Voiceitt, a speech recognition software for people with speech and motor disabilities, raised an additional $10 million in a Series-A funding round.

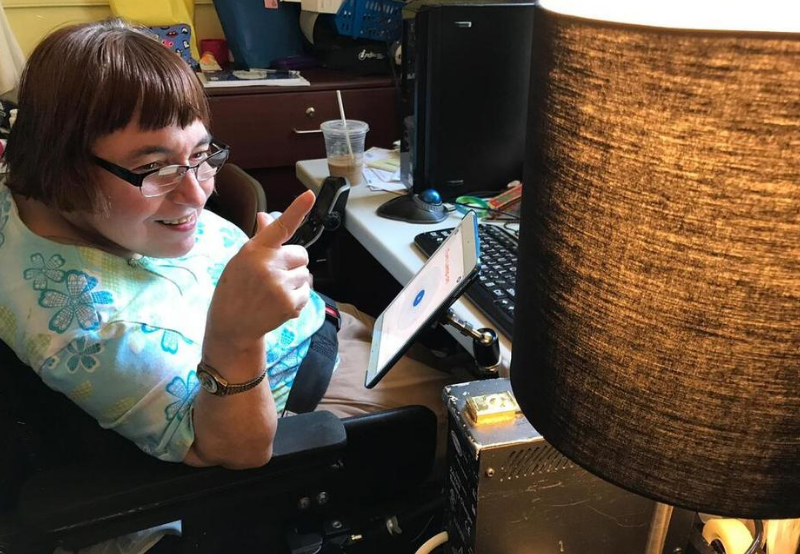

According to the company, the software translates unintelligible and atypical speech in real-time, enabling people with severe speech impairments to communicate by voice. The software is also used by healthcare providers, speech and occupational therapists, researchers, and disability organizations in the United States and Europe.

“Voiceitt provides a new dimension of independence and quality of life for people with speech and motor disabilities, and a compelling tool for those who care for and about them. Our technology helps with this and much more,” said Danny Weissberg, CEO & Co-Founder.

He continued, “With the impact of the COVID-19 pandemic, our objectives are not only to support the individual’s in-person communication but also to assist healthcare professionals and support the continuum of care for their patients.”

The funding round was led by a group of investors, including Viking Maccabee Ventures, Microsoft’s M12, AMIT Technion, Cahn Capital Corp, Connecticut Innovations, and AARP, with participation from Quake Capital, SLJ Family Office, Dreamit Ventures and The Disability Opportunity Fund.

“As we continue our growth, we are committed to our mission of making speech accessible to all. Our long-term vision is to integrate Voiceitt’s customizable speech recognition with mainstream voice technologies to enable environmental control through a universally accessible voice system,” said Sara A. Smolley, EVP & Co-Founder of Voiceitt. “Voiceitt’s versatile technology can be applied in a range of voice-enabled applications in diverse contexts and environments.”

The latest additional round brings the company’s total raised to date to over $15 million. The company employs 25 people with offices in Israel and the United States.

New York-based Cahn Capital Corporation served as Investment Bankers for the company in this Series-A funding round. ”

Digital health investment activity is robust in 2020, defying economic headwinds as investors realize its potential amid the COVID-19 crisis. Venture capital firms invested $6.3 billion in the first half of 2020, according to the latest Mercom 1H 2020 Digital Health Funding Report.

Image Credit: Voiceitt