2021 Q4 and Annual Funding and M&A Report for Storage, Grid & Efficiency

Price range: $599.00 through $799.00

VC funding for battery storage companies

totaled $8.8 billion

– Get the Report!

Click here to download our 2021 Q4 and Annual Funding and M&A Executive Summary on Battery Storage, Smart Grid, and Efficiency.

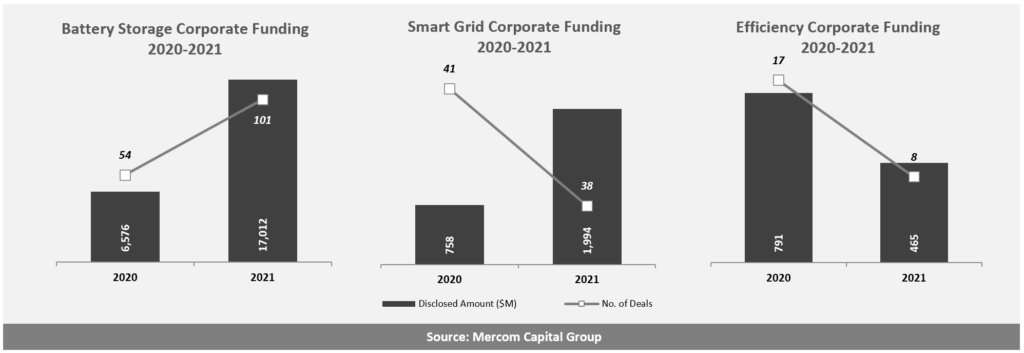

Total corporate funding (including venture capital funding, public market, and debt financing) for the battery storage, smart grid, and energy efficiency sectors in 2021 was up by 140%, with $19.5 billion compared to $8.1 billion in 2020.

Global VC funding (venture capital, private equity, and corporate venture capital) for battery storage, smart grid, and energy efficiency companies in 2021 was 290% higher with $10.1 billion compared to $2.6 billion raised in 2020.

Battery Storage

Total corporate funding in the battery storage sector was up 159%, with $17 billion in 101 deals in 2021. Funding raised in 2021 was the highest since 2014, and the deal count nearly doubled compared to 2020. VC funding for battery storage companies totaled $8.8 billion in 81 deals, compared to $1.6 billion raised in 32 deals in 2020, a 470% increase.

Lithium-ion-based battery technology companies received the most VC funding in 2021. Other categories that received funding included energy storage systems, solid-state batteries, flow batteries, thermal energy storage, liquid metal batteries, solid-state batteries, gravity storage, and metal-hydrogen batteries.

There were 24 M&A transactions in the battery storage category in 2021.

Smart Grid

Smart grid companies raised $1.2 billion in VC funding in 35 deals in 2021, a 55% increase compared to $748 million raised in 38 deals in 2020. Total corporate funding, including debt and public market financing, came to $2 billion in 38 deals compared to $758 million in 41 deals in 2020.

Smart charging companies had the largest share of VC funding in the sector in 2021 with $789 million in 18 deals, followed by distributed generation and integration companies with $155 million in six deals and data analytics companies with $116 million in three deals.

In 2021, there were 19 M&A transactions recorded in the smart grid sector compared to 21 transactions in 2020.

Efficiency

VC funding for energy efficiency companies came to $122 million in seven deals in 2021 compared to $291 million in 16 deals in 2020. Total corporate funding, including debt and public market financing, reached $465 million in 2021 compared to $791 million in 2020.

M&A activity for efficiency companies in 2021 decreased with three transactions. In 2020, there were four M&A transactions.

Mercom Capital Group’s Battery Storage, Smart Grid, and Efficiency Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends and analysis. These reports help bring clarity to professionals in the current financial landscape of the smart grid industry.

The Quarterly Funding and M&A Reports contain quarter-over-quarter (QoQ) information on market activity displayed in easy-to-digest charts, graphs and tables, as well as data-driven analysis covering:

- Venture capital funding deals including top investors, QoQ trends, and a breakdown of charts and graphs by stage;

- VC funding by technology;

- Debt and other funding deals;

- Mergers and Acquisitions (M&A) including QoQ trends, with charts and graphs by technologies;

- Battery and storage funding deals;

- Smart Grid funding deals;

- Energy Efficiency funding deals;

- New cleantech funds;

This report also contains comprehensive lists of all announced deals and transactions during the quarter, including:

- VC deals and investors;

- M&A transactions and acquirers;

- New cleantech funds.

There were 106 companies and investors covered in this report. The report is 159 pages in length and contains 140 charts, graphs and tables.