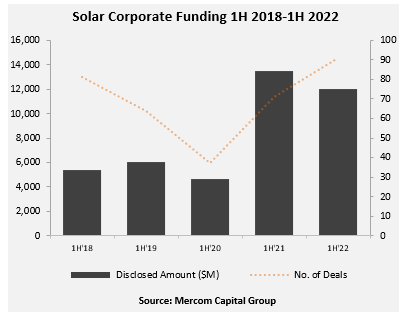

Total corporate funding (including venture capital funding, public market, and debt financing) in 1H 2022 stood at $12 billion, 11% lower compared to the $13.5 billion raised in 1H 2021. The number of deals increased 28% year-over-year, with 91 deals in 1H 2022 compared to 71 deals in 1H 2021.

“The current state of the economy—inflation, higher interest rates, supply chain issues—has started to impact fundraising in the solar sector. Even though the first half numbers held up, there was a pronounced slowdown from Q1 to Q2. Besides venture and private equity funding, all other areas experienced a decline in financing activity. But the value of solar is more evident than ever to markets that are dependent on energy imports. Clean energy installation goals are being ramped up around the world, and solar is a long-term beneficiary of this trend,” said Raj Prabhu, CEO of Mercom Capital Group.

To get the report, visit: https://mercomcapital.com/product/1h-q2-2022-solar-funding-ma-report/

In 1H 2022, venture capital (VC) funding activity rose 125% with $3.7 billion in 53 deals compared to the $1.6 billion raised in 26 deals in the first half of 2021.

In 1H 2022, venture capital (VC) funding activity rose 125% with $3.7 billion in 53 deals compared to the $1.6 billion raised in 26 deals in the first half of 2021.

Of the $3.7 billion in VC funding raised, 89% went to solar downstream companies, with $3.3 billion in 39 deals.

The top VC deals in 1H 2022 were: $750 million raised by Intersect Power, $375 million raised by Palmetto, $350 million raised by Agilitas Energy, $260 million raised by Sun King, $251 million raised by Guangdong Gaojing Solar Energy Technology, and $237 million raised by Ignis.

A total of 145 VC investors participated in solar funding in 1H 2022.

Solar public market financing in 1H 2022 came to $3.3 billion in eight deals, 10% lower compared to $3.7 billion in 13 deals in 1H 2021.

Announced solar debt financing activity in 1H 2022 ($5 billion in 30 deals) was 39% lower compared to the first half of 2021 when $8.2 billion was raised in 32 deals.

In 1H 2022, five securitization deals totaled $1.4 billion, a 26% decrease compared to $1.9 billion raised in seven deals in 1H 2021. Cumulatively, over $12 billion has been raised through securitization deals since 2013.

In 1H 2022, there were a total of 53 solar M&A transactions compared to 54 transactions in 1H 2021. In 1H 2022, the top deal was by Macquarie Asset Management, a consortium with British Columbia Investment Management Corporation (BCI) and MEAG, which agreed to acquire Reden Solar from InfraVia Capital Partners and Eurazeo for an enterprise value of $2.72 billion.

In 1H 2022, there were a total of 148 project acquisitions for 38 GW of solar projects compared to 136 project acquisitions totaling 40 GW in 1H 2021.

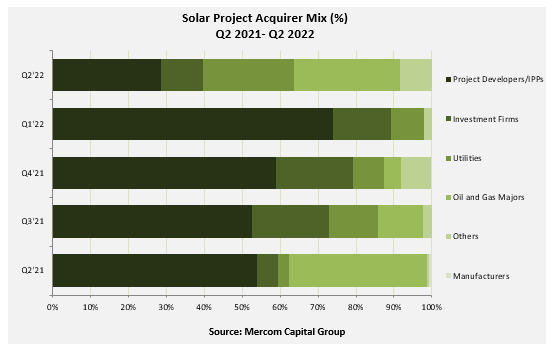

Project Developers and Independent Power Producers were the most active acquirers of solar projects in Q2 2022, picking up 4.1 GW, followed by Oil and Gas Majors with 4 GW. Electric Utilities acquired 3.4 GW of projects, and Investment Firms acquired 1.6 GW. Other insurance, pension funds, energy trading companies, industrial conglomerates, and IT firms acquired a total of 1.2 GW.

There were 391 companies and investors covered in this report. It is 100 pages in length and contains 84 charts, graphs, and tables.

To get the report, visit: https://mercomcapital.com/product/1h-q2-2022-solar-funding-ma-report/