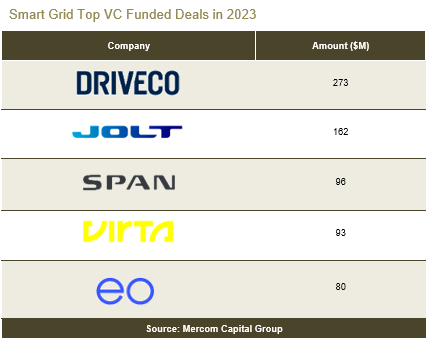

The Top 5 Smart Grid VC funding deals in 2023 were Driveco with $273 million, Jolt Energy with $162 million, SPAN with $96 million, Virta with $93 million, and EO Charging with $80 million.

In 2023, 13 debt and public market financing deals were announced, totaling $1.8 billion, compared to $1.4 million raised in 12 deals in 2022.

In 2023, there were 11 M&A transactions (four disclosed) in the Smart Grid sector. In 2022, there were 20 transactions (five disclosed).

To get a copy of the report, visit: https://mercomcapital.com/product/annual-q4-2023-funding-ma-report-storage-grid