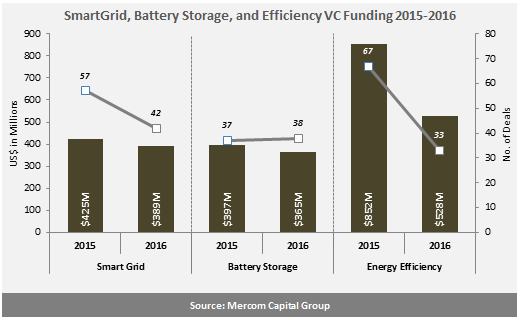

Venture capital (VC) funding (including private equity and corporate venture capital) for Smart Grid companies dropped to $389 million in 42 deals, compared to $425 million in 57 deals in 2015. Total corporate funding, including debt and public market financing, came to $613 million compared to $527 million in 2015.

To get a copy of the report, visit: https://mercomcapital.com/product/smart-grid-2016-q4-and-annual-funding-and-ma-report/

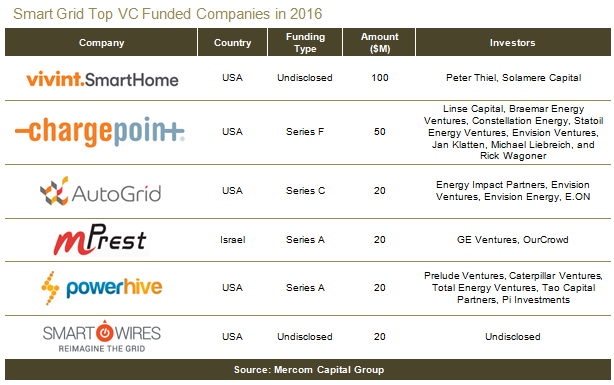

The top VC funded companies in 2016 were Vivint SmartHome, which brought in $100 million, ChargePoint which raised $50 million, followed by AutoGrid, mPrest, Powerhive and Smart Wires each raising $20 million.

Eighty-two investors funded Smart Grid companies in 2016, compared to 103 in 2015. Top VC investors in 2016 included Total Energy Ventures, Envision Ventures, and GE Ventures.

Smart Grid Communications companies, including Home and Building Automation technology companies, attracted the largest share of VC funding in 2016 with $154 million in 11 deals, followed by plug-in hybrid electric vehicles (PHEV) Smart Charging companies and Vehicle to Grid (V2G) companies with $83 million in four deals.

There were five debt and public market financing deals announced in 2016 for Smart Grid companies for a total of $224 million. There were no IPOs announced in 2016 for Smart Grid companies.

There were 15 Smart Grid M&A transactions (four disclosed) for $2.4 billion in 2016. The top disclosed transaction was the $1.7 billion acquisition of Xylem by Sensus. Other disclosed transactions included Southern Company’s acquisition of PowerSecure for $431 million, Centrica’s acquisition of ENER-G Cogen International for $208 million, and Norvestor Equity’s acquisition of Eneas Group’s for $89.2 million.

Battery Storage

VC funding for Battery Storage companies fell marginally to $365 million in 38 deals compared to $397 million in 37 deals in 2015. Total corporate funding, including debt and public market financing, came to $540 million compared to $676 million in 2015.

Energy Storage System companies received the most funding with $146 million followed by Lithium-based Battery companies with $79 million.

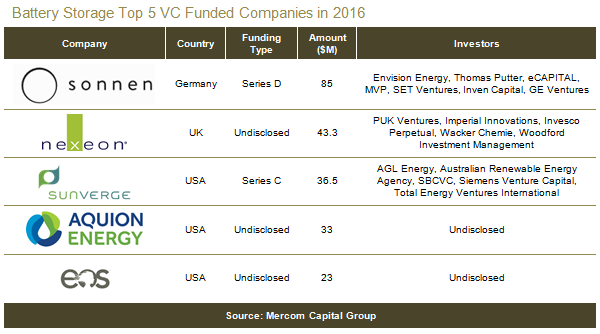

The top VC funded companies included sonnen which raised $85 million, Nexeon raised $43.3 million, Sunverge Energy brought in $36.5 million, Aquion Energy raised $33 million, and Eos Energy Storage raised $23 million.

Sixty-two VC investors participated in Battery Storage deals in 2016 compared to 57 in 2015.

Debt and public market financing for Battery Storage companies fell to $175 million from the $279 million raised in 2015. There were no IPOs announced in 2016 for Battery Storage companies.

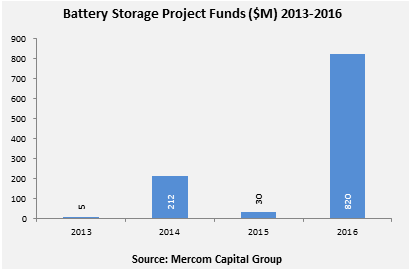

Although VC funding into battery storage companies declined, a significant amount of funding went into energy storage project funds which received a total of $820 million in seven deals compared to $30 million in three deals in 2015.

There were 11 M&A transactions (three disclosed) for Battery Storage companies in 2016, compared to 11 M&A transactions (four disclosed) in 2015. The most notable transaction was Total’s acquisition of Saft for $1.1 billion.

Efficiency

VC funding for the Energy Efficiency sector fell sharply, bringing in $528 million in 33 deals compared to $852 million in 67 deals in 2015. Total corporate funding, including debt and public market financing, was $3.8 billion, compared to $2 billion in 2015.

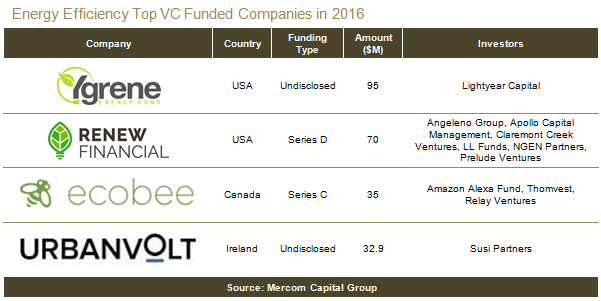

The top VC funded companies were Ygrene Energy Fund, which raised $95 million, followed by Renew Financial with $70 million, ecobee with $35 million, and UrbanVolt brought in $32.9 million.

Efficiency Finance companies captured the most funding with $256 million in seven deals. A total of 72 investors participated in funding deals compared to 129 investors in 2015. Four investors in 2016 were involved in multiple deals; Prelude Ventures participated in three deals and EnerTech Capital, LL Funds, NGEN Partners had two deals each.

Energy Efficiency companies raised nearly $3.2 billion in debt and public market financing. Financing in Energy Efficiency is also moving toward project funding. Property Assessed Clean Energy (PACE) financing totaled $2.3 billion in 12 deals in 2016 compared to $1.1 billion in seven deals in 2015. There were nine securitization deals in 2016 for nearly $1.8 billion compared to seven securitization deals for $802 million in 2015. Securitization deals have now exceeded $2.8 billion in 16 deals since 2014.

There was one IPO in 2016; Philips Lighting, a provider of energy efficient LED lighting products, systems and services, raised $959 million in its IPO.

M&A activity in the efficiency sector in 2016 dipped with 14 transactions (five disclosed). In 2015, there were 45 M&A transactions (22 disclosed).

The largest disclosed transaction was the $532 million acquisition of Opower by Oracle. Other important transactions included the acquisition of Daintree Networks by GE subsidiary, Current and Wipro EcoEnergy’s acquisition by Chubb Alba Control Systems, an indirect subsidiary of United Technologies.

To get a copy of the report, visit: https://mercomcapital.com/product/smart-grid-2016-q4-and-annual-funding-and-ma-report/

Image credit: RES Group